Only 77 Apps Operated by the Top 5 Financial Groups

[Asia Economy Reporter Park Sun-mi] "Dear customer, to trade stocks, you must first access the securities application (app) once and register additional information. Would you like to launch the app?" Kang Jin-young (40), who recently opened a linked bank-securities account, became a new app user after hearing that securities trading was also possible through the bank application (app). However, to trade stocks via the bank app, she had to go through the process of separately installing the securities company app. As a result, two apps were added to the five already installed in Kang’s smartphone finance app category.

The banks’ ‘one-app’ strategy, which aims to handle multiple financial sector tasks through a single mobile app, is currently at a standstill. Although efforts are underway to consolidate functions scattered across dozens of apps into one integrated financial platform, accessibility remains poor and consumer inconvenience continues. Recently, financial authorities promised to ease regulations related to bank apps, but due to gaps between affiliates and security issues, it is expected to be difficult to create apps as fast and lightweight as those of big tech (large information technology companies) and fintech (finance + technology) firms.

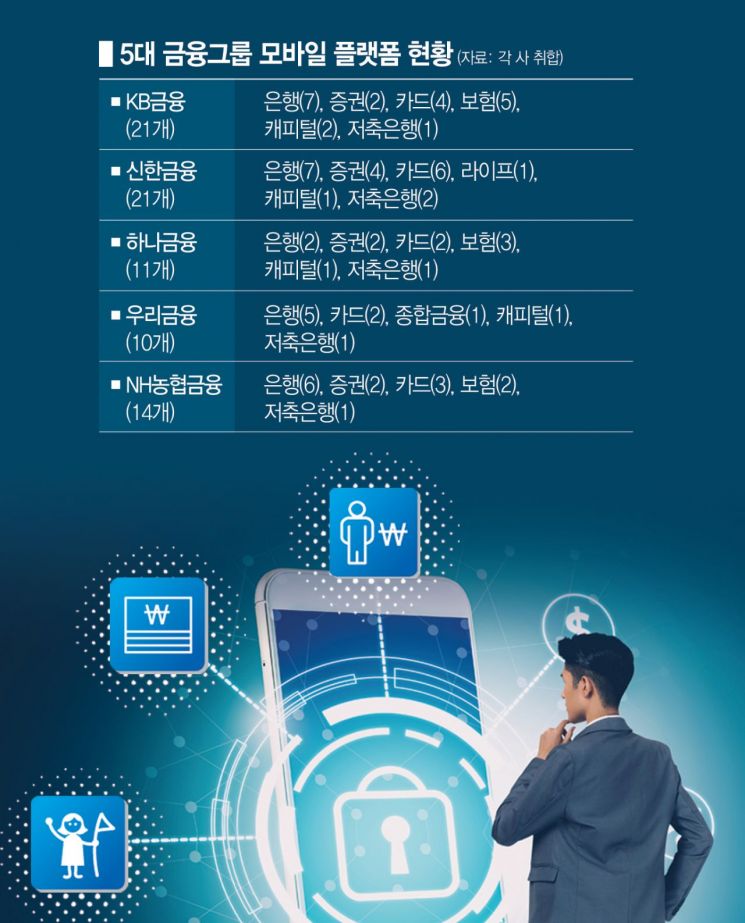

According to the financial sector on the 30th, five financial groups?KB, Shinhan, Hana, Woori, and NH Nonghyup?operate a total of 77 financial apps deemed effective. KB and Shinhan each offer the most, with 21 apps. Hana Financial operates 11, while Woori and NH Nonghyup run 10 and 14 mobile platforms, respectively.

The sector with the most apps is banking, which holds a significant share within financial groups. KB Financial operates the bank’s representative integrated app ‘KB Star Banking,’ but including this, it offers seven apps such as ▲KB Star Notification ▲Liiv Next ▲Liiv Smart ▲KB Star Corporate Banking ▲KB Real Estate ▲KB My Money. Similarly, Shinhan Financial runs seven bank apps, including the flagship app ‘SOL,’ ▲Shinhan S Bank Mini ▲SOL Alimi ▲SOL Biz Shinhan Corporate Bank ▲SOL Global, and two apps related to its affiliate Jeju Bank.

Financial groups have been working for several years to create a ‘smart flagship app’ that integrates affiliate services to respond to competition from big tech and fintech and to prevent the loss of MZ (Millennial + Gen Z) generation customers. However, adding various financial service apps has increased consumer inconvenience. Apps that are infrequently used often get mixed with existing apps and neglected.

For example, with KB Financial’s flagship app KB Star Banking alone, customers can access services from six financial group affiliates without installing separate apps. The problem is that the actual available services are limited. Customers without a KB Securities account must install a securities app separately to open a new securities account through KB Star Banking’s non-face-to-face account opening service.

Financial companies cite regulatory barriers as the reason why the one-app strategy is difficult. A financial sector official explained, "There were many legal restrictions such as the Financial Holding Companies Act, the Capital Markets Act, and the Financial Consumer Protection Act, which made sharing customer information between group companies complicated."

In contrast, big tech and fintech firms offer all services through a single super app. They include banking, securities, insurance, payments, and other services in one financial app as functions, eliminating the need to install multiple apps from the start, creating a sensation. Toss, for example, aimed from its launch to allow all financial services it provides to be used through one app.

They made it possible to use all affiliate services such as Toss Securities and Toss Bank within one financial platform, in addition to existing Toss services. This approach differs from financial groups that create multiple apps per company and then undergo integration processes for overlapping parts. A Toss representative explained, "The true one-app strategy is to allow customers to solve everything by entering one app without having to go through a difficult and complicated app search process when they need financial-related services."

Why ‘One-App’ for All Financial Transactions Is Difficult

The biggest reason financial companies have not achieved true app integration is the complex entanglement of regulations and interests across financial sectors. Financial companies are fighting back against the ‘super app’ promoted by big tech by developing ‘financial platforms’ that encompass multiple services, but many hurdles remain. To resolve the ‘tilted playing field’ controversy between big tech and banks, financial authorities have promised institutional support, but they face the challenge of redefining regulatory boundaries between consumer protection and convenience.

The one-app strategy set by major domestic financial groups involves creating an integrated bank app that consolidates scattered bank app functions and then expanding access to services of affiliated financial companies based on it.

This is necessary to maximize synergy among financial affiliates with the full implementation of the API-based MyData system starting January 1 next year. MyData providers can analyze customers’ bank, card transaction history, insurance information, investment information, etc., to recommend advantageous financial products, and customers can easily subscribe to customized products through one-stop comparison. Once financial groups with portfolios across financial sectors can offer true ‘one-app’ services, they can expand their customer base and scale up services synergistically.

However, since the 2014 personal information leak incident at card companies, sharing customer information between group companies has been difficult. To prevent this, legal hurdles have been raised through the Financial Holding Companies Act, the Capital Markets Act, and the Financial Consumer Protection Act, making it hard to unify all services of financial affiliates into one app.

A bank official explained, "System-wise, it is possible to handle securities, card, insurance, and other financial affiliate tasks within one bank app, but for consumer protection, when creating transaction ledgers through non-face-to-face real-name verification, the process must go through the respective affiliate directly." He added, "This is to prevent account opening abuse and protect customer information as recommended by financial authorities."

Another bank official said, "Although MyData has lowered barriers between financial sectors, it is true that financial affiliate tasks possible through one app are still focused on simple inquiries. Many financial regulations still need to be dismantled for active subscription and transactions of various financial products," he confessed.

Challenges Remain Despite Promises to Ease Regulations

Financial authorities have expressed their willingness to support the establishment of one-app systems in response to the ‘tilted playing field’ criticism raised by financial groups.

Financial Supervisory Service Governor Jeong Eun-bo recently said at a meeting with financial holding company chairpersons, "We will consider ways to facilitate smoother information sharing within financial groups to enhance synergy," reflecting industry difficulties. Financial Services Commission Chairman Ko Seung-beom also stated, "We will create institutional conditions to enable a digital universal bank that provides various services such as banking, securities, and insurance tailored to customer needs through one super app."

However, financial authorities do not attribute the slow progress of integrated platform construction solely to regulations. While there are principles to protect financial consumers and comply with financial sector laws, they see the large gap in interests among financial affiliates within groups as a bigger factor. An official said, "The difficulty in building integrated platforms is due not only to regulations but also to complex internal differences within groups. We will create institutional conditions to strengthen platform competitiveness, but it will be difficult to gather consensus and proceed because interests differ by sector within groups."

Even fintech companies that include all financial services in one app evaluate that the banks’ belated ‘one-app’ strategy will not be easy. A fintech official said, "Financial companies are rushing to implement the one-app strategy, but it will be difficult to integrate existing apps into one and eliminate overlapping apps. Conflicts of interest among affiliates make it hard for large organizations," he said.

Experts point out that efforts to improve fairness that can resolve the differences with big tech and fintech, which freely operate financial and non-financial businesses for consumer benefit, are urgently needed. Kim Woo-jin, senior research fellow at the Korea Institute of Finance, argued that financial authorities should allow domestic financial holding companies to operate non-financial platforms and advised, "Since authorities announced they would consider allowing digital universal banks, they should promptly prepare detailed measures to improve regulatory fairness as follow-up."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)