Decline Since 2018

Record Low 0.60 in Q2 This Year

Money Supply Exceeds Economic Scale

Excess Liquidity Flows into Asset Markets

Money Supply Increases Despite Rate Hikes

Velocity of Circulation Expected to Drop Further

[Asia Economy Reporter Jang Sehee] The velocity of money circulation, which indicates how much money is circulating in the market, has hit an all-time low. Although an excessive amount of money was injected during the COVID-19 response, the actual inflow into the real economy was limited. Notably, even in September, right after the interest rate hike, the money supply continued to increase, suggesting that the slowdown in money flow may persist. Experts interpret this as a result of liquidity excessively flowing into asset markets, warning that if the velocity of money circulation does not increase, the effectiveness of monetary policy will decline and asset polarization could worsen.

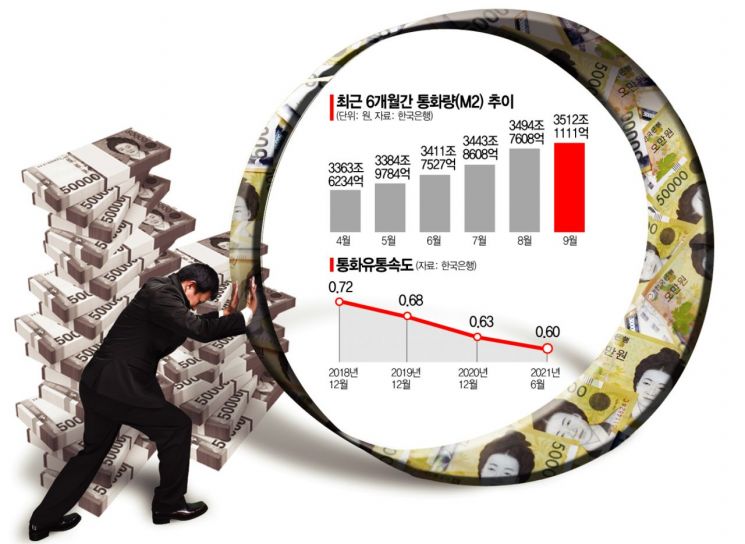

◆ All-time low velocity of money circulation = According to the Bank of Korea on the 29th, the velocity of money circulation in June was recorded at 0.60. The velocity of money circulation is calculated by dividing the real economic indicator, Gross Domestic Product (GDP), by the money supply indicator M2, which shows how much money is in circulation. This is the lowest since the related statistics began in 2002.

The decline in the velocity of money circulation is due to the amount of money increasing relative to the size of the economy. This means that the Korean economy is not properly absorbing the scale of money. Funds without a proper destination flowed into asset markets such as real estate and the stock market. A Bank of Korea official stated, "There has been an increase because households and companies have taken out many loans."

The decline in the velocity of money circulation reduces the inflow of funds into consumption and investment. Consequently, economic vitality inevitably decreases. When private consumption and construction investment in the fourth quarter of 2019, just before the COVID-19 outbreak, are set to 1, these indicators in the third quarter of this year recorded 0.98 and 0.93 respectively. They still remain below pre-COVID-19 levels.

The velocity of money circulation has been on a continuous downward trend since 2018 (0.72), before COVID-19. After entering the 0.6 range in 2019, it fell to 0.63 last year. Although the Bank of Korea maintained a 0% interest rate for 20 months, there were limits to increasing consumption and investment.

◆ Investment and consumption ‘plummet,’ monetary policy effectiveness ↓ = Despite interest rate hikes, the money supply in circulation has increased, leading to expectations that the velocity of money circulation will decline further. The money supply provided by the Bank of Korea reached 3512.011 trillion won in September, a 12.8% increase compared to the same period last year. This was after the interest rate hike in August. Generally, when interest rates rise, the money supply decreases. When the money supply decreases, the velocity of money circulation speeds up. This means that the money supply was not significantly affected by the single interest rate hike.

The money supply growth rate recorded double digits at 10.05% in January this year and continued to rise in July (11.38%) and August (12.49%).

Bank of Korea Governor Lee Ju-yeol also expressed concern about the decline in the velocity of money circulation. Governor Lee said, "The fundamental problem is that money is not moving into productive sectors," adding, "Above all, it is important to promote corporate activities."

Experts also pointed out the need to channel market funds into production, investment, and consumption. Professor Lee In-ho of Seoul National University’s Department of Economics said, "Most of the money released is not leading to investment and consumption but is flowing into asset markets, reducing the effectiveness of monetary policy," adding, "As the easing stance of monetary policy loses its effectiveness in adjusting the economy, the rationale for raising interest rates has grown stronger." He further warned, "If money does not circulate like blood and is concentrated only in asset markets, polarization will also worsen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)