[Asia Economy Reporter Lee Seon-ae] The era of investing in unlisted companies is booming. As large corporations are increasingly engaging in corporate venture capital (CVC) investments and establishing CVCs, funds are pouring into domestic unlisted venture investments, and the overall trust in the unlisted market has risen, leading to a sharp increase in transactions by individual investors. With the active trading of unlisted stocks, the securities industry is focusing on expanding the 'unlisted market' business by creating dedicated analysis teams for unlisted companies and developing trading platforms.

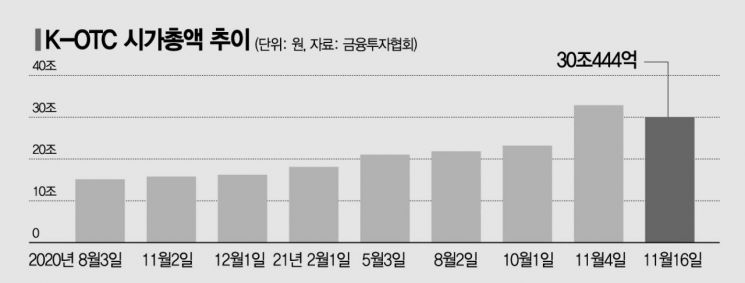

According to the Korea Financial Investment Association on the 17th, the market capitalization of the regulated over-the-counter market K-OTC soared from around 16 trillion won in November last year to 34 trillion won this month, marking a growth rate of over 100% in about a year. On the 15th and 16th, the market capitalization fluctuated between 30 trillion and 31 trillion won. K-OTC, operated and managed by the Financial Investment Association, allows convenient trading of unlisted stocks through securities firms' Home Trading Systems (HTS) and Mobile Trading Systems (MTS). The 'Securities Plus Unlisted' platform, which enables trading of unlisted stocks, has also recorded explosive growth. Launched in November 2019 by Samsung Securities in partnership with Dunamu, Securities Plus Unlisted recently surpassed 800,000 members and 1 million downloads.

This is due to increased investor confidence in unlisted companies. In particular, the influx of funds from large corporations into unlisted ventures has been a major factor in market expansion. Samsung Electronics' CVC, Samsung Venture Investment, executed investments exceeding 100 billion won by the third quarter, more than triple the amount invested last year. Kakao's CVC, Kakao Ventures, also invested over 50 billion won, reportedly more than double last year's investment.

By the end of the year, with the allowance of CVCs held by holding companies, more funds from large corporations are expected to flow in. At the industry meeting on CVC and venture investment system improvements held by the Fair Trade Commission on the 11th, 16 companies affiliated with holding company systems, including SK, LG, Hyundai Heavy Industries Group, GS Group, Hyosung Group, and CJ Group, showed interest. As a result, the total investment execution amount by CVCs held by domestic large business groups (with total assets exceeding 5 trillion won) is expected to exceed 1 trillion won for the first time this year. The investment amount executed by the third quarter is estimated to be over 800 billion won. The total unlisted venture investment has already surpassed last year's annual level. Unlisted venture investments reached 5.0253 trillion won by the third quarter, exceeding last year's annual investment of 4.3045 trillion won, an 84% increase compared to the same period last year. By industry, investments exceeding 1 trillion won were made in ICT services, bio/medical, distribution, and services.

Nam Ki-yoon, a researcher at DB Financial Investment, said, "A virtuous cycle structure between the listed and unlisted markets is being created," adding, "Many investors, including listed companies, general corporations, financial firms, and individual investors, are engaging in unlisted investments, so more investments are expected next year compared to this year."

A venture capital (VC) industry official stated, "Startups in fields that these large corporations have identified as new growth engines, such as semiconductors, batteries, displays, mobility, and e-commerce, are attracting large-scale investments and there is growing anticipation for technological innovation through collaboration."

The securities firms are also busy. They are expanding their businesses to make the unlisted market a new source of revenue. KB Securities and NH Investment & Securities are preparing to launch separate platforms for trading unlisted stocks. DB Investment & Securities has been regularly publishing reports on unlisted companies about once or twice a week since 2019, the first among securities firms. KB Securities recently established a New Growth Company Solutions Team to analyze unlisted companies. KB Securities is the first to organize a dedicated team for this purpose.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.