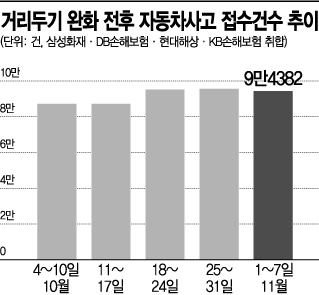

8% Increase from Previous Month in This Month's 1st-7th Days

Auto Insurance Loss Ratio Also Expected to Rise

[Asia Economy Reporter Oh Hyung-gil] Car accidents have increased again with the phased transition to daily life recovery (With Corona). Car accidents, which had decreased due to social distancing measures implemented during the COVID-19 pandemic, have rebounded since mid-last month as traffic volume increased. The loss ratio of auto insurance, which had been stable, is also expected to rise again ahead of the year-end.

According to the non-life insurance industry on the 16th, the number of car accident claims received by four major non-life insurers?Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine & Fire Insurance, and KB Insurance?in the third week of last month, when social distancing was eased, reached 95,169 cases.

This is an increase of nearly 10,000 cases compared to 87,282 and 87,233 cases received in the first and second weeks of October, respectively.

The government implemented social distancing easing measures on October 18. Private gatherings were allowed up to 8 people, including those fully vaccinated, and restaurants and cafes were permitted to operate until midnight. In the month when the With Corona measures were implemented, the number of car accident claims received from the 1st to the 7th reached 94,382 cases, an 8.1% increase compared to the same period last month.

The insurance industry analyzed that the increase in car accidents was due to the combined effect of the easing of social distancing measures and seasonal factors such as increased outings during the autumn foliage season.

An insurance industry official said, "Car accidents typically increase in winter, but this year, signs of an increase have appeared since October," adding, "It is understood that the increase in travel and outings, which were restricted due to social distancing, has led to more accidents."

As car accident claims increase, the previously stable auto insurance loss ratio is expected to deteriorate again. The insurance industry is closely monitoring the loss ratio trend ahead of the year-end, when car accidents typically surge.

As of the third quarter of this year, the cumulative auto insurance loss ratios of major insurers were ▲Samsung Fire & Marine Insurance 79.1%, ▲DB Insurance 78.1%, ▲Hyundai Marine & Fire Insurance 79.5%, and ▲Meritz Fire & Marine Insurance 76.7%, about 10 percentage points lower than the same period last year. They have contributed to reducing insurance operating losses by maintaining the estimated appropriate auto insurance loss ratio of 77-78%.

However, concerns are rising that the loss ratio will worsen due to scheduled increases in repair fees starting in December. In September, the insurance industry and the automobile repair industry held the Auto Insurance Repair Council and finally agreed on a 4.5% increase in hourly labor costs for auto repairs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.