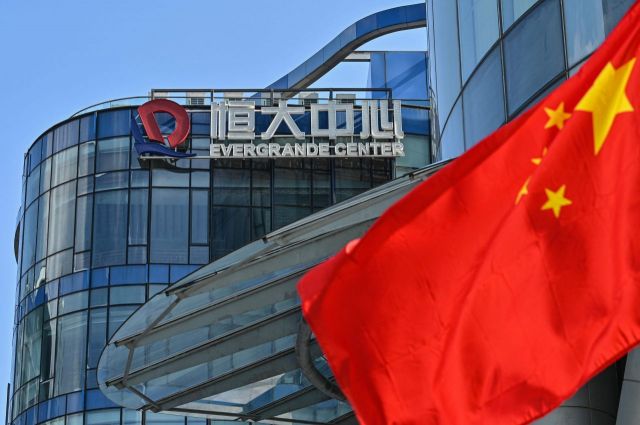

[Asia Economy Reporter Song Seung-seop] The stock price of Evergrande Group, China's second-largest real estate developer, which has signaled a default, plummeted by about 20%.

According to major foreign news reports on the 6th, Evergrande closed at 1.81 Hong Kong dollars that day, a drop of 19.56%. The Hang Seng Index on the Hong Kong Stock Exchange closed at 23,349.38, down 1.76% from the previous trading day.

On the night of the 3rd, Evergrande announced that it was unlikely to fulfill a debt guarantee of 260 million dollars (approximately 307.5 billion KRW). The dominant interpretation is that this is effectively a declaration of default. Separate from the guarantee, Evergrande must pay bond interest amounting to 82.49 million dollars (approximately 97.6 billion KRW) by that day. Failure to repay this could increase the likelihood of an official default.

The Chinese government maintains that the Evergrande default crisis will have a limited impact on the overall domestic economy. Some speculate that Chinese authorities may lower the reserve requirement ratio to mitigate the shock to the banking sector.

The local media, state-run Xinhua News Agency, predicted that since the Chinese government has begun active intervention by dispatching a task force to Evergrande, it will help resolve risks and protect rights and interests.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)