The Accelerating Expansion of Financial Services for Youth in the Financial Sector

[Asia Economy Reporter Park Sun-mi] Starting January next year, minors aged 14 to under 19 will also be included in the MyData (personal credit information management) service, accelerating the expansion of financial services targeting youth in the financial sector. Financial institutions are actively moving to secure future customers by launching credit cards exclusively for minors and establishing prepaid electronic payment methods that allow remittance, withdrawal, and payment without ID or bank accounts.

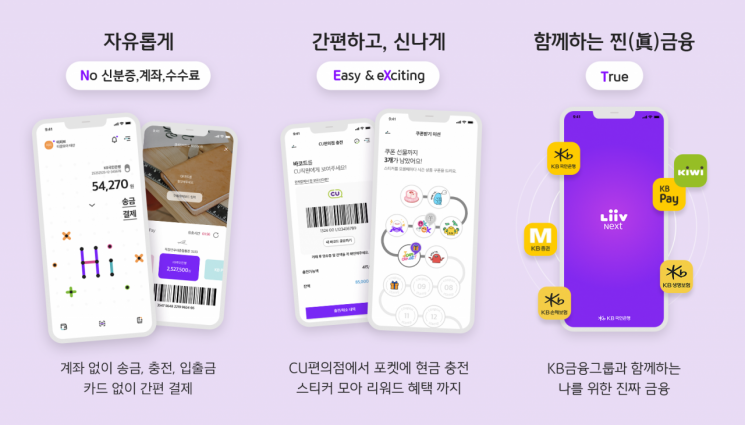

According to the financial sector on the 24th, KB Kookmin Bank recently launched ‘Liiv Next,’ a financial platform exclusively for Generation Z. This platform focuses on the financial independence of minors who have had difficulty conducting independent financial activities due to the lack of ID or bank accounts. Teen customers without ID can access the prepaid electronic payment method ‘Liiv Pocket’ through mobile phone authentication, enabling remittance, deposit, and ATM withdrawals.

The platform also includes a Pay function, allowing minors without cards to make online and offline payments up to a daily limit of 300,000 KRW. Based on this Generation Z exclusive platform, Kookmin Bank plans to provide youth with savings and AI-based financial services.

Shinhan Bank also introduced a rechargeable pay service at the end of last month in collaboration with Shinhan Card, which has received positive responses by allowing teenagers to use it freely both online and offline. The ‘Shinhan Meme,’ a prepaid electronic payment method exclusively for teenagers, can be used without a bank account.

Users can transfer money without fees via the bank app SOL and the card app Shinhan Play, and earn 5% points back on spending at convenience stores, music streaming services, and app markets frequently used by teenagers. Separately, Shinhan Bank signed a business agreement with the education company Daekyo and has started building the ‘Kids Bank’ platform targeting elementary and middle school students. The goal is to create a convergence platform based on education, finance, and entertainment.

Hana Bank has been operating the ‘iBuja App,’ a Generation Z exclusive platform that children can join with parental consent via mobile phone, since June. It includes functions for collecting (allowance, part-time jobs, savings), spending (payments, transfers, ATM withdrawals), and growing money (stock investment experience). Notably, minors can easily make payments at Zero Pay affiliated stores such as convenience stores, snack bars, and stationery shops using the app, send money to other app members, and withdraw up to 300,000 KRW from ATMs.

The card industry has also entered the credit card market for teenagers directly through the Financial Services Commission’s innovative financial service system since the second half of this year. Until now, teenagers only used ‘Umppa (mom and dad)’ cards, but now a window has opened for them to receive credit cards in their own names in the form of ‘youth family cards.’ Samsung Card and Shinhan Card currently provide related services. To address concerns about misuse of youth cards, each card company sets monthly and per-use limits and restricts usage to sectors such as transportation, stationery/bookstores, convenience stores, and academies. These measures aim to prevent misuse and fraudulent use by minors.

The expansion of financial services targeting youth in the financial sector aligns with regulatory easing by financial authorities. Although MyData providers are restricted from using minors’ credit information for purposes other than inquiry and analysis or providing it to third parties, minors will be included as eligible users.

A bank official explained, "Generation Z is the future leader of finance, and internet banks are expanding financial services for youth to capture the market. Since minors will also be included in MyData services, the moves by commercial banks to target youth will accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.