[Asia Economy Reporter Kiho Sung] BankSalad announced on the 1st that it will launch a full-scale MyData pilot service.

BankSalad's MyData pilot service will be initially available to new customers to ensure technical stability and traffic distribution, and will be gradually applied to approximately 9 million BankSalad users by December.

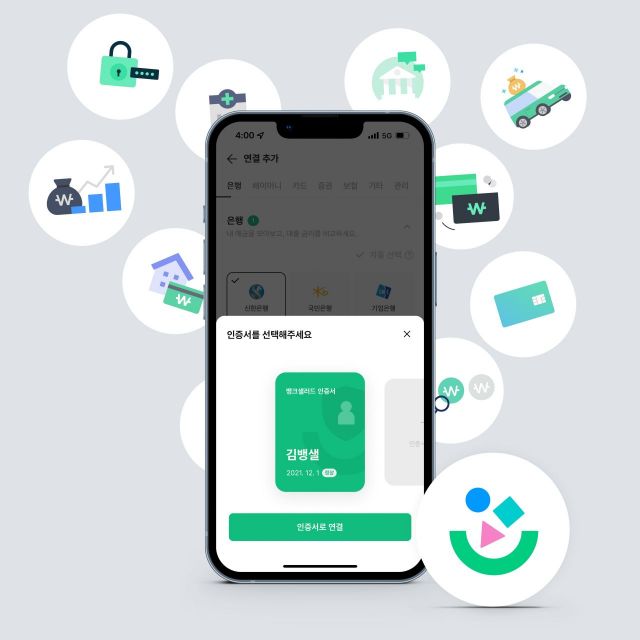

With the application of the MyData standard Application Programming Interface (API), the previously major inconvenience of slow scraping integration speed will be significantly improved. Users will no longer need to enter each financial institution's ID and password separately, enabling seamless real-time integration. While the scraping method took an average of over 30 minutes to integrate with 10 financial institutions, using the MyData standard API-based unified authentication reduces integration time by more than 90%, allowing completion within 2 to 3 minutes.

Additionally, leveraging the know-how accumulated since 2017 in household ledger and asset management services along with sophisticated data analysis solutions, BankSalad focuses on advancement by gathering scattered financial information through BankSalad certificate-based unified authentication to provide personalized services. Services utilizing more detailed financial MyData such as loan balances, interest rates and repayment information, stock holdings and valuation amounts, card payment details, and point status will be added.

Kim Taehoon, CEO of BankSalad, stated, “The adoption of the financial MyData standard API has greatly improved the user integration process,” and added, “BankSalad will solidify its position as the leading asset management platform in Korea through strong data security, service stability, and differentiated data analysis and matching technologies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.