[Asia Economy Reporter Lee Seon-ae] The December initial public offering (IPO) market is expected to experience a drought. Although the record for this year has been broken at an all-time high based on data up to November, the number of IPO companies in December alone is expected to be unusually low compared to previous periods.

According to the Korea Exchange on the 24th, only three companies have confirmed IPOs in the KOSDAQ market for December, excluding reverse listings through SPACs. This is significantly fewer compared to 17 in 2019 and 19 in 2020. The KOSPI market is also experiencing an IPO drought, except for some REIT listings. This is due to increased stock market volatility leading to a selective approach to public offerings, resulting in weak demand forecasts from institutional investors. Companies such as SM Shipping, Netmarble Neo, and Simone Accessory Collection have postponed their listings, judging that they would not be able to receive their desired valuation (enterprise value).

The most notable company in the December IPO market is ToolGen. ToolGen, the KONEX market leader with gene-editing technology, has filed for preliminary review for KOSDAQ transfer listing four times including this year, but failed to pass the listing review in the previous three attempts due to reasons such as unregistered patents. This year, it received approval for the listing review for the first time, marking six years since it first applied for a technology special listing. ToolGen is not only pursuing patent revenue using gene-editing technology but also conducting research to develop therapeutics and plant and animal seeds. During the listing process, it plans to raise up to 120 billion KRW through new share issuance to invest in patent registration and research and development related to gene-editing platform technology.

Hainhwan KB Securities researcher said, "The bio sector, which had the worst returns this year, has recently shown a rebound trend, creating a positive environment for ToolGen and the sector overall. However, the significantly low number of IPO companies in December compared to the past could be an important variable, as the limited number of IPO companies may lead to concentrated subscription demand," he explained.

Interest in Auto&n, an automotive lifestyle platform company, is also high. Auto&n started as an in-house venture of Hyundai Motor Group in 2008 and spun off in 2012. Established with the motto of being an automotive specialized platform company, it has built a sourcing network of about 20,000 automotive products and an offline installation network of about 10,000 stores, supplying products related to popular electric vehicles such as the Ioniq 5 and Casper, as well as new cars.

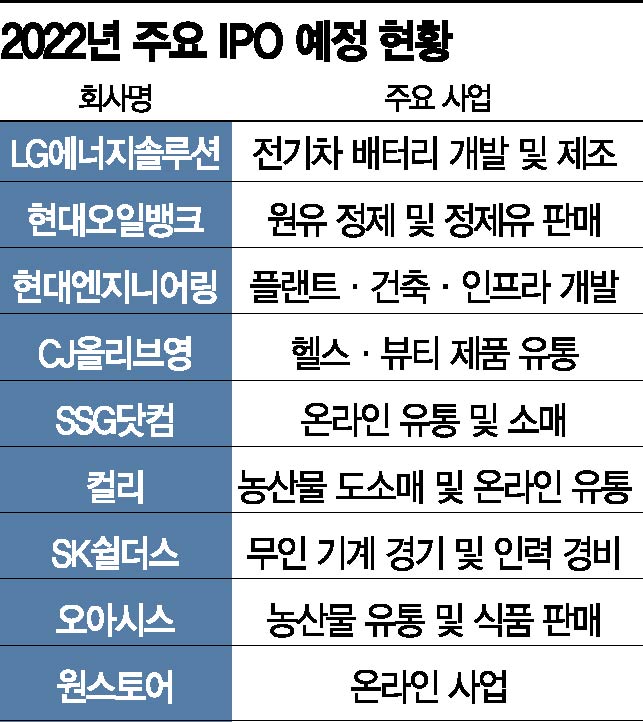

The IPO market is expected to heat up again with the new year. LG Energy Solution, Hyundai Oilbank, Hyundai Engineering, CJ Olive Young, SSG.com, Kurly, SK Shielders (formerly ADT Caps), Oasis, and One Store are all preparing to enter the public offering market one after another.

LG Energy Solution, considered the biggest fish in the first quarter of next year, is drawing intense attention as its market capitalization is estimated at around 70 trillion KRW, potentially debuting as the third largest company in the KOSPI market. Hyundai Engineering, which is going public for the first time in 20 years since its founding, is also scheduled to enter the stock market stage within January if the schedule proceeds as planned. Hyundai Engineering's enterprise value is estimated to be up to 10 trillion KRW. Hyundai Oilbank, the refining company of Hyundai Heavy Industries Group, is also accelerating its IPO and plans to make its third attempt. Hyundai Oilbank has pursued IPOs twice before, with an enterprise value estimated up to 10 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)