Woori Financial Research Institute Surveys 4,000 Mass Affluent Individuals

Net Assets Excluding Debt Total 765.4 Million KRW

[Asia Economy Reporter Kim Jin-ho] The net assets of the mass affluent, who belong to the top 10-30% income bracket, increased this year centered on real estate and stocks despite the COVID-19 pandemic.

Woori Financial Group's Woori Financial Management Research Institute announced this on the 5th through the report "Mass Affluent in the Pandemic Era." The survey was conducted nationwide on 4,000 people who meet the criteria for the mass affluent from September to October.

The mass affluent refers to households in the top 10-30% income bracket. The target is households with a pre-tax annual income of 70 million KRW or more but less than 120 million KRW.

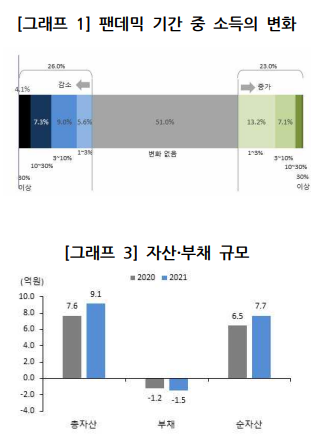

This year, the net assets of the mass affluent amounted to 913.74 million KRW, an increase of 149.01 million KRW (19.5%) compared to the previous year (764.73 million KRW). After deducting liabilities of 148.34 million KRW, net assets recorded 765.40 million KRW.

The average real estate valuation was 750.42 million KRW, an increase of 141.43 million KRW compared to the previous year, while financial assets were 120.77 million KRW, a decrease of 5.16 million KRW. However, among financial assets, stock valuation was 33.67 million KRW, an increase of 10.97 million KRW. Among respondents, 37.8% said their real estate holdings increased during the pandemic, and 29% said their stock holdings increased.

A representative from Woori Financial Management Research Institute analyzed, "The proportion of real estate in total assets rose to 78.7%, up 2.1 percentage points from the previous year, intensifying the concentration on real estate."

Changes in income and asset values during the pandemic appeared to affect the satisfaction and perception of work value among the mass affluent. The percentage of respondents who felt the value of work activities decreased compared to before COVID-19 was 28.7%, nearly twice as high as those who felt it increased (15.5%). This was analyzed to be due to the relatively small increase in earned income compared to the rise in asset prices.

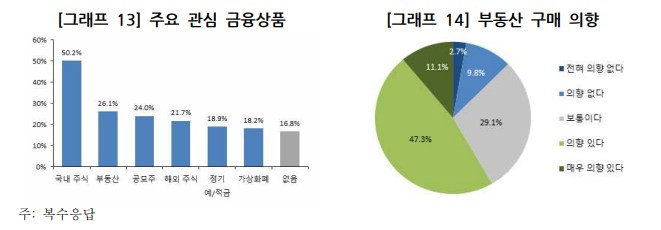

After the pandemic, investment activities among the mass affluent increased, and the need for asset management was strongly recognized. One-third of respondents believed their financial asset investment activities increased during the pandemic. Also, the proportion seeking high-risk, high-return investments rose by 10 percentage points to 43.6% compared to the previous year. The mass affluent showed high interest in ▲domestic stocks ▲real estate ▲public offerings ▲overseas stocks, among others.

In particular, more than half of respondents (58.4%) said they intend to purchase real estate in the future. However, they responded sensitively to the recently continuously rising loan interest rates.

Regarding asset management channels, smartphone apps surpassed face-to-face employee services. Responses indicating a preference for asset management via smartphone apps were 35.6%, surpassing face-to-face employee services at 29.3%. Considering that face-to-face employee services accounted for 45.9% in last year's survey, the report analyzed that digital transformation is accelerating even in the asset management sector.

A representative from Woori Financial Management Research Institute suggested, "As the wealth of the mass affluent grows and interest in asset management increases, financial companies need to strengthen asset management services targeting the mass affluent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)