Considering Q3 Performance, Achievement Not Easy

"Mid-Interest and Debt Refinancing Loans Should Be Excluded from Total Volume Regulation"

[Asia Economy Reporter Kiho Sung] The proportion of loans to middle- and low-credit borrowers by internet-only banks in the third quarter has fallen significantly short of the target, making it virtually impossible to achieve this year's goal. Previously, financial authorities warned that penalties would be imposed if the targets were not met, and with the decision on next year's household loan total volume regulation limit imminent, internet banks are becoming increasingly anxious. Industry voices are calling for measures such as excluding middle- and low-credit loans from the total volume regulation to boost lending to this segment.

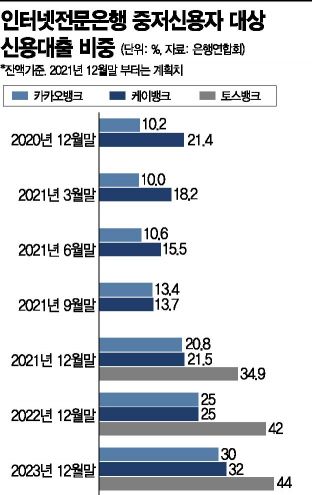

According to the Bankers Association on the 30th, as of the end of the third quarter this year, the proportion of loans to middle- and low-credit borrowers with a credit evaluation score (CB) of 820 or below was 13.4% for KakaoBank and 13.7% for K Bank. The year-end targets for the proportion of loans to middle- and low-credit borrowers set by KakaoBank and K Bank are 20.8% and 21.5%, respectively. Notably, K Bank's proportion decreased from 18.2% at the end of March to 15.5% at the end of June, and further down to 13.7% at the end of September.

The situation is even more challenging for Toss Bank. Launched in October, Toss Bank halted lending just ten days after its debut due to the financial authorities' household loan total volume management regulations. Toss Bank's proportion of mid-interest rate loans stands at 28.2%, far surpassing other banks. However, with a target of 34.9% and lending operations suspended, increasing this proportion is practically impossible. During business days, Toss Bank's proportion of middle- and low-credit borrowers even reached as high as 33.3%.

As none of the internet banks have met their targets, there are criticisms that the initial goals were set too high. Although middle- and low-credit loans had not been closely monitored before, the issue gained attention when financial authorities announced measures in May and internet banks submitted their targets. This has led to opinions that the timeframe was too tight and that the plan became complicated due to the interplay with the financial authorities' household loan total volume regulation.

The real challenge lies in next year. The Financial Services Commission recently proposed lowering next year's household loan total volume management target to 4-5%, down from this year's 5-6%, forcing financial institutions to significantly reduce their limits. Furthermore, since the financial authorities have stated that they will consider imposing disadvantages such as restrictions on new business approvals for internet banks that fail to meet the middle- and low-credit loan proportion targets, there are concerns that next year's limits could be adversely affected.

Internet banks are determined to achieve their mid-interest rate loan targets in the remaining month. This is because they expect that the financial authorities will not impose penalties unconditionally but will consider how much effort the banks have made.

An internet bank official said, "The mid-interest rate loan target is a promise not only to the government but also to our customers, so we will do our best until the end. However, we need to consider feasible methods such as excluding middle- and low-credit loans and refinancing loans (loan switching) from the total volume regulation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.