Deterioration of Credit Card Companies' Business Environment

Intensified Competition Expected in Auto Installment Financing Market

to Enhance Profitability

[Asia Economy Reporter Ki Ha-young] The scale of automobile installment financing handled by credit card companies is approaching 10 trillion won. This is due to credit card companies aggressively expanding their automobile installment assets as part of business diversification. With the business environment surrounding the credit card industry worsening, including the inclusion of card loans in the Debt Service Ratio (DSR) calculation starting next year, competition in the automobile installment financing market is expected to become even more intense.

According to the industry on the 6th, the automobile installment financing assets of six credit card companies operating in this sector?Shinhan, KB Kookmin, Woori, Samsung, Hana, and Lotte?amounted to 9.8467 trillion won as of the end of the third quarter this year. This represents a 13.7% increase compared to the end of last year.

Industry leader Shinhan Card grew by 7.8% to 3.8563 trillion won compared to the end of last year, while second-ranked KB Kookmin Card recorded 3.4476 trillion won. Samsung Card aggressively increased its automobile installment financing assets starting this year, achieving a sharp 46% rise to 760.9 billion won compared to the end of last year.

Notably, the growth of small and medium-sized credit card companies stands out. Woori Card rapidly expanded by 32%, from 1.0676 trillion won at the end of last year to 1.4094 trillion won in the third quarter this year. Early this year, Woori Card upgraded its Capital Finance Department to the Auto Finance (Automobile Finance) Headquarters and reorganized its automobile finance organization to aggressively grow its automobile installment market. Hana Card, which entered the automobile installment financing market this year, recorded 251.7 billion won, rising to fifth place in the industry. Lotte Card also showed 120.9 billion won, growing 43.8% from 84.1 billion won at the end of last year.

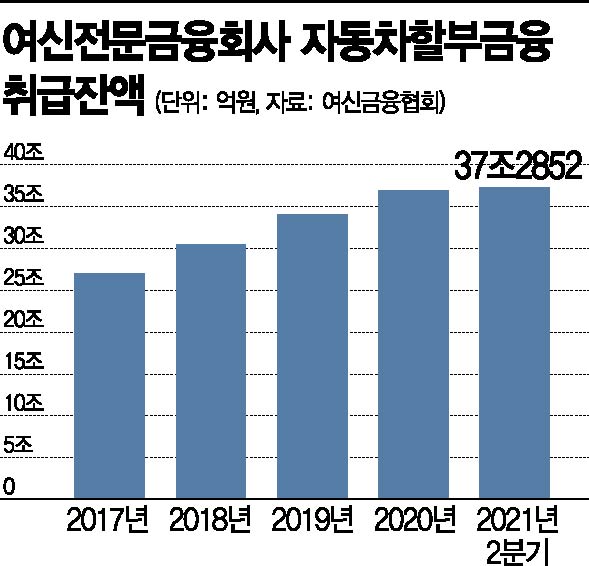

As credit card companies have entered the automobile installment financing market, the balance of automobile installment financing has increased by nearly 10 trillion won over the past four years. According to the Korea Federation of Credit Finance, the balance of automobile installment financing, which reached 27.0267 trillion won in 2017, surged 38% to 37.2852 trillion won in the second quarter of this year. Accordingly, the market share of credit card companies in the new car financing market has nearly doubled over the past four years, reaching close to 30%.

Competition surrounding automobile installment financing is expected to become even fiercer. This is because merchant fee rates are being considered for further reduction by the end of this year despite already operating at a loss, and card loans will be included in the DSR calculation starting next year. With the possibility of rising procurement costs due to interest rate hikes, credit card companies are struggling to find ways to improve profitability going forward.

An industry official said, "In the case of automobile installment financing, credit card companies have no choice but to target this market from the perspective of business diversification," adding, "Since the core business of credit sales is operating at a loss and the loan market, including card loans that have offset this so far, is facing stricter regulations, improving profitability is an urgent matter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)