Samsung, Hanwha, Kyobo, etc. Decline at End of September Compared to Previous Quarter

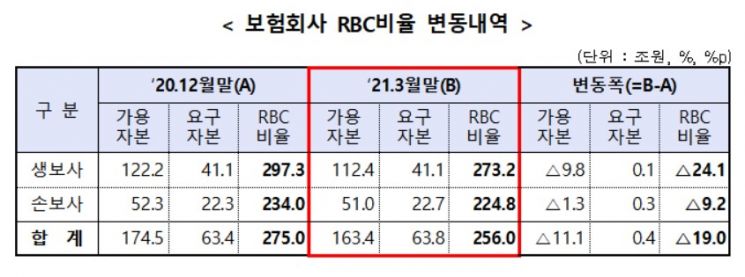

[Asia Economy Reporter Oh Hyung-gil] The Risk-Based Capital (RBC) ratio, which indicates the financial soundness of insurance companies, is declining. Although efforts are being made to increase capital through the issuance of subordinated bonds, concerns are growing that the downward trend in the RBC ratio will accelerate as bond valuation gains decrease with the end of the zero interest rate era.

According to the insurance industry on the 26th, the RBC ratios of major insurers fell one after another at the end of September. Samsung Life Insurance's RBC ratio as of the end of September was 311.3%, down 21.7 percentage points from 333.1% in the previous quarter. Hanwha Life also recorded 193.5%, down 8.5 percentage points from the previous quarter, while Kyobo Life Insurance slightly decreased from 285.0% to 283.6%.

Among non-life insurers, Samsung Fire & Marine Insurance's RBC ratio dropped 7.7 percentage points from 322.4% to 314.7%. Hyundai Marine & Fire Insurance and KB Insurance, which successfully issued subordinated bonds in the first half of the year, managed to raise their RBC ratios to some extent.

The RBC ratio is calculated by dividing the insurer’s available capital, which can cover losses from various risks, by the required capital, which is the amount of loss expected if those risks materialize. The Insurance Business Act mandates maintaining this ratio above 100%.

Interest rate hikes are expected to further lower the RBC ratio. When interest rates rise, bond prices fall, reducing valuation gains on bonds classified as available-for-sale securities. The decreased bond valuation gains are directly reflected in capital, leading to a decline in the RBC ratio.

Insurers with low RBC ratios or those that have reclassified bonds from held-to-maturity securities to available-for-sale securities face an even greater burden of bond valuation losses due to rising interest rates.

Experts point out that during periods of rising interest rates, it is difficult to maintain the RBC ratio solely through retained earnings growth, so it is necessary to prepare in advance for issuing capital securities such as subordinated bonds and hybrid capital securities.

However, with the rise in long-term government bond yields and widening credit spreads, issuance conditions for subordinated bonds and hybrid capital securities are deteriorating. The capital recognition ratio for hybrid capital securities is 100%. In contrast, for subordinated bonds, the recognized amount is reduced by 20% annually if the remaining maturity is within five years.

Jo Young-hyun, a research fellow at the Korea Insurance Research Institute, urged, "To improve expected returns, it is necessary to reduce the credit risk of investment assets that have expanded in recent years and increase the proportion of long-term government and public bonds. Regarding household loans, the risk of unsecured loans should be carefully monitored, and for corporate loans, the repayment ability of vulnerable companies and risks related to overseas alternative investments should also be closely examined."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.