Hana Financial Investment Report

Possibility of Oil-Producing Countries Increasing Production and Strategic Petroleum Reserve Releases

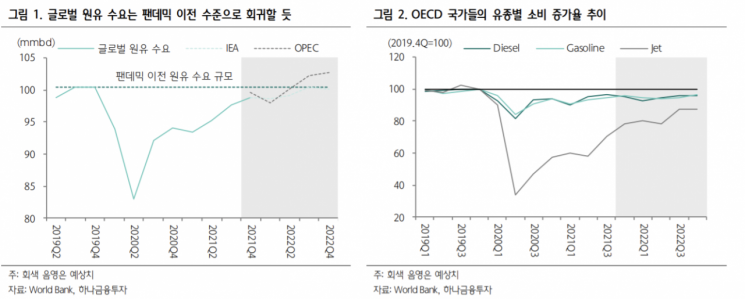

[Asia Economy Reporter Minji Lee] As oil supply and demand gradually improve next year, global oil demand is expected to return to pre-crisis levels.

On the 19th, Hana Financial Investment stated, “Currently, global oil demand is about 3% below pre-pandemic levels,” and “As oil demand gradually improves next year, global oil demand is predicted to return to pre-crisis levels.”

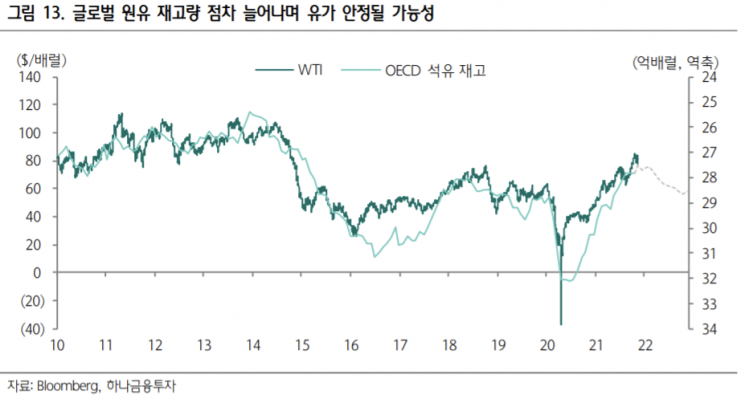

Since September, oil prices have been rising rapidly due to concerns over oil inventory shortages. However, next year, as oil-producing countries continue to increase production, concerns about supply shortages are expected to be alleviated. The United States has fully recovered its production levels to pre-hurricane levels since October, and oil production is on the rise. To stabilize oil supply, the U.S. government is also likely to release strategic petroleum reserves. Researcher Jeon Gyu-yeon said, “The U.S. currently holds about 600 million barrels of strategic petroleum reserves, which is roughly equivalent to one month’s consumption based on average daily oil consumption,” adding, “It is also a factor that President Biden requested China to release reserves during the U.S.-China summit.”

OPEC+ is maintaining a gradual production increase policy, but recently some member countries have failed to meet their agreed production quotas, resulting in a production cut compliance rate exceeding 100%. Saudi Arabia and Russia, which lead production, have been steadily increasing output, and it is noteworthy that Russia is producing beyond the agreed amount.

Researcher Jeon explained, “OPEC+’s gradual production increase policy will continue next year, and production cuts will be completely lifted in September 2022,” adding, “From May next year, production baselines for some oil-producing countries including the UAE, Saudi Arabia, and Russia will increase, which could lead to higher oil supply.”

However, for the time being, oil prices are expected to remain high due to limited oil production amid insufficient oil inventories and increased demand for heating oil during the winter season. There are also factors limiting demand recovery. Recently, with the resurgence of COVID-19 in Europe and other regions leading to strengthened quarantine measures, prolonged supply chain disruptions have weakened manufacturing companies’ production and new orders, which further deteriorates demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.