Demand Forecast for Institutions on the 29th-30th of This Month... KOSDAQ Listing Next Month

Continuous Record-Breaking Performance... Emerges as Leading VC Stock

[Asia Economy Reporter Minwoo Lee] The KOSDAQ listing of KTB Network, a subsidiary of KTB Investment & Securities, is approaching. Having consistently recorded strong performance by investing early in companies such as Toss and Baedal Minjok, it is expected to emerge as the leading venture capital (VC) firm in the future.

According to the financial investment industry on the 25th, KTB Network will conduct a demand forecast for institutional investors on the 29th and 30th. Based on the upper limit of the desired public offering price, the market capitalization is estimated to reach 700 billion KRW. This size ranks second in the venture capital sector, following Woori Technology Investment, which has a market cap of about 840 billion KRW. Depending on the stock price trend after listing, it is also expected to become the leading VC firm.

KTB Network is a first-generation domestic VC established in 1981. Its strengths lie in over 40 years of investment experience and exit achievements. It has invested in 671 companies based on fund liquidation and managed 58 funds, recording an internal rate of return (IRR) of 19.8%. Its assets under management (AUM) total 1.1195 trillion KRW, placing it among the top in the industry.

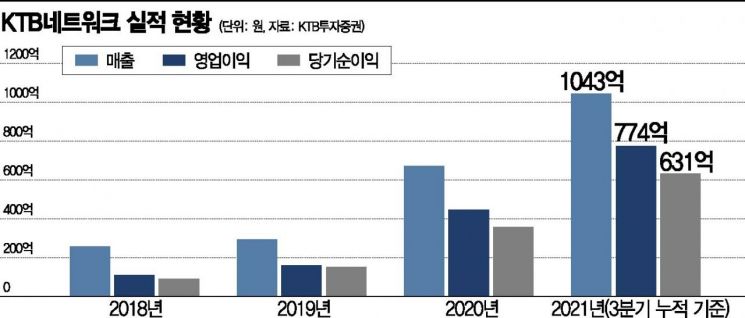

Its performance is also on an upward trend. Last year, it posted a net profit of 35.8 billion KRW, ranking first in net profit within the VC industry. The cumulative net profit for the third quarter of this year reached 63.1 billion KRW, already surpassing last year’s results and setting a record high.

This is attributed to consistent investments in promising companies. A representative example is its investment in Woowa Brothers, the operator of the delivery application Baedal Minjok. It invested 2.3 billion KRW and recovered 62.9 billion KRW. It also made an early investment in Viva Republica, the operator of the fintech service Toss. At the time of investment, Toss’s valuation was 25 billion KRW, but it is now valued at over 8 trillion KRW. Additionally, it invested in RBW, an entertainment agency that was listed on KOSDAQ on the 22nd, achieving more than tenfold returns.

Overseas investments account for about 30% of the total investment amount and are also active. It invested in Xpeng, a Chinese electric vehicle company listed on the U.S. stock market, earning five times the returns. The bio company CARsgen posted an 11-fold valuation gain as of the end of September. Mobility platform Grab in Indonesia and U.S. fintech platform Sofi are also expected to deliver solid results in the future.

Meanwhile, KTB Network plans to offer 20 million new shares in this listing. The desired public offering price range is 5,800 to 7,200 KRW, with a total offering amount of 116 billion to 144 billion KRW. After conducting a demand forecast for institutional investors on the 29th and 30th, the public offering price will be finalized, followed by a general public offering on the 6th and 7th of next month. The lead underwriter is Korea Investment & Securities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)