Early Customer Acquisition Determines Success

Preparing Segmented Customized Services

[Asia Economy Reporter Kiho Sung] The launch of MyData (personal credit information management) services is just two weeks away. Financial companies are putting all their efforts into early customer acquisition through differentiated services ranging from genetic testing to year-end tax settlement. Early customer acquisition is seen as crucial to the overall success of the business, raising concerns about overheated competition.

According to the financial sector on the 21st, financial companies selected as MyData operators are currently undergoing final approval from the Financial Services Commission and functional suitability review by the Financial Security Agency, followed by a closed beta test (CBT) conducted by the Credit Information Center. The MyData pilot service will begin on the 1st of next month.

Although it is a pilot service, financial companies are focusing on preparations with the determination equivalent to a full-scale service due to intense early competition. A representative from a MyData company said, "Due to the nature of digital finance, there is a sense of crisis that only a few companies will survive," adding, "Also, since the MyData market starts from the same starting point for everyone, the key will be how many new ideas are generated."

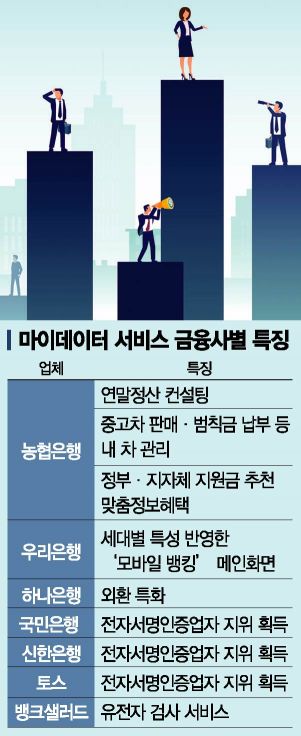

Among banks, NH Nonghyup Bank is attracting the most attention. Nonghyup Bank will launch various services based on ‘NH Asset Plus,’ which collects transaction information from all financial companies to manage customers’ assets and consumption status, and ‘Financial Planner,’ which manages financial schedules such as automatic transfers and utility bills all at once. Notably, services such as ‘Year-end Tax Settlement Consulting,’ which analyzes customers’ income and financial transactions and provides ongoing simulations for year-end tax settlement consulting; ‘My Car Management,’ which allows users to check vehicle prices, insurance, fines, and penalties; and ‘Customized Information Benefits,’ recommended by the government or local governments, are drawing attention. Nonghyup Bank plans to start MyData services immediately from the 1st of next month.

Woori Bank is conducting a pre-opening notification event ahead of the launch of the ‘Woori MyData Service.’ In particular, to enhance the service, the mobile banking main screen has been revamped. Three types?‘Fun Type,’ ‘Easy Type,’ and ‘Basic Type’?have been introduced according to generations, allowing customers to choose among them. For example, the ‘Fun Type’ for the MZ generation prioritizes displaying items where goals can be set and achievement rates checked, while the ‘Easy Type’ for senior generations prioritizes displaying ‘personal financial schedules.’

Some have also acquired the status of electronic signature certification service providers, the ‘master key’ of MyData services. KB Kookmin Bank, Shinhan Bank, and Toss have been selected as operators for integrated authentication. To use MyData services, users need to verify and access their personal credit information scattered across various financial institutions. However, this process is greatly simplified through integrated authentication institutions. To become an integrated authentication institution, one must have the status of an electronic signature certification service provider and pass strict security standards set by authorities. Hana Bank is reportedly preparing a MyData service specialized in foreign exchange.

Some have expanded their scope beyond finance to health information. BankSalad has partnered with genetic analysis company Macrogen to offer genetic testing services. Currently, as a beta service, genetic testing is provided free of charge to the first 500 daily applicants. Through genetic testing, users can identify genetic traits across six categories and 65 items, including ▲nutrients ▲exercise ▲skin and hair ▲dietary habits ▲personal characteristics ▲health management. These results can be viewed in the health tab within BankSalad.

However, from next year, insurance and securities companies will also enter the MyData market following banks and fintech companies, raising concerns about excessive competition among operators. Currently, some financial companies are offering expensive prizes such as the latest luxury cars to secure customers or even assigning customer subscription quotas per employee. Financial authorities plan to closely monitor such excessive competition and prepare countermeasures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.