Card Loans, Rising Interest Rates... Increase in High Credit Borrowers' Share

Concerns Over Access to Quick Loans for Low-Income People if DSR Card Loans Are Introduced Next Year

[Asia Economy Reporter Ki Ha-young] Due to the government's strengthened management of household loans, the average interest rate on card loans (long-term card loans) is rising, and the proportion of high-credit borrowers using card loans is also increasing. There are concerns that the card loan interest rates are likely to rise further, and from next year, card loans will be included in the calculation of the borrower-level total debt service ratio (DSR), drastically reducing the borrowing options for low-income households.

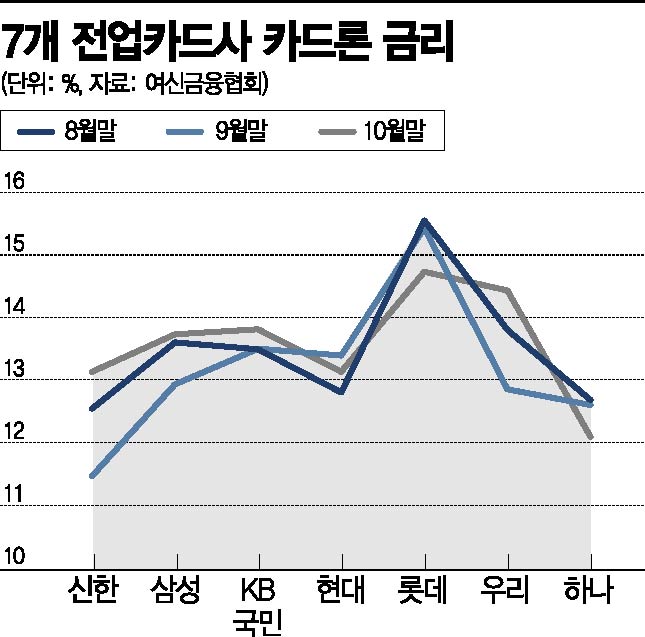

According to the disclosure by the Credit Finance Association on the 27th, as of the end of October, the average interest rates (operating prices) for card loans based on standard grades at seven major credit card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, and Hana Card) ranged from 12.09% to 14.73%. The average across the seven companies was 13.58%, up 0.41 percentage points from the previous month (13.17%).

Last month, among the seven card companies, four saw an increase in their average card loan interest rates. Shinhan Card, which has the largest card loan balance, recorded the largest increase, rising 1.67 percentage points from the previous month to 13.13%. Woori Card also saw a significant rise, increasing 1.58 percentage points to 14.43%, following Shinhan Card. Samsung Card and KB Kookmin Card also rose by 0.8 percentage points and 0.31 percentage points, reaching 13.73% and 13.81%, respectively.

As financial authorities closely monitor card loans to manage household debt, card loan interest rates are trending upward. Lotte Card raised its card loan interest rate by 2.2 percentage points in August alone, and Hyundai Card's card loan interest rate jumped 0.59 percentage points in September compared to the previous month. In fact, card loan usage surged this year. According to the Financial Supervisory Service, card loan usage in the first half of this year reached 28.9 trillion won, a 13.8% increase compared to the previous year. During the same period, card loan usage also increased by 5.8% compared to the first half of last year.

Despite the rise in card loan interest rates, high-credit borrowers are flocking to card companies as bank credit loan rates increase. This is a kind of 'balloon effect.' As of September, the proportion of Samsung Card members with card loan interest rates below 10% reached 24.79%, an increase of 7.56 percentage points from the previous month. Shinhan Card also saw the proportion of card loan customers with interest rates below 10% rise by 5.23 percentage points to 23.36%. During the same period, Woori Card recorded a 4.37 percentage point increase to 10.92%.

There is a strong possibility that card loan interest rates will continue to rise, raising concerns within and outside the industry that urgent cash channels for small business owners and low-income households will disappear. The Bank of Korea raised the base interest rate by 0.25 percentage points from 0.75% to 1% on the 25th. When the base rate rises, funding costs also increase, forcing card companies to raise interest rates on loan products such as card loans. Moreover, the financial authorities' stance on curbing household loans remains unchanged. Starting January next year, card loan balances will be included in the DSR calculation. The DSR standard for borrowers in the secondary financial sector has also been lowered from 60% to 50%.

An industry insider said, "With the base interest rate rising, card companies are likely to raise interest rates on loan products such as card loans," adding, "From next year, as card loans are included in the DSR calculation, companies will have no choice but to operate products conservatively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.