Abolition of Apartment and Short-Term Registered Rentals under the July 10 Measures

Significant Increase in Comprehensive Real Estate Tax This Year Due to Loss of Benefits

Some Multi-Homeowners Consider Selling Amid 'Tax Bomb'

Some Hold On While Tenants Show Signs of Tax Burden Shift

This year, as the comprehensive real estate tax (종합부동산세) has sharply increased, opposition is growing mainly among landlords whose registered rental properties were automatically deregistered. This is because the number of rental business operators who benefited from the exclusion from the comprehensive real estate tax aggregation under the July 10th measures last year has decreased, leading to a significant increase in both the number of taxpayers and the amount of tax imposed. Complaints about tax bills that have risen at least threefold compared to last year are mounting not only among apartment owners but also among those holding small multi-family housing units.

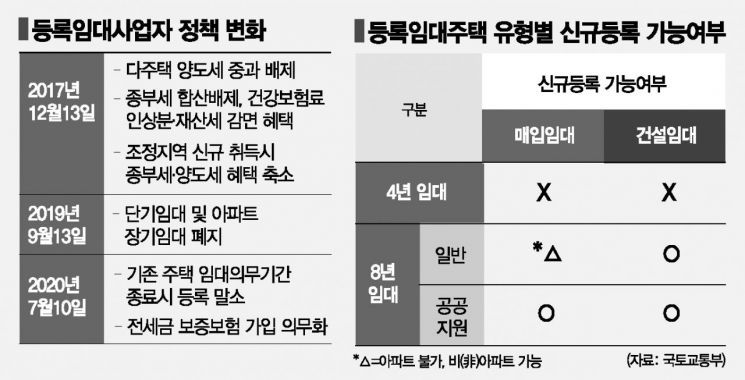

According to the real estate industry on the 24th, the government's July 10th measures last year completely abolished the apartment and short-term rental systems, resulting in a significant increase in the comprehensive real estate tax burden for landlords whose registrations were canceled. Registered rental business operators had previously benefited from exclusion from the comprehensive real estate tax aggregation, but the government last year pointed to rental business operators as the main culprits of rising housing prices and abolished the short-term (4 years) and long-term (10 years) apartment rental types.

In fact, among existing rental business operators, there is an outcry that they have to pay tens of millions of won in comprehensive real estate tax this year. Landlord A, who lives in Seoul, said, "Two apartments I have owned for 30 years were automatically deregistered, and this year the comprehensive real estate tax came out to 83 million won. It was hard to sell them because I was a rental business operator, but suddenly getting hit with a tax bomb is absurd."

Many landlords who own multi-family housing such as villas, not just apartments, have also seen their comprehensive real estate tax burden increase due to the abolition of short-term rentals. Landlord B, who lives in Incheon, said that about 42 million won in comprehensive real estate tax was imposed this year, adding, "I don't own a single apartment and have only rented out for more than 10 years, but the tax burden has become too heavy due to the deregistration of rental business operators during Minister Kim Hyun-mi's tenure at the Ministry of Land, Infrastructure and Transport."

Multi-family housing and other properties that are not apartments can be re-registered as long-term rental housing to receive tax benefits, but since subscription to guarantee insurance has become mandatory, many cases find even this difficult. In B's case, he said, "I can register as a long-term rental business operator, but the loan interest on the building is high, so it seems difficult. I feel suffocated all day because I can't do this or that."

C, who owns five one-room urban lifestyle housing units and one apartment for actual residence in the Gyeonggi-do area, said, "The combined official price is less than 1.1 billion won, but registration was automatically canceled and I was imposed a comprehensive real estate tax of 5.35 million won. When I called the tax office, they said it couldn't be helped because I didn't register for long-term rental, but since it's difficult to subscribe to guarantee insurance, what am I supposed to do?"

The Korea Landlords Association is taking collective action, including pursuing an unconstitutional lawsuit, as landlords' anger grows. According to the National Tax Service, the number of rental housing business operators who voluntarily or automatically deregistered this year is estimated to be about 33,000. The association emphasized, "Many rental business operators are suffering due to the comprehensive real estate tax notices and oppressive taxation," and added, "We will investigate cases of damage and raise awareness of the current unreasonable situation."

Some predict that multi-homeowners who have checked their comprehensive real estate tax bills this year may sell their houses before the tax base date next year. However, many opinions on real estate-related online cafes say they will wait until the next presidential election. A landlord who owns two rental houses in Daejeon said, "I think an unbearable comprehensive real estate tax will be imposed next year, but if I sell the house, I don't think I can buy it again at that price."

Rather than selling, there are opinions to raise monthly rent when signing new lease contracts next year. Eunhyung Lee, a senior researcher at the Korea Construction Policy Research Institute, said, "If demand for monthly rent such as half-jeonse increases due to future tightening of jeonse loan regulations, the burden of comprehensive real estate tax will increase, which may lead to a stronger pass-through effect on monthly rent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)