[Asia Economy Reporter Ji Yeon-jin] On the 29th, the Financial Supervisory Service (FSS) announced that it signed a Memorandum of Understanding (MOU) with the Korea Securities Depository (KSD) to share information on financial investment products.

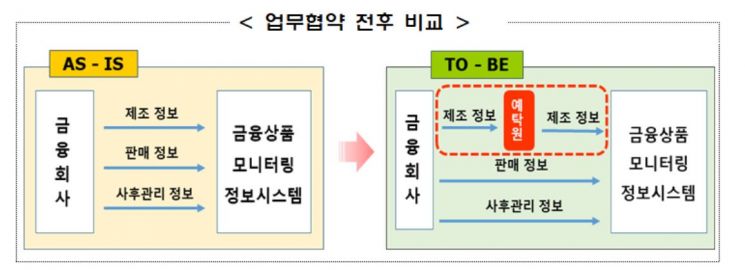

The FSS is strengthening preventive supervision to ensure that large-scale financial consumer damages, such as the Lime incident and other private fund incidents, do not recur. As part of this effort, it is building a financial product monitoring information system that can obtain and monitor detailed information on individual financial products at each stage, including manufacturing, sales, and post-management.

This MOU involves sharing financial investment product manufacturing information collected by the KSD from financial companies on every business day. As of the end of June this year, the number of financial investment product items subject to sharing reaches approximately 144,000.

Through this MOU, the two institutions aim to establish comprehensive monitoring conditions at the financial product level to early identify high-risk financial products and those with a high possibility of incomplete sales, thereby preventing large-scale consumer damages. They also expect a significant reduction in the burden on financial companies to submit data.

The FSS plans to build the infrastructure for data sharing with the KSD next year and then begin sharing data.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)