Top Net Purchase Stock 'Meta Platforms (Facebook)'

Zuckerberg Reveals Business Shift Intent, Buys About 220 Billion Won This Month

[Asia Economy Reporter Minji Lee] So-called Seohak Ants, who actively invest in overseas stocks, are actively jumping into investments related to 'Metaverse' stocks. As the metaverse has been established as a 'mega trend,' investor interest in related stocks is expected to grow further.

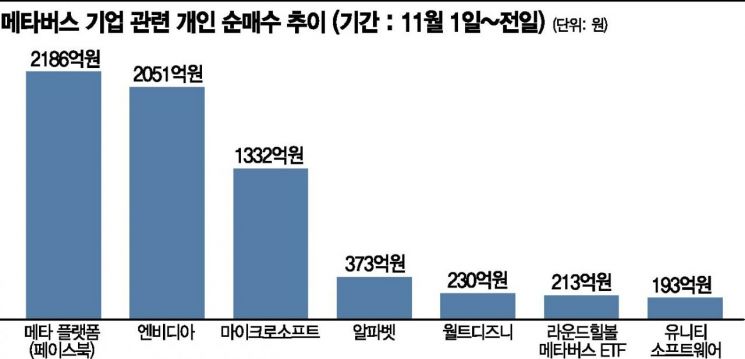

According to the securities information system SaveRo on the 16th, domestic investors purchased 218.6 billion KRW worth of Meta Platforms (Facebook) from the 1st of this month until the day before. When CEO Mark Zuckerberg announced his determination to lead a major business shift to the new metaverse business by even abandoning the Facebook name at the end of last month, the scale of domestic investors' investments was the largest among overseas stocks. The amount purchased in the last 10 trading days is larger than the net purchase amount of 205.6 billion KRW in the past month.

Im Jiyong, a researcher at NH Investment & Securities, analyzed, "Meta Platforms has presented the concept, characteristic components, and vision of the metaverse more concretely than any other company, so it is judged to have the highest understanding of the metaverse." He added, "The key is to build a metaverse ecosystem (OS) beyond Android and iOS, and attention should be paid to whether this will resolve the discount factor compared to Apple and Alphabet."

The 2nd and 3rd ranked net purchase stocks by Seohak Ants were Nvidia (205.1 billion KRW) and Microsoft (133.2 billion KRW). Nvidia was re-evaluated as it introduced the open platform 'Omniverse,' where virtual 3D creation tools are gathered in one place, moving beyond the framework of a semiconductor company. Its stock price also rose about 35% from $222.22 to $300.25 over the past month. Microsoft also rose about 9.4% in a month riding the metaverse wave, drawing investor attention due to its goal of building a B2B (business-to-business) based metaverse.

Seohak Ants also accumulated more than 20 billion KRW in the metaverse ETF ‘ROUNDHILL BALL METAVERSE ETF,’ which was listed in June last month. This ETF has a relatively large proportion of hardware and software sectors necessary for implementing the metaverse. This differs from domestic listed metaverse ETFs, which focus on content and mainly include gaming and entertainment companies. Major holdings include ‘Nvidia’ (9.94%), ‘Roblox’ (8.47%), ‘Microsoft’ (6.98%), ‘Unity Software’ (6.24%), and ‘Meta Platforms’ (5.90%).

Disney was also among the top holdings. Although the stock price fell about 10% in the past week due to disappointing earnings and concerns that subscriber momentum for Disney+, the new DTC business segment, might slow down, domestic investors increased their net purchase amount to 23 billion KRW, more than the 17.3 billion KRW in the past month. When Disney mentioned that it is "considering building its own metaverse," investor sentiment is presumed to have expanded with expectations that theme parks could also be enjoyed in the metaverse. Additionally, domestic investors purchased about 19.3 billion KRW worth of Unity Software, a game development engine company presented as the top preferred stock in the software area within the metaverse value chain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.