[Asia Economy Reporter Ji-hwan Park] Samsung Securities stated on the 5th that concerns about a peak-out (passing the high point) were highlighted in DocuSign's Q3 performance this year.

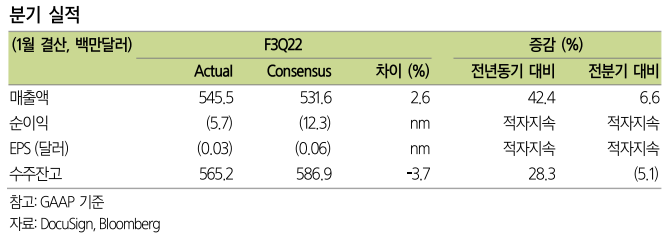

Jung-han Kim, a researcher at Samsung Securities, said, "Q3 revenue was $546 million, a 42% increase compared to the previous year," adding, "this exceeded the consensus ($532 million). The annual revenue guidance is $2.083 billion to $2.089 billion, and the Q4 revenue guidance of $557 million to $563 million also fell short of the consensus. As a result, despite generally solid Q3 results, concerns about peak-out were highlighted due to order backlog and guidance falling short of expectations, causing the after-hours stock price on the 3rd to plunge by 29%.

Researcher Kim said, "The growth stock premium disappeared as the price returned to the May low (179 dollars), when untact peak-out concerns were at their maximum," adding, "This is a pattern similar to growth stocks like Snap and Pinterest, which plunged after recent earnings announcements." In particular, although the Omicron variant remains a variable, it is expected that returning to six consecutive quarters of high growth recorded after the pandemic will not be easy.

He noted, "The average subscription revenue per customer reached an all-time high of $476.2, but this was judged to be more influenced by a slowdown in new customer inflow," emphasizing, "In a situation where expectations for the untact boom are diminishing, expanding sales across CLM services beyond electronic signatures has become even more important."

Researcher Kim added, "The mid- to long-term outlook remains positive, but in the short term, momentum is expected to be lacking due to peak-out," and said, "It is necessary to approach this from a trading perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.