Even Lowering Prices Won't Bring Buyers... Anxious Homeowners

Purchase Demand Frozen Amid Combined Burdens of Comprehensive Real Estate Tax and Loan Regulations

Busan, Daegu, Sejong, Ulsan, Jeonnam... Many Want to Sell Homes

Still Need to Watch Whether This Leads to a Major Downturn

A, who owns an apartment in Gwangmyeong, Gyeonggi Province, recently found himself in a tight spot. To benefit from the temporary capital gains tax exemption for owning two houses under one household, he must sell one property by early next year. However, despite lowering the asking price, no buyers have appeared for several months. He has already reduced the price by 20 million KRW compared to the complex's record high. A said, "Even after listing the property on multiple real estate platforms, almost no one comes to view the house," adding, "I'm considering whether to lower the price by another 30 to 40 million KRW for a quick sale."

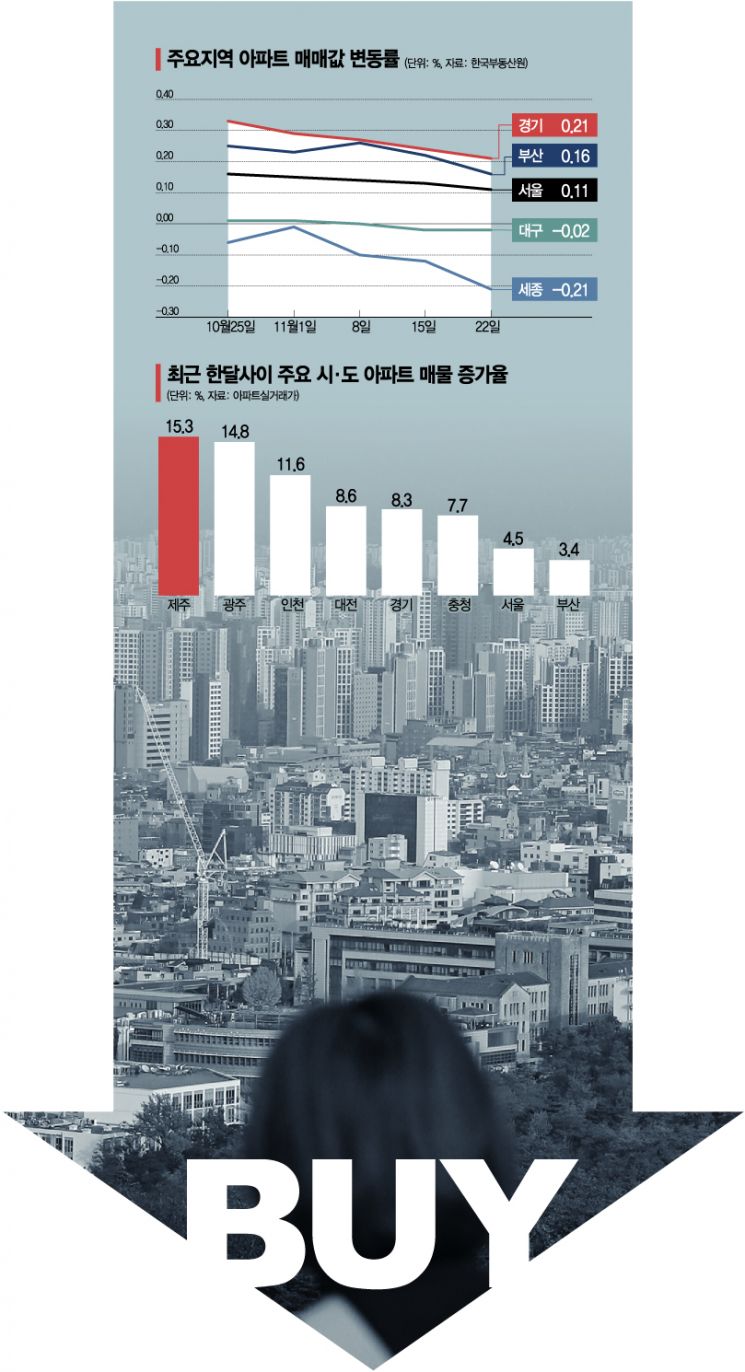

Apartment buying demand is rapidly cooling in major regions nationwide, including Seoul, Gyeonggi Province, Busan, Daegu, and Sejong. The perception that housing prices have peaked, combined with the government's tightening of loan regulations and news of a 'comprehensive real estate tax bomb,' has sharply reduced the number of prospective buyers. Daegu and Sejong are already experiencing steep declines, and even Seoul, once considered 'impregnable,' has seen sellers outnumber buyers. Although the overall upward trend continues, its pace is steadily slowing, leading experts to suggest that signs of a downturn are becoming more pronounced.

Sharp Decline in Buying Demand Not Only in Seoul but Also in Provinces

According to the real estate industry and frontline real estate agencies on the 26th, the contraction in buying demand that began in earnest last month is worsening. According to Korea Real Estate Statistics, the sales supply-demand index fell below the baseline of 100 in Seoul, Busan, Daegu, Ulsan, Sejong, and Jeonnam. This means there are more sellers than buyers. The atmosphere on the ground, which is not reflected in the statistics, is similar. Buyers, exhausted by the skyrocketing housing prices over recent years, have given up on purchasing, intensifying the 'transaction cliff' phenomenon.

Sejong is a representative example, where housing prices surged due to the administrative capital relocation issue last year but have recently shown a clear downward trend. B, who owns an apartment in Dodam-dong, Sejong, listed the property in October last year after being transferred to Seoul but could not sell it due to lack of buyers and ended up renting it out. The area was once popular, with actual transaction prices soaring to 900 million KRW due to its proximity to Osong Station, but recently, even lowering the asking price below neighboring complexes has made sales difficult. B lamented, "The real estate market cooled down suddenly, making it hard to sell."

The situation is similar elsewhere. In metropolitan cities like Busan and Daegu, it is not difficult to find complexes where actual transaction prices have dropped by tens of millions of KRW compared to early this year. A representative from a real estate agency in Busanjin-gu, Busan, said, "Transactions are mainly happening through quick sales, so the price increase trend has stalled," adding, "Although the overall upward trend remains, the number of buyers has sharply decreased."

Comprehensive Real Estate Tax Bomb and Interest Rate Hikes... "No One is Buying Houses"

The slowdown in housing prices is mainly attributed to the government's loan regulations, rising interest rates, seasonal off-peak periods, and psychological fatigue from prolonged price increases. In Seoul, the number of apartments priced under 600 million KRW, which non-homeowners can afford with loans, has already significantly decreased due to the price surge, and the increased loan burden has heightened the 'wait and see' sentiment.

In fact, some in the industry predict that by late next year, subscription competition rates may decline starting from the outskirts of the metropolitan area. While subscription competition rates in the metropolitan area often reached hundreds to one due to overheated housing prices, recently, some complexes have seen rates drop to around 10 to 1. A Korea Real Estate Board official explained, "Since the comprehensive real estate tax notices were issued on the 22nd and concerns about additional interest rate hikes have overlapped, buying demand has weakened and the wait-and-see attitude has deepened," adding, "This week, among the 25 autonomous districts in Seoul, 21 showed a reduced rate of apartment price increases."

Questioning a Major Downturn

On the other hand, some experts say it is still too early to talk about a major downturn. They argue that the buying demand has weakened forcibly due to strong government regulations, but the actual demand to buy houses has not decreased. If regulations are eased around next year's presidential election, housing prices could surge again.

Seo Jin-hyung, president of the Korea Real Estate Society and professor at Gyeongin Women's University, said, "Liquidity in the market remains abundant, and supply expansion is still a distant issue," adding, "While a sharp rise like in recent years is unlikely, a gradual upward trend is expected to continue. I do not expect housing prices to turn downward."

In fact, apartments priced below 600 million KRW, where loans are relatively easier to obtain, and some areas in Incheon and Gyeonggi Province are known to have high buying demand. Demand has shifted from heavily regulated apartments to officetels and villas, causing an unusual phenomenon where prices of 'non-apartments' are soaring.

Yoon Ji-hae, senior researcher at Real Estate R114, explained, "Although artificial regulations are significant, supply-demand issues have not improved at all," adding, "While multi-homeowners may feel pressure due to the comprehensive real estate tax burden, the heavy capital gains tax burden means few properties are coming onto the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.