Monthly Average Custody Size of U.S. Stocks Surpasses $60 Billion for the First Time

Seohak Ants Maintain Custody Size Despite U.S. Stock Market Decline

[Asia Economy Reporter Gong Byung-sun] The average monthly holding size of U.S. stocks by domestic investors purchasing overseas stocks (Seohak Gaemi) has exceeded $60 billion (approximately 70.83 trillion KRW). This is attributed to the stagnant domestic stock market while the U.S. stock market recorded all-time highs and showed an upward trend. However, uncertainties are increasing as Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), has indicated a proactive response to inflation.

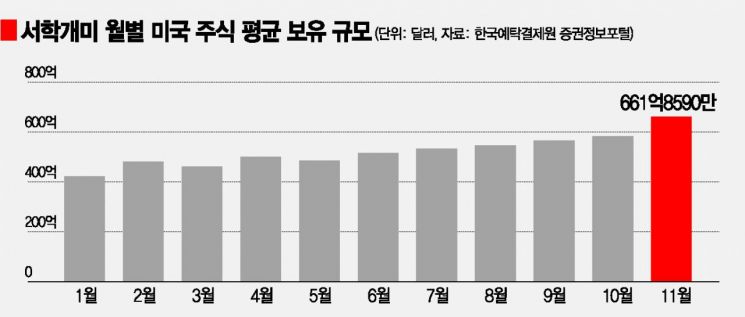

According to the Korea Securities Depository's Securities Information Portal on the 2nd, the average holding size of U.S. stocks by Seohak Gaemi in November this year was $66.1859 billion. This exceeds 78 trillion KRW in Korean won. Additionally, this is the first time the average monthly holding size of U.S. stocks has surpassed the $60 billion mark. Compared to November last year ($29.1286 billion), the average holding size has more than doubled.

The average holding size increased more steeply in November. Compared to the average holding size in October ($58.2797 billion), it rose by about 13.57% in just one month. Although the holding size has steadily increased every month since May this year, the growth rate had not exceeded 10%. In February this year, the average holding size ($48.0527 billion) increased by 13.85% compared to the previous month.

While KOSPI was sluggish, the U.S. stock market hit all-time highs... Seohak Gaemi also paid attention to new stocks

The reason Seohak Gaemi increased their holdings of U.S. stocks is that while the KOSPI was stagnant in November, the U.S. stock market continuously broke new records. This is also why, despite the recent downturn in the U.S. stock market, Seohak Gaemi still trust and maintain their U.S. stock holdings around $66 billion to $67 billion. On November 8 (local time), the Dow Jones Industrial Average (36,565.73), on the 22nd the S&P 500 (4,743.83), and Nasdaq (16,212.2) all reached all-time highs. Meanwhile, the KOSPI remained between 2,900 and 3,000 points and even closed down at 2,839.01 on the 30th of last month.

Individual stocks also attracted the interest of Seohak Gaemi. Tesla played a significant role in driving Seohak Gaemi's buying momentum by surpassing the $1,000 mark for the first time on October 25. In fact, Tesla was the most net-purchased stock among overseas stocks in November, with approximately $715.55 million. Additionally, Rivian, a newly listed electric vehicle company on the 10th of last month, surpassed Volkswagen's market capitalization within a week of listing, prompting Seohak Gaemi to net purchase $260.26 million worth of shares thereafter.

However, there are concerns that Seohak Gaemi's U.S. stock investment performance may deteriorate in the future due to increasing uncertainties stemming from inflation. On the 30th of last month, Chairman Powell stated at the U.S. Senate Banking Committee, "Because inflationary pressures are high, we will discuss at the December meeting whether it is appropriate to end asset purchase tapering a few months earlier." If the tapering period is shortened, the timing of interest rate hikes will also accelerate. If liquidity decreases due to rate hikes, damage to the U.S. stock market is inevitable.

Hwang Se-woon, a research fellow at the Korea Capital Market Institute, explained, "Since domestic investors approach U.S. stocks from a diversification perspective, the holding size of Seohak Gaemi will not decrease significantly," but added, "If tapering begins in earnest, stock price adjustments are inevitable starting this month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)