Upbit, Bithumb, and Other Cryptocurrency Exchange Stocks Plummet

Signs of Increasing Market Volatility

[Asia Economy Reporter Gong Byung-sun] Cryptocurrency prices plummeted over the weekend, causing related stocks to underperform. Furthermore, there are concerns that the cryptocurrency market could trigger a 'wag the dog' phenomenon, shaking the entire domestic stock market. The 'wag the dog' phenomenon refers to a situation where the tail wags the body, meaning the usual order of cause and effect is reversed.

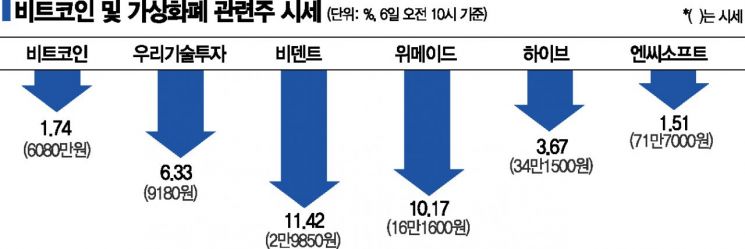

As of 10 a.m. on the 6th, Woori Technology Investment, a stock related to Dunamu, the operator of the domestic cryptocurrency exchange Upbit, recorded a 6.33% drop (620 KRW) from the previous day to 9,180 KRW. Bident, related to the domestic cryptocurrency exchange Bithumb, also fell by 11.42%. Non-fungible token (NFT) related stocks are also sluggish. Wemade, HYBE, and NCSoft, each with a market capitalization exceeding 1 trillion KRW, fell by 10.17%, 3.67%, and 1.51%, respectively.

The slump in cryptocurrency-related stocks was foreshadowed by the weekend crash in cryptocurrencies. On the 4th, Bitcoin recorded an intraday drop of 17.71% from the previous day, reaching 56 million KRW. NFT-related cryptocurrencies also underperformed. Sandbox and Bora fell by 26.27% and 38.74%, respectively, giving back recent gains. On the same day, as cryptocurrencies crashed, a mix of selling and bargain buying caused Upbit's trading volume to surge to $12.53369 billion KRW (14.8274 trillion KRW), but it shrank to $6.3 billion on the 6th, indicating market stagnation. Additionally, the combined trading volume of exchanges such as Bithumb, Coinone, and Korbit halved from about $2.8 billion on the 4th to about $1.4 billion on the same day.

Cryptocurrency Market Shakes Stock Market... Nasdaq Also Falls 1.92% Amid Cryptocurrency-Related Stock Slump

This downturn in the cryptocurrency market is increasing volatility in the stock market. The KOSDAQ, where many cryptocurrency-related stocks are listed, fell 1.21% compared to the previous day at the same time, showing a larger drop than the KOSPI, which fell 0.73%. This contrasts with January 2018, when Bitcoin fell 40.73% over a month during a cryptocurrency crash, while the KOSDAQ rose 14.42%. In the U.S., a 'wag the dog' phenomenon is already occurring, where the overall stock market is shaken by the slump in cryptocurrency-related stocks. On the 3rd (local time), Coinbase, MicroStrategy, and Square, which have actively entered the cryptocurrency business, plunged 6.69%, 7.66%, and 5.64%, respectively, causing the Nasdaq, which had started higher, to close down 1.92% from the previous day.

As more domestic companies have recently entered the cryptocurrency market, such concerns are growing in the domestic stock market as well. Starting with Wemade, various game companies, entertainment firms, and media companies are indiscriminately attempting NFT businesses. Moreover, these companies have yet to show clear results, but their stock prices have surged sharply, suggesting a larger potential drop. During November alone, the stock prices of cryptocurrency-related companies Gamevil, Wemade Max, Bident, and Danal surged by 155.80%, 144.92%, 113.54%, and 77.01%, respectively.

Professor Hong Ki-hoon of Hongik University's Department of Business Administration explained, "Regardless of shareholders' opinions, some companies have taken on the risks of cryptocurrency," adding, "In the short term, the domestic stock market will show volatility due to cryptocurrencies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)