Statistics Korea Announces October 2021 Industrial Activity Trends

Deputy Prime Minister Hong Nam-ki: "Impact of Substitute Holidays and Base Effects... Favorable November Expected Due to Export Strength and Domestic Demand Improvement"

[Sejong=Asia Economy Reporter Kim Hyun-jung] With both manufacturing and service production declining, total industrial production in October fell 1.9% from the previous month, marking the largest decrease in 18 months. Although the economic recovery and improvement trend seen in September has stalled, the government explains that the effects of base factors and substitute holidays must also be considered. Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, forecasted, "In November, major indicators are expected to show relatively favorable results due to strong exports, improved domestic demand conditions from the gradual return to normal life, and a technical rebound influenced by the low base effect from the previous month."

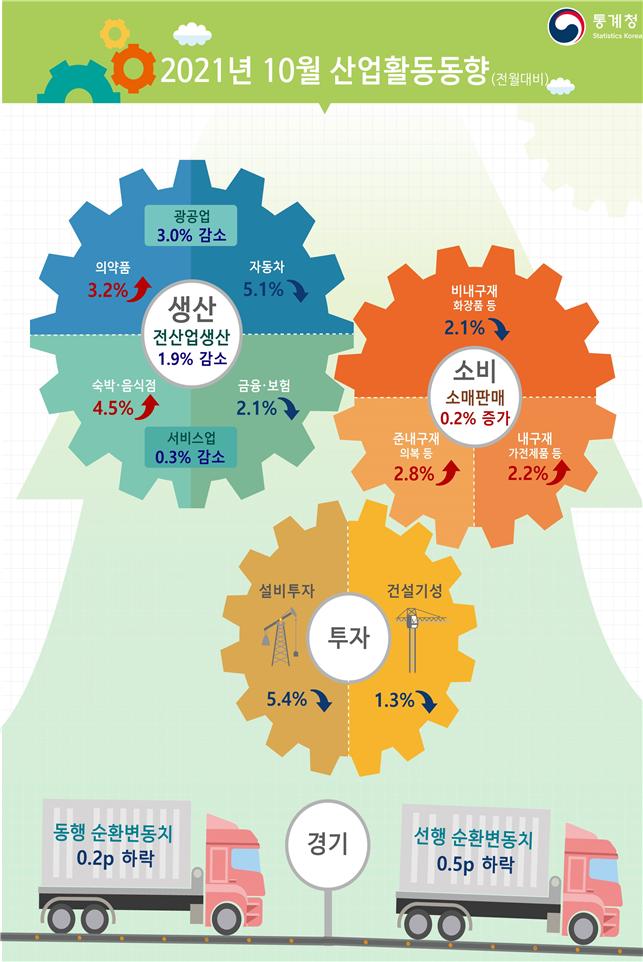

According to the Industrial Activity Trends report by Statistics Korea on the 30th, the total industrial production index (seasonally adjusted, excluding agriculture, forestry, and fisheries) was 110.8 (2015=100) in October, down 1.9% from the previous month. This is the largest decline in a year and a half since April last year (-2.0%). Total industrial production had decreased by 0.7% and 0.1% in July and August respectively, rebounded by 1.1% in September, but turned downward again in October.

Oh Woon-seon, Director of Economic Trend Statistics at Statistics Korea, explained, "Key indicators excluding consumption, such as production and investment, weakened compared to the previous month, showing a pause in the recent economic recovery trend." However, he added, "The October downturn should be viewed considering the reduced working days due to designated substitute holidays and the high base effect from September. It is premature to judge the economic trend based solely on October's figures."

Manufacturing continued its decline for the fourth consecutive month, falling 3.1% due to global supply chain issues. The service sector, which had increased by 1.4% in the previous month, turned to a 0.3% decrease in October. Public administration dropped 8.9% due to base effects from quarterly defense lease payments, and construction decreased by 1.3%.

On the other hand, the retail sales index (seasonally adjusted), which reflects consumption trends, rose 0.2% from the previous month to 121.5 (2015=100). Although the retail sales index continued to increase following September's 2.4% rise, the growth rate significantly weakened.

Facility investment and construction output decreased by 5.4% and 1.3%, respectively. The decline in facility investment is the largest in 17 months since May last year (-5.7%).

The coincident index of economic indicators, representing the current economy, stood at 101.0, and the leading index, forecasting future economic conditions, was 101.6, both down by 0.2 and 0.5 points respectively.

Director Oh stated, "We do not see the economic improvement trend as broken; exports remain strong, and consumer sentiment is improving with expanded vaccination, so the recovery trend is expected to continue. However, uncertainties regarding the domestic COVID-19 situation are increasing, and downside pressures remain due to external issues such as global supply chain disruptions and rising international raw material prices, making future economic outlook uncertain."

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki is presiding over the 48th Emergency Economic Central Countermeasures Headquarters meeting held at the Government Seoul Office in Jongno-gu, Seoul on the 23rd. Photo by Kim Hyun-min kimhyun81@

Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki is presiding over the 48th Emergency Economic Central Countermeasures Headquarters meeting held at the Government Seoul Office in Jongno-gu, Seoul on the 23rd. Photo by Kim Hyun-min kimhyun81@

Deputy Prime Minister Hong posted on his Facebook page the same day, detailing the impact of substitute holidays and base effects, and predicted improvement in indicators for November.

He mentioned, "Most indicators fell significantly compared to the previous month. However, it is necessary to interpret the October figures considering the two-day substitute holiday effect and base effects compared to September." He added, "A substantial part of the decline in manufacturing production in October was due to substitute holidays. With substitute holidays for National Foundation Day and Hangul Day, the number of working days decreased by two from the original 23 days, which alone accounts for about an 8% reduction in production." Furthermore, he explained, "Key indicators, including total industrial production, recorded positive growth in September, so October's figures reflect a relative adjustment. The continuation of global supply chain disruptions in October also contributed to the weak indicators." He then forecasted, "In November, major indicators are expected to show relatively favorable results due to strong exports, improved domestic demand conditions from the gradual return to normal life, and a technical rebound influenced by the low base effect from the previous month."

He also expressed concerns about increasing uncertainties due to the emergence of the Omicron variant and other factors. He wrote, "The fourth quarter economic rebound is a very important period as it sets the growth rate for this year and the starting point for next year. Downside risks such as global supply disruptions and inflation concerns persist, and uncertainties related to domestic COVID-19 spread and new variant viruses are growing, so vigilance cannot be relaxed." Additionally, he stated, "While doing our best to stabilize the quarantine situation, we will make every effort in the remaining period to respond decisively in domestic demand, investment, and fiscal execution to achieve the growth recovery target set for this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.