Major Financial Institution for MZ Generation, K-Bank Leads with 43.8%

15% of MZ Using K-Bank Plan to "Change Their Main Bank"

Research Institute: "Commercial Banks Must Also Strengthen Platform Competitiveness"

[Asia Economy Reporter Kwangho Lee] The MZ generation (Millennials + Generation Z), which has rapidly emerged as the "economic powerhouse," identified KakaoBank as the most important financial service provider. Additionally, big tech companies (large information technology firms) have established themselves as indispensable financial service providers in the daily lives of the MZ generation, with Naver Pay being considered a more important financial institution than traditional banks.

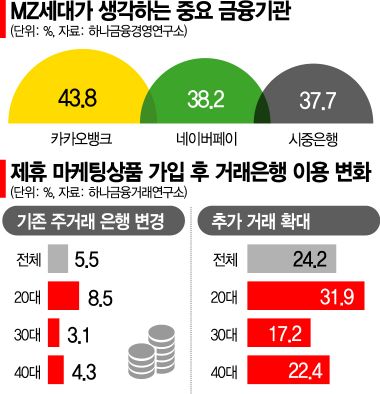

According to the report "The Need to Expand Collaboration Between Big Tech and Banks," released on the 16th by Hana Financial Management Research Institute, the most important financial institutions as perceived by the MZ generation (based on the combined rankings of 1st, 2nd, and 3rd choices) were KakaoBank at 43.8%, followed by Naver Pay at 38.2%, and traditional banks at 37.7%. This means that 8 out of 10 MZ generation individuals consider big tech companies as their primary financial payment method over traditional banks.

The number of big tech users is rapidly increasing. As of the end of the third quarter, the monthly active users of the KakaoBank mobile application exceeded 14.7 million, making it the largest in the entire banking sector. The number of customers increased from 15.44 million at the end of last year to 17.4 million as of the end of September this year. The number of users of Naver Pay, as well as K Bank and Toss Bank, is also rapidly growing.

Most of these generations use both traditional banks and internet-only banks as their main banking institutions. Among all respondents, 79.4% reported using both traditional banks and internet-only banks. Only 20.0% of the MZ generation used traditional banks exclusively, and just 0.6% used only internet-only banks.

KakaoBank Users Are MZ; 15% Plan to "Switch Their Main Bank"

Ji-hyun Kim, a research fellow at Hana Financial Management Research Institute, predicted, "Although traditional banks still hold a high share as the main bank for the MZ generation, the usage of internet-only banks is expected to increase in the future." It is anticipated that traditional banks will be used for salary accounts, internet-only banks for inquiries and transfers, and fintech services for remittances, payments, events, and promotions.

Among the MZ generation currently using KakaoBank (70.2%), 15.8% stated they plan to switch their main bank to KakaoBank. Meanwhile, 52.8% responded that they are evenly split.

The research institute advised that, given the convenience and simplicity of big tech services, usage is likely to shift in the future, so traditional banks should focus on strengthening their own platform competitiveness.

Research fellow Kim suggested, "Banks should enhance their own platforms while continuing marketing collaborations with big tech, and consider competitive and cooperative strategies with big tech by building new cooperative revenue models using Banking as a Service (BaaS) and other means."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.