China Export Restrictions Could Emerge Anytime

Government Already Aware of Risks

"Focus on Companies Internalizing and Diversifying Raw Material Supply"

On the 21st of last month, a notice about the shortage of urea solution was posted at a gas station in Seoul. [Image source=Yonhap News]

On the 21st of last month, a notice about the shortage of urea solution was posted at a gas station in Seoul. [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] At the beginning of last month, supply chain issues originating from China, such as the shortage of urea solution, have continued to emerge. In the mid to long term, it is expected that dependence on Chinese imports will be alleviated through diversification of import sources and reshoring of production. Amid this trend, there is an analysis suggesting the need to pay attention to materials and components stocks related to high-growth renewable energy sectors such as secondary batteries and solar power.

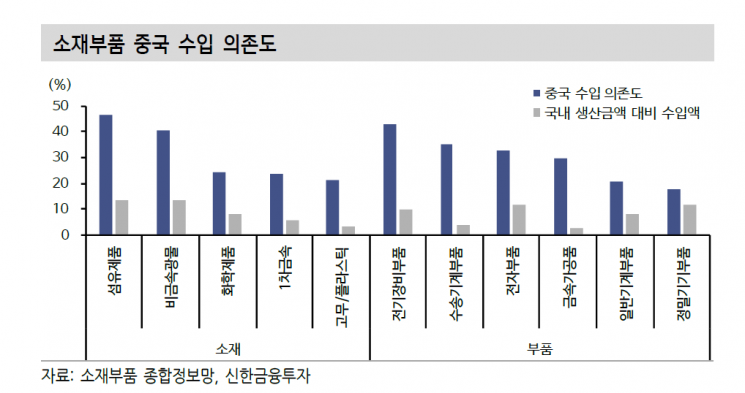

On the 5th, Shinhan Financial Investment made this diagnosis. In a mixed phase of the spread of the new COVID-19 variant Omicron and inflation concerns, price volatility of commodities with large Chinese production volumes, such as nickel and aluminum, has increased. Furthermore, as the conflict between China and Australia escalated into a coal supply issue, the subtle tensions between the U.S. and China continue, making it necessary to prepare for unexpected incidents such as trade disruptions. Ultimately, it is analyzed that reducing dependence on Chinese imports is an essential task in the mid to long term.

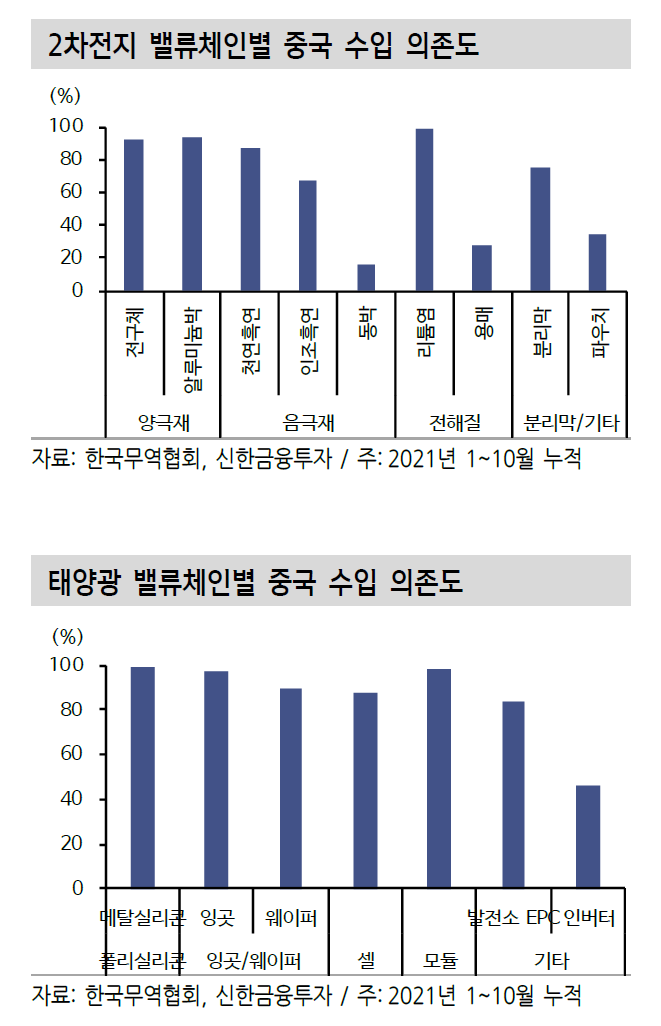

According to Korea's Harmonized System Korea (HSK) 6 classification, among items with cumulative import amounts exceeding 100 million USD from January to October this year, 150 items have a Chinese import ratio of 50% or more. This accounts for 23.9% of the total. Particularly concerning are the high-growth renewable energy sectors such as secondary batteries and solar power. China's influence is absolute at all stages of the value chain. For secondary batteries, the dependence on raw materials for cathodes is high: manganese (99%), lithium (83%), cobalt (62%), aluminum (93%), and for anode raw materials, natural graphite (87%) and artificial graphite (67%). For solar power, import dependence across all processes such as ingots (98%), wafers (90%), cells (88%), and modules (98%) reaches 70-90%.

Researcher Donggil Noh of Shinhan Financial Investment said, "It is difficult to completely escape China's influence as it has monopolized the global market with price competitiveness. However, in a situation where demand is rapidly increasing due to the expansion of renewable energy's share, if sudden supply chain issues like the urea solution incident occur, companies capable of localization and internalization among material companies will attract attention," he analyzed.

There is already a similar past case. In July 2019, when the Japanese government imposed export restrictions on key semiconductor materials such as hydrogen fluoride, fluorinated polyimide, and resist, small and medium semiconductor material stocks responded the fastest. In the second half of that year, the cumulative relative return of small and medium semiconductor stocks compared to KOSDAQ was 17.4%.

If China restricts exports due to raw material supply instability, secondary battery and solar power materials and components, which have significant supply chain influence, are likely to be the main targets. Researcher Noh said, "Even if export restriction issues do not come to the forefront, considering that the government recognized the need to reexamine the Chinese supply chain following the urea solution incident, it will be positive for the domestic renewable energy value chain," and added, "Although some secondary battery material stocks have seen valuation pressures rise during the Q4 rally, companies actively pursuing diversification of raw material supply and internalization will be the focus."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)