[Asia Economy Reporter Jeong Hyunjin] Due to the decline in the base effect after COVID-19, instability in raw material supply, and ongoing uncertainties including US-China trade conflicts, it is forecasted that the recovery of performance in Korea's key manufacturing industries will slow down next year. While the export growth rate of the manufacturing sector is expected to significantly decrease compared to this year, the home appliance and steel industries are predicted to see a decline in sales, whereas the shipbuilding industry is expected to experience a substantial increase.

On the 30th, the Federation of Korean Industries announced that these findings were revealed through the '2021 Performance and 2022 Outlook Survey' conducted among 10 major export-oriented industry associations including semiconductors, automobiles, petroleum refining, shipbuilding, steel, display, auto parts, textiles, home appliances, and biohealth.

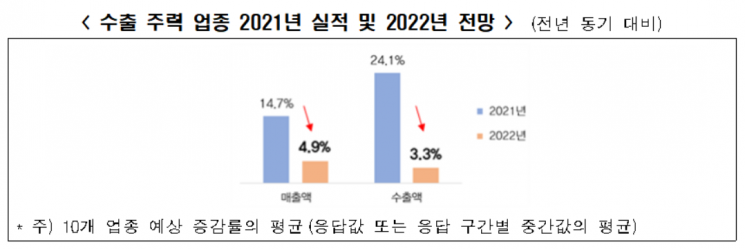

The average total sales of the surveyed industries this year are predicted to increase by 14.7% compared to the previous year, and exports by 24.1%. Next year, sales are expected to grow by 4.9% and exports by 3.3%, continuing growth for two consecutive years; however, the growth rate is expected to weaken as the base effect diminishes. In particular, the export growth rate is projected to be only one-seventh of this year's.

This year, sales declines are anticipated in the shipbuilding and automobile sectors. The sharp drop in shipbuilding sales is due to the preemptive recognition of cost losses as construction loss provisions, caused by soaring prices of raw materials such as thick steel plates (over 6mm thickness). The automobile industry is estimated to contract by up to 5% compared to the previous year due to production disruptions from vehicle semiconductor shortages and decreased domestic demand.

Next year, industries such as home appliances and steel are expected to see sales decrease compared to this year. The home appliance sector anticipates a 5-10% sales decline as the special demand effect from COVID-19, such as increased demand for premium products, diminishes. The steel industry expects sales to drop by up to 5% due to global demand slowdown and export price adjustments. The display and semiconductor industries are forecasted to have performance levels similar to this year, reflecting declines in panel and memory prices respectively.

Conversely, the shipbuilding industry is expected to increase sales by more than 20% compared to 2021, supported by increased orders and rising ship prices. Additionally, the textile industry (benefiting from the resurgence of the Korean Wave overseas and the reflective gains from US sanctions on Chinese products leading to increased demand for high value-added products), petroleum refining (increased jet fuel demand due to the transition to With COVID-19), and biohealth (continued expansion of biopharmaceutical exports) sectors are also expected to see sales growth of 5-15% compared to this year.

In terms of profitability, operating profits for all industries except shipbuilding are expected to rise compared to the previous year, while next year, operating profits in the home appliance, display, semiconductor, and steel sectors are predicted to decline.

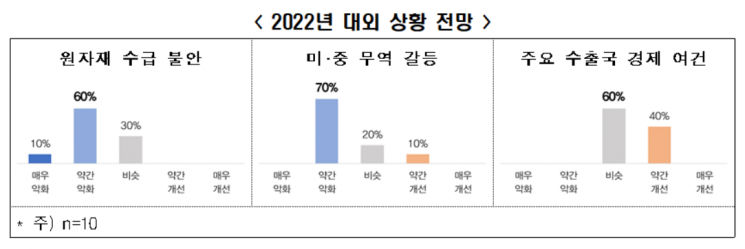

Major domestic industry associations foresee that issues recently emerging for domestic export companies?such as instability in raw material supply, US-China trade conflicts, and protectionism?will continue to impact next year. Particularly, regarding raw material supply, 60.0% of respondents evaluated it as 'slightly worsening' and 10.0% as 'significantly worsening' compared to this year, with no industry expecting any improvement. The US-China trade conflict is also expected to 'slightly worsen' according to 70.0% of the industries surveyed.

On the other hand, the overall domestic economic outlook for next year is overwhelmingly optimistic, with 50.0% expecting it to be 'similar to this year' and 40.0% anticipating 'slight improvement.' Corporate domestic investment is expected to 'slightly improve' (60.0%) compared to this year, and domestic employment is expected to remain 'similar' (70.0%). Regarding concerns related to corporate management activities, 'regulations and competition restrictions' had the highest response rate at 30.0%, followed by 'labor burdens such as difficulties in workforce management due to the 52-hour workweek system' (20.0%), and 'greenhouse gas reduction burdens' (15.0%).

The 10 major export-oriented industry associations identified 'expansion of tax support for corporate investment activities' (30.0%) as the most needed policy to improve the business environment. They also emphasized the need for ▲ efforts to improve trade conditions with major export countries ▲ expansion of labor flexibility and wage stabilization ▲ workforce development aligned with industrial demand.

The Federation of Korean Industries summarized the five key variables for next year's domestic key manufacturing industries as 'TIGER' based on the difficulties and desired policies expressed by the export-oriented industry associations. A federation official explained that the acronym combines the English initials of Tax, Inflation, Global supply chain, Environmental standards, and Regulation. Yuh Hwan-ik, head of the Federation's Corporate Policy Office, stated, "Amid ongoing adverse factors such as raw material price instability and supply chain disruptions, and the persistent risk of COVID-19 resurgence, proactive and preemptive policy support is necessary to help companies overcome difficult conditions next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.