Including Businesses Subject to Assembly Bans and Operating Restrictions

Decided to Provide Extensive Support up to 'Small Enterprises'

[Asia Economy Reporter Kim Bo-kyung] The government is expanding the scope of special guarantee support by regional credit guarantee foundations for small business owners with medium to low credit ratings who have been affected by COVID-19.

The Ministry of SMEs and Startups announced on the 28th that it will expand the support targets for special guarantees for small business owners with medium to low credit (credit score 839 points, credit grade 4 or below).

The special guarantee for small business owners with medium to low credit is a support program implemented since August through supplementary budgets to assist small business owners struggling due to the impact of COVID-19.

It provides guarantee support up to a limit of 20 million KRW for 5 years (1 year grace period, 4 years installment repayment), with low guarantee fees (exempted in the first year, 0.6% for years 2 to 5) and interest rates around 2.7% (CD rate (91 days) + 1.6 percentage points, as of November 19).

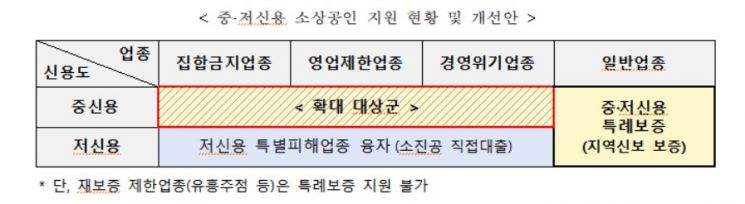

However, only general industries with decreased sales were supported, which caused a problem where businesses in the assembly ban, business restriction, and management crisis sectors?who faced relatively greater difficulties due to government quarantine measures?were unable to receive guarantee support.

To resolve this issue, the scope of special guarantee support will be expanded.

Previously, only general industries (those with 10-20% sales decrease eligible for the Hope Recovery Fund) could apply, and businesses directly subject to government quarantine measures such as assembly bans and business restrictions, as well as those in management crisis sectors with significant sales declines, were excluded from support.

Accordingly, the support targets have been expanded to allow business owners in medium credit rating assembly ban, business restriction, and management crisis sectors to also apply for special guarantees.

Furthermore, 'small enterprises' that had been excluded from special guarantees until now will also be included in the support targets.

Originally, to focus on very small businesses, small enterprises with 5 or more employees were excluded, but to provide broader support, the scope has been expanded to include small enterprises as well.

Small business owners with medium to low credit can consult and apply through regional credit guarantee foundations nationwide (179 branches).

Kwon Young-hak, Director of Corporate Finance at the Ministry of SMEs and Startups, stated, "Through the reorganization of special guarantees, we hope to alleviate the accumulated economic difficulties of small business owners caused by the prolonged COVID-19 pandemic and support the phased recovery of daily life."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)