Four Months After 4th Generation Launch... Big 5 Non-Life Insurers Sell Only 300,000 Policies

Premiums Up to 70% Cheaper... 20,000 Switching from 1st Generation

[Asia Economy Reporter Oh Hyung-gil] Since the launch of the 4th generation indemnity health insurance, the rate at which existing indemnity policyholders have switched their contracts has been found to be less than 20%. Despite the recent soaring loss ratios of indemnity insurance and expectations of double-digit premium increases next year, policyholders are reluctant to switch contracts even if the premiums are expensive.

According to the non-life insurance industry on the 29th, the total number of 4th generation indemnity insurance policies sold by the five major non-life insurers?Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine & Fire Insurance, KB Insurance, and Meritz Fire & Marine Insurance?from July to October was 299,618.

In the first month of launch, July, 63,687 policies were sold, followed by 78,051 and 78,471 contracts in August and September, respectively. Last month also saw only 79,409 policies sold, showing no significant increase over the four months. This is less than half of the average monthly sales of 252,897 policies in the first half of this year.

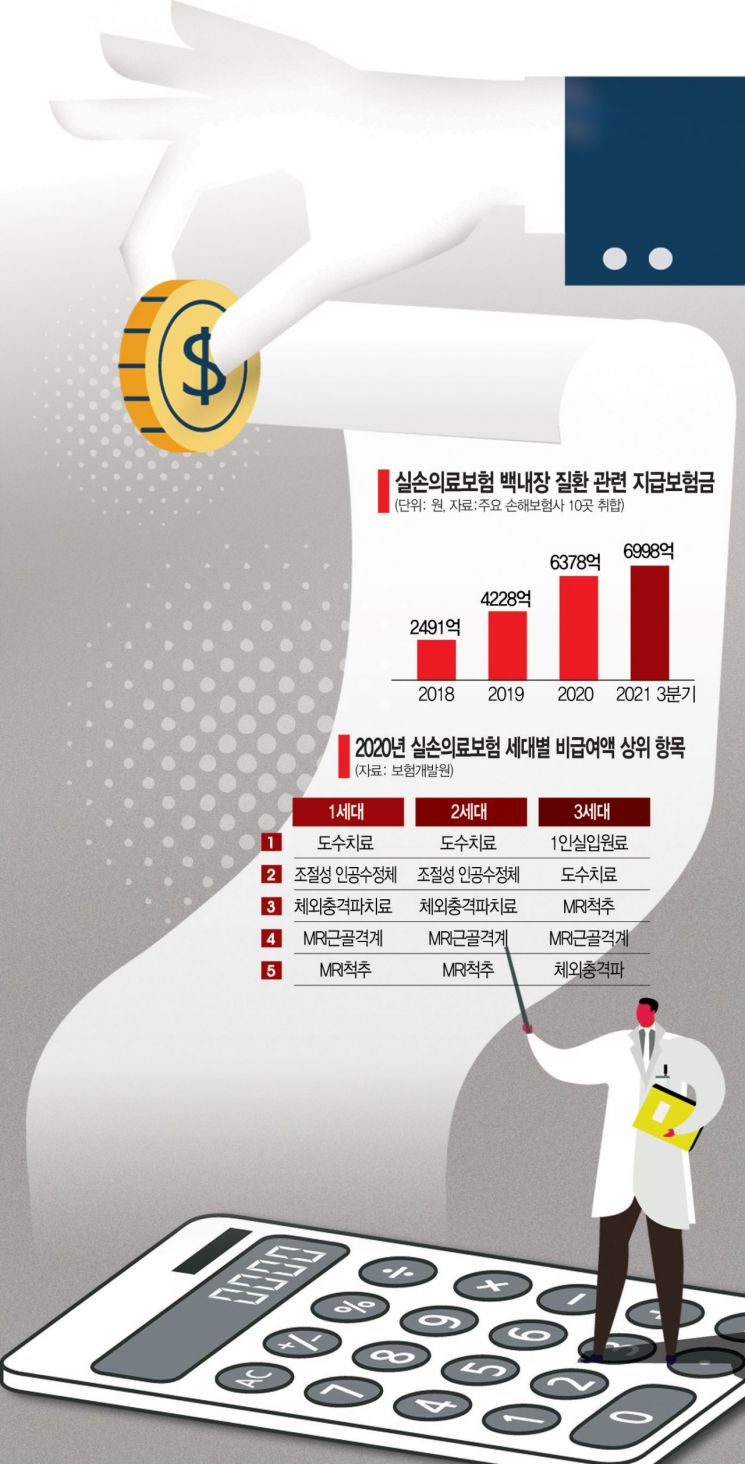

The problem is that existing indemnity policyholders are not switching to the 4th generation. Existing indemnity insurance is categorized into the 1st generation sold until September 2009, the 2nd generation sold from October 2009 to March 2017, and the 3rd generation sold from April 2017 to June of this year.

Among these, the number of 1st generation policyholders who switched to the 4th generation is 27,686, accounting for only 9.2% of 4th generation sales. The switch from the 2nd to the 4th generation was 22,103 cases (7.3%), and from the 3rd to the 4th generation only 1,388 cases (0.4%) were recorded.

The non-life insurance industry estimates that as of the third quarter this year, there are 7.69 million 1st generation indemnity policyholders, 13.29 million 2nd generation, and 7.53 million 3rd generation. Even considering the 4th generation sales by other insurers outside the five major companies that account for over 80% of the indemnity insurance market, the rate of switching among existing policyholders remains extremely low.

Of the remaining approximately 240,000 cases excluding contract switches, most are new subscriptions, but even these new subscriptions have not increased compared to the average monthly new subscriptions of 168,720 in the first half of the year.

The 4th generation indemnity insurance attracted attention at launch for having lower premiums than existing indemnity insurance. For a 40-year-old man, the average monthly premium for indemnity insurance by non-life insurers is 40,749 KRW for the 1st generation, 24,738 KRW for the 2nd generation, and 13,326 KRW for the 3rd generation, while the 4th generation is known to be 11,982 KRW, which is 10-70% cheaper.

Despite the burden of many premiums, the reason for not switching to the 4th generation is interpreted by the insurance industry as the premium increase being at a tolerable level compared to the advantages of existing indemnity insurance. A representative example is that the deductible amounts are lower in existing indemnity insurance: 1st generation (0-20%), 2nd generation (10-20%), and 3rd generation (10-30%).

The more existing policyholders maintain their current indemnity insurance, the more rapidly the loss ratio of indemnity insurance is expected to rise. As of the end of September, the risk loss ratio for the 1st generation reached 140.7%. This means that for every 100 KRW paid in premiums, 140 KRW was paid out in claims. The 2nd generation also had a risk loss ratio of 128.6%, and the 3rd generation 112.1%.

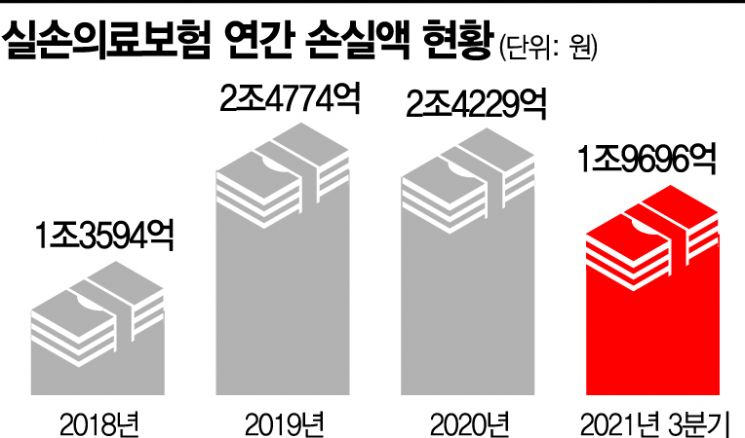

The deficit in indemnity insurance, which was 1.3594 trillion KRW in 2018, jumped to 2.4774 trillion KRW in 2019. Last year recorded 2.4229 trillion KRW, and this year, as of September, it is approaching 2 trillion KRW, expected to incur the largest loss ever. Typically, loss amounts increase in the fourth quarter, and considering the current upward trend and fourth-quarter forecasts, the indemnity insurance loss for the non-life insurance industry this year is estimated to reach about 2.9 trillion KRW.

As the loss ratio rises, it leads to premium increases. Last year, premiums rose by an average of 9%, and this year by about 10-12%. In April, premiums for 1st generation products increased by up to 21.2%.

An official from a non-life insurer said, "As indemnity policyholders age, the likelihood of illness and hospital visits increases, so they are not switching to the 4th generation immediately," adding, "Although separate screenings were removed to make it easier for existing policyholders to switch, it has been insufficient to change consumers' minds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.