National Tax Service 2021 National Tax Statistics 4th Interim Release

Decrease in Additional Tax and Capital Gains Tax, Significant Increase in Inheritance and Gift Tax

[Sejong=Asia Economy Reporter Kim Hyun-jung] Last year, inheritance and gift taxes additionally collected through tax audits by the National Tax Service (NTS) exceeded 800 billion KRW. This represents an increase of nearly 46% compared to the previous year.

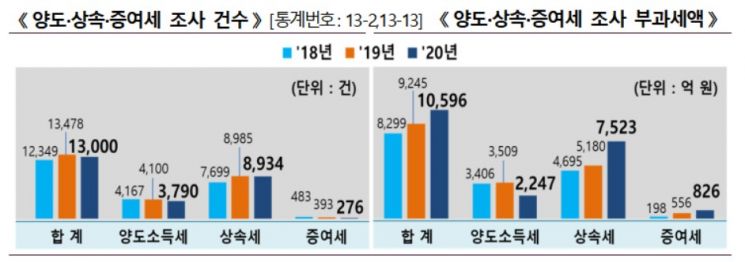

According to the 4th National Tax Statistics released on the National Tax Statistics Portal (TASIS) by the NTS on the 29th, the total assessed tax amount from inheritance (752.3 billion KRW) and gift (82.6 billion KRW) tax audits last year was 834.9 billion KRW, up 45.6% from 573.6 billion KRW the year before. In contrast, capital gains tax decreased by 36.0%, from 350.9 billion KRW to 224.7 billion KRW.

The number of audit cases for each tax category all showed a decline compared to the previous year. The total number of completed audits for capital gains, inheritance, and gift taxes was 13,000 cases, down 3.5% from 13,478 cases the previous year.

Last year, the amount issued via electronic tax invoices was 3,243 trillion KRW, a decrease of 20.9 trillion KRW (0.6%) from 3,264.1 trillion KRW the previous year. By business type, corporate businesses issued 2,861.6 trillion KRW (88.2%), and general businesses issued 381.6 trillion KRW (11.8%). By industry, manufacturing accounted for 1,355 trillion KRW (41.8%), wholesale trade 638.4 trillion KRW (19.7%), and services 353.6 trillion KRW (10.9%) in that order.

During the same period, the total amount of cash receipts issued to domestic consumers was 123 trillion KRW. By merchant industry type, retail accounted for 45.5 trillion KRW (37.0%), services 9.6 trillion KRW (7.8%), and food service 7.1 trillion KRW (5.8%). The number of cash receipt issuances was 4.13 billion, averaging about 80 receipts per person, with an average amount of approximately 30,000 KRW per issuance.

Domestic-source income for non-residents and foreign corporations totaled 63,700 cases, with total payments of 54.8 trillion KRW and withholding tax of 5.5 trillion KRW, representing decreases of 7.1%, 6.2%, and 8.3% respectively compared to the previous year. By income type, dividend income was 26.9 trillion KRW (49.1%), royalty income 15.8 trillion KRW (28.8%), and capital gains from securities 6.4 trillion KRW (11.7%).

Last year, the number of foreign-invested corporations and domestic branches of foreign corporations was 8,695 and 2,014 respectively, increasing by 64 and 7 compared to the previous year. By industry, wholesale trade accounted for 4,087 (33.0%), services 3,302 (26.7%), and manufacturing 1,974 (15.9%).

The number of completed audits for individual and corporate businesses was 7,979 cases, down 13.9% (1,285 cases) from 9,264 cases the previous year. The assessed tax amount also decreased by 24.6% to 4.6 trillion KRW from 6.1 trillion KRW.

During the same period, earned income and child tax credits were paid to 4.91 million households totaling 5 trillion KRW, based on the preparation date of the National Tax Statistical Yearbook. Including late applications until the end of November, the amount is expected to be similar to the 2019 payment (5.1 trillion KRW to 5.06 million households). The average payment per household for earned income and child tax credits is estimated at 1.14 million KRW (based on 4.39 million net households), similar to the previous year (1.14 million KRW).

By age group, the distribution of earned income and child tax credit payments was 1.1 trillion KRW for those under 30, 1 trillion KRW for those in their 40s, and 900 billion KRW for those in their 50s. By household type, single-person households received 2.4 trillion KRW (48%), single-earner households 2.2 trillion KRW (44%), and dual-earner households 400 billion KRW (8%).

Meanwhile, to improve timeliness, the NTS has shifted from releasing national tax statistics twice annually before the publication of the National Tax Statistical Yearbook in December to releasing statistics on an ongoing basis according to production timing. This data release is the 4th such release, disclosing a total of 136 national tax statistics. Detailed information can be found on the National Tax Statistics Portal (National Tax Statistics Inquiry → Ongoing Release).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.