Saemaeul Geumgo to Stop Handling Mortgage Loans from 29th, Shinhyup from 30th

Balloon Effect Caused by Excessive Total Volume Regulation

Increased Hardship for Low-Income, Low-Credit Citizens

[Asia Economy Reporters Jin-ho Kim and Seung-seop Song] Saemaeul Geumgo, which operates 1,300 branches nationwide, and credit unions have completely suspended handling mortgage loans. Although there were recent reports of some banks resuming lending, the situation has quickly shifted to a freeze on loans in the secondary financial sector. Critics point out that the loan market has fallen into complete "chaos" due to the balloon effect caused by the government's excessive total volume regulation.

According to the financial sector on the 29th, Saemaeul Geumgo has stopped selling four types of household loan products, including housing purchase loans and balance payment loans for pre-sale housing, at all its branches starting that day. Additionally, loans through loan recruitment agencies have also been restricted. They have decided not to pay fees on all household loans secured by housing, including living stabilization funds. The date for resuming loans is undecided. (Refer to our report on the 26th [Exclusive] Saemaeul Geumgo also fully suspends household loans from the 29th... Regulation 'Balloon Effect')

Credit unions have also decided not to accept mortgage loan applications for housing purchase purposes, including balance payment loans, starting from the 30th, and will also suspend personal credit loans. The resumption date is also undecided for credit unions.

The complete suspension of mortgage loan handling by Saemaeul Geumgo and credit unions is largely due to the demand that could not cross the bank threshold because of the total volume regulation. Earlier in August, starting with NH Nonghyup Bank, major city and regional banks raised their lending thresholds one after another.

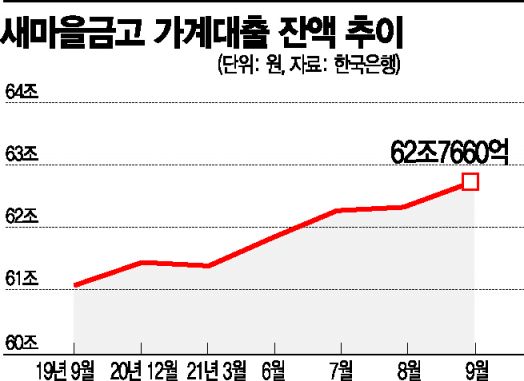

According to the Bank of Korea, the balance of household loans at Saemaeul Geumgo showed little change in the first half of this year. It increased by only 473 billion KRW over six months, from 61.394 trillion KRW at the end of last year to 61.868 trillion KRW at the end of June. However, the increase accelerated in the second half. From the end of June to the end of September, it rose by 898 billion KRW in just three months.

In particular, the increase in October and November was reportedly unusually large. Although financial authorities required portfolio changes such as reducing the proportion of secured loans and submission of weekly household loan growth figures to prevent the balloon effect toward secondary financial institutions like Saemaeul Geumgo, the effect was minimal. An insider familiar with internal affairs hinted, "Due to the balloon effect caused by loan restrictions at other financial institutions, household loans at Saemaeul Geumgo surged sharply in November," adding, "It is understood that the increase exceeded the targets set by financial authorities."

The situation is similar for credit unions. As of this month, they appear to have exceeded the household loan growth limit (4.1%) set by financial authorities. According to the Bank of Korea, the balance of household loans at credit unions was 35.865 trillion KRW as of September, a 2.47% (865 billion KRW) increase compared to the end of last year. Considering that the increase in September alone was about 300 billion KRW, it is estimated that the remaining limit (570 billion KRW) was greatly exceeded over the past two months.

Other secondary financial institutions besides Saemaeul Geumgo and credit unions are also expected to continue tightening loans. The Financial Supervisory Service reportedly issued guidelines to savings banks, Saemaeul Geumgo, and local Nonghyup units to lower their household loan growth targets for next year compared to this year. Given that low-income and low-credit households are their main customers, it is analyzed that they will face a more severe "loan famine" than this year.

Meanwhile, mortgage loan interest rates at insurance companies have also surged. Within a month, all products with the lowest annual interest rates in the 2% range have disappeared, and products exceeding 5% annual interest rates are increasing. Insurance companies are also facing significant demand that has shifted to them to avoid total volume regulation, but the interest rate hikes have increased borrowers' burdens.

A financial sector official said, "The secondary financial sector is mainly used by low-income households, so the sudden suspension of loan handling could cause great difficulties," adding, "The impact of the total volume regulation, which started in the second half of the year, seems to be intensifying toward the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.