Bogeumjari Loan Interest Rate Hits Highest in 3 Years... Eligibility and Didimdol Also Rising

Bank of Korea Base Rate Hike Expected... Increased Interest Burden for Low-Income Households

Experts Say "Policy Finance Should Be Steadily Supplied" Amid Concerns of Side Effects

[Asia Economy Reporters Jin-ho Kim and Hyo-jin Kim] Park Eun-ji (38, pseudonym), who dreamed of buying her first home by the end of this year, has recently been struggling with issues related to applying for the Bogeumjari Loan. This is because interest rates have risen significantly over the past year, and the application conditions have become much stricter. The Bogeumjari Loan interest rate, which was available at the mid-2% range a year ago, has recently reached the mid-3% range, marking the highest level in over three years. The loan application deadline has also been drastically tightened from 20 days prior to 50 days prior. Park said, "The interest rate is one thing, but my bigger concern now is whether I can even get the loan," adding, "I am so worried that I might have to ask the homeowner to postpone the final payment date, and I can't sleep."

As a result of the financial authorities tightening household loans, the handling of policy mortgages has effectively stopped this year, which is expected to further increase the level of 'housing instability' felt by low-income households. In particular, the interest rates of major policy mortgage products have recently hit their highest levels in over three years, raising the threshold for low-income households’ 'last bastion' for homeownership. This loan shortage is expected to continue next year, and there are concerns that excessive loan restrictions will ultimately cause greater harm to low-income households.

◆ Relying solely on policy mortgages... increased interest burden = According to financial authorities on the 18th, there are concerns that the interest burden on low-income households flocking to policy mortgages to avoid tightened bank loans will increase day by day.

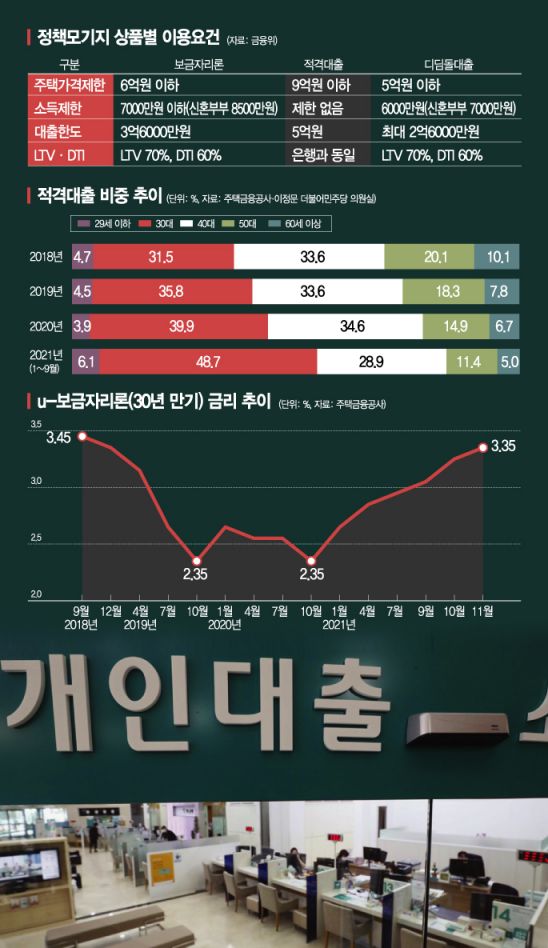

According to the Korea Housing Finance Corporation, the loan interest rate for the U-Bogeumjari Loan (based on a 30-year term) this month is 3.35% per annum, the highest since September 2018 (3.45% per annum). The Bogeumjari Loan interest rate has been on a steady rise since hitting a low of 2.35% per annum in October last year. With market interest rates rising rapidly this year, the rate has surged by 1 percentage point in just one year.

The situation is similar for the Eligible Loan and Didimdol Loan. At the beginning of this year, the average interest rate for Eligible Loans at commercial banks was in the 2% range, but it has soared to the mid-3% range in the second half of the year. The Didimdol Loan has also recently decided to raise interest rates by up to 0.35 percentage points.

The problem lies in the interest burden on low-income households. With policy mortgage usage itself becoming a 'needle's eye' to find, the rapid increase in interest rates only adds to the burden. For example, a borrower who took out a 300 million KRW Bogeumjari Loan in October last year had to pay 1.16 million KRW monthly for principal and interest, but a borrower taking out the loan this month must bear 1.32 million KRW.

In particular, with the Bank of Korea expected to raise the base interest rate twice by early next year, the interest burden is likely to increase further. Some analyses suggest that if the base rate is raised twice, policy mortgage interest rates breaking through 4% is only a matter of time.

There are also forecasts that it will be even harder to obtain policy mortgages next year. The Financial Services Commission is reportedly considering reducing the policy mortgage supply target for next year from the original 37 trillion KRW to below 33 trillion KRW. There are concerns that policy mortgage handling could be suspended earlier than this year.

◆ Heartbreaking for the homeless “Low-income funds have run dry” = Experts express concern that with policy mortgages effectively blocked, the breakthrough for real demanders trying to buy homes, especially low-income households, has completely disappeared. Professor Kim Dae-jong of the Department of Business Administration at Sejong University said, "Policy finance is like the last bastion for low-income households," adding, "The fact that policy finance has run dry means that funds for low-income households have run out."

Professor Kim also analyzed that the current government’s excessive tightening of loans to compensate for its failure in real estate policy has led to this outcome. The government is using every means to show that it has stabilized housing prices, but the problem is that while it does not leave real estate to the market, it seems to neglect financial issues like interest rates by leaving them to the market.

He emphasized, "This is a harsh reality for low-income households," and added, "At least policy finance should be steadily supplied."

Voices continue to be raised that this phenomenon is fundamentally a side effect of the current 'total volume regulation' policy. Professor Oh Jung-geun of the Department of Economics at Konkuk University said, "It is necessary to consider switching to a soundness management method rather than total loan volume regulation, as in advanced financial countries," adding, "The total volume regulation method inevitably distorts the price function of money, that is, the interest rate setting structure."

Professor Sung Tae-yoon of the Department of Economics at Yonsei University advised, "It is necessary to strengthen competition to break the monopoly power of financial companies," and "Loans should be smoothly provided according to income or credit rating."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.