Kim Tae-ju, Director of Taxation at the Ministry of Economy and Finance, Emphasizes on Radio Program

"First-home owners can receive up to 80% deduction through senior citizen and long-term holding deductions"

[Sejong=Asia Economy Reporter Kim Hyun-jung] Regarding concerns that the comprehensive real estate tax (종합부동산세, 종부세) burden has excessively increased to a "bomb level," the Ministry of Economy and Finance stated that it is "difficult to agree" with such claims.

Kim Tae-ju, Director of Taxation at the Ministry of Economy and Finance, said on KBS radio program 'Choi Kyung-young's Strong Current Affairs' that "most of the housing-related 종부세 billed this year is borne by multi-homeowners and corporations, which is an expected policy effect following the strengthening of 종부세 to stabilize the housing market," adding, "Since this tax is not imposed on the general public, it is difficult to agree with the term 'bomb'." When asked by the host whether the tax amount on the 종부세 notice would be surprisingly high for those who received it, he explained, "Those who see a significant increase are multi-homeowners and corporations, while first-home owners in one household will see little to no increase."

Of the total housing-related 종부세 billed this year (5.7 trillion KRW), about 89%, or 5 trillion KRW, is paid by multi-homeowners and corporations. On the other hand, the amount paid by 132,000 first-home owners in one household accounts for only 3.5% of the total, approximately 200 billion KRW, according to the Ministry of Economy and Finance. Additionally, 73% of first-home owners subject to 종부세, or 95,000 people, own homes valued at 2.5 billion KRW or less, and the average 종부세 they pay is around 500,000 KRW.

However, Director Kim noted, "Even first-home owners may pay more 종부세 if they own ultra-high-priced homes," stating that for a home valued at 3.4 billion KRW, the average tax amount is about 2.34 million KRW. He emphasized that "first-home owners can receive up to 80% deduction by combining senior citizen and long-term holding deductions," highlighting the detailed design of the system.

He also added, "Among first-home owners subject to taxation this year, 85% receive at least one type of deduction, and about one-third of them receive a combined 80% deduction," explaining, "This means that 80% of the tax amount is reduced."

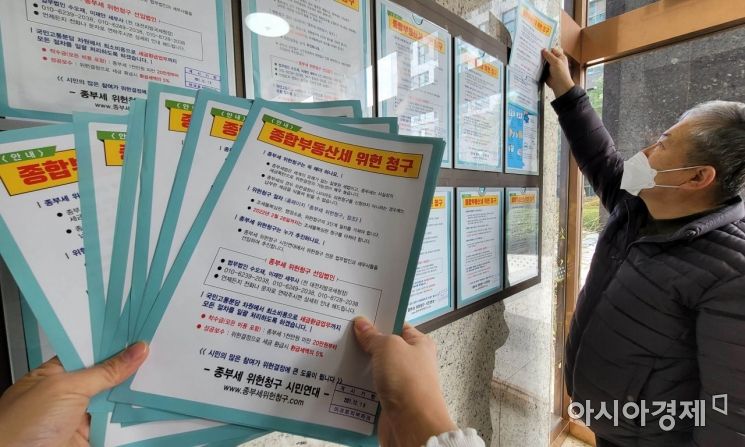

Officials affiliated with the Citizens' Coalition for the Unconstitutionality of the Comprehensive Real Estate Tax posted a notice regarding the unconstitutionality claim of the Comprehensive Real Estate Tax at an apartment in Seocho-gu, Seoul, on the 22nd. Photo by Kang Jin-hyung aymsdream@

Officials affiliated with the Citizens' Coalition for the Unconstitutionality of the Comprehensive Real Estate Tax posted a notice regarding the unconstitutionality claim of the Comprehensive Real Estate Tax at an apartment in Seocho-gu, Seoul, on the 22nd. Photo by Kang Jin-hyung aymsdream@

In response to the question, "Is there a case where a first-home owner buying a 30-pyeong apartment in Gangnam pays a combined property tax and 종부세 of 10 million KRW?" he explained, "For homes valued between 3.1 billion and 9.1 billion KRW, the average 종부세 is about 8 million KRW," adding, "In the case of very ultra-high-priced homes, such a tax burden combining property tax and 종부세 could occur." He further stated, "The 종부세 revenue is not used by the central government to cover fiscal deficits but is allocated to local governments," and explained, "The National Tax Service collects the tax and transfers it to the Ministry of the Interior and Safety, which then distributes it considering local fiscal conditions and population to promote regional balanced development."

Regarding calls to introduce heavy taxation on foreigners acquiring domestic real estate, he responded, "According to international norms, it is not permissible to discriminate against nationals of specific countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.