As the shortage of urea solution originating from China has emerged, related companies are gaining attention. When China stopped exporting urea to prioritize its domestic demand, the domestic urea solution market, which had relied on China for 97% of its raw materials, faced an emergency. Although the situation has calmed down with the suspension of China’s export restrictions, there are calls for fundamental solutions such as expanding domestic production. Domestic urea solution manufacturers include Lotte Fine Chemical and KG Chemical in the Ulsan Industrial Complex, which account for more than 50% of domestic production, as well as Huchems in the Yeosu Industrial Complex and Aton Industry in the Iksan 2nd Industrial Complex. We analyzed the performance and financial structure of these companies, whose stock prices have been highly volatile due to the urea solution issue.

[Asia Economy Reporter Park So-yeon] Huchems, a mid-sized company in the Yeosu Industrial Complex, mainly produces nitric acid, mononitrobenzene (MNB), dinitrotoluene (DNT), and also manufactures industrial urea solution. Its market share in the urea solution market is about 0.5%.

Huchems is a key affiliate of Taekwang Industrial. Taekwang Industrial acquired it from Namhae Chemical in 2006. As of the end of the first half of this year, Taekwang Industrial holds 39.95% of Huchems’ shares, and related parties including Chairman Park Joo-hwan of the Taekwang Industrial Group directly own 3.46%. NongHyup Economic Holdings owns 8.33%, and the National Pension Service holds 8.12%. The market capitalization is about 960 billion KRW.

The manufacturing industry centered on fine chemicals accounts for 100% of sales. Although it is noted as a urea solution producer and its stock price has been declining continuously, the actual proportion of urea solution sales in its business is minimal. Most sales come from polyurethane raw materials and nitric acid production. As of the first half of this year, about 70% of sales came from the polyurethane raw material production business. DNT and MNB are produced and sold as NT products, which are polyurethane materials. Another area is the nitric acid division, essential for semiconductor wafer cleaning. They produce and sell nitric acid products such as dilute nitric acid, agricultural nitric acid, and aqua regia as NA series products, with ammonia as the main raw material, accounting for 27% of sales. Additionally, they sell ammonia products, urea solution products, and carbon emission rights obtained through greenhouse gas reduction in the domestic emission rights market. The ratio of domestic to export sales as of the first half of this year is 80.7% to 19.3%.

Huchems’ greatest strength is its strong market dominance. It exclusively supplies the domestic market with polyurethane raw materials used in a wide range of applications from textiles, paints, and sponges to furniture, automobiles, and building materials. Thanks to its monopolistic market position, Huchems has a solid sales structure. Most contracts with customers are long-term, lasting 10 to 15 years.

Used in various fields such as textiles and automobiles

Strong dominance as exclusive domestic supplier

Asia’s largest nitric acid production capacity

Leading carbon emission rights seller as new growth engine

Stable operating profit margin and strong cash flow

Huchems also possesses Asia’s largest nitric acid production capacity. Nitric acid is a chemical necessary for the cleaning process that removes foreign substances from semiconductor wafers. Huchems supplies over 90% of the domestic nitric acid market. Currently, it is investing an additional 150 billion KRW to build a new nitric acid plant. The production capacity expansion is about 400,000 tons, and upon completion, the annual production capacity of its main product, nitric acid, will increase from about 1.1 million tons to 1.5 million tons.

The carbon emission rights sales division is considered Huchems’ new growth engine. Last year, it sold 1.85 million tons of carbon emission rights, ranking first in domestic emission rights sales. The company has a separate division for emission rights sales. Domestic carbon emission rights trading began in 2015 and has seen increasing transaction volumes and prices every year.

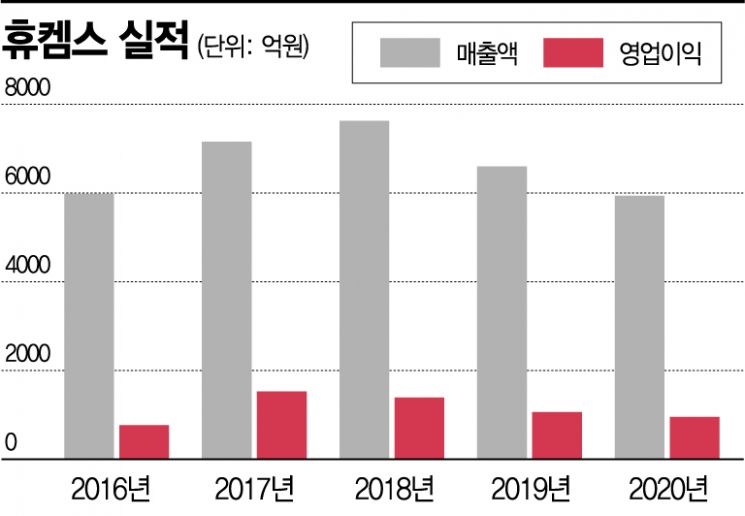

Despite the impact of COVID-19, Huchems showed a solid operating profit margin thanks to its unique production capacity. Over the past five years, Huchems has maintained steady operating profits of about 70 billion to 150 billion KRW. During the same period, the operating profit margin ranged from 12% to 21%. It has also continued steady CAPEX (capital expenditure) investments of about 17 billion to 35 billion KRW annually. Interest-bearing debt decreased from 140.4 billion KRW in 2016 to about 63 billion KRW in 2020. The debt ratio stands at 26.11%. The company has stable cash flow and a high dividend payout ratio. Of its assets worth about 900 billion KRW, more than half, 470 billion KRW, are cash equivalents. Over the past five years, the cash dividend payout ratio ranged from 44% to 77%.

However, there are noticeable areas for improvement in ESG (environmental, social, and governance) management. Huchems has 249 employees in total, including 58 administrative staff and 191 production workers. The number of female employees, including six fixed-term workers, is only 12, which is less than 5% of all employees. As of the first half of the year, the average salary per employee was 38 million KRW, but the average salary for female employees was 16 million KRW, showing a significant wage gap between male and female employees. Meanwhile, Chairman Park Joo-hwan’s total compensation for the first half was 850 million KRW, which is salary income, with an annual salary of 1.7 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)