Growth Stocks or Value Stocks, Which Should You Buy?

"Earnings Improvement is Basic, Recommend Stocks with Momentum"

[Asia Economy Reporter Ji Yeon-jin] As global inflationary pressures intensify and concerns about early interest rate hikes in the United States grow, an investment strategy once considered conventional wisdom in the stock market has recently lost its relevance.

According to the Korea Exchange on the 15th, the KRX Media & Entertainment Index rose 8.11% from the beginning of this month through the 12th, recording the highest returns. During this period, the KRX Consumer Discretionary index fell 2.13%, and the KRX Banks and KRX Insurance indices posted returns of -1.71% and -1.21%, respectively. Typically, during periods of interest rate hikes, value stocks based on earnings, such as cyclical stocks and bank stocks, are considered beneficiaries. However, this month, when the timing of the U.S. rate hikes was brought forward, value stocks actually declined, while media and gaming stocks related to the so-called ‘Metaverse,’ which are considered growth stocks, rose sharply.

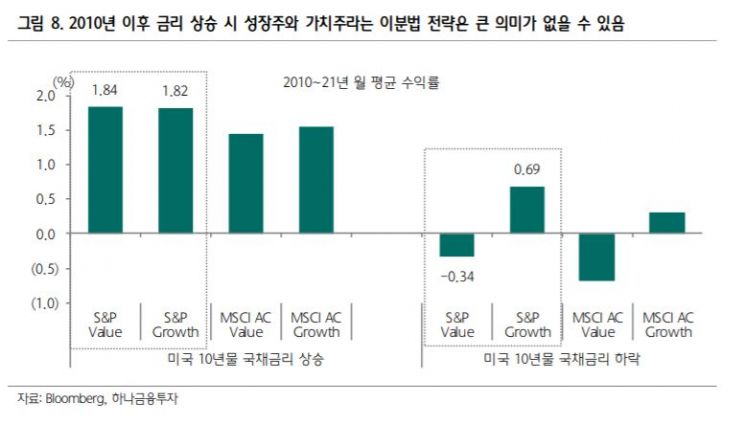

The financial investment industry interprets this as a change in investors’ style strategies. Until the 2000s, movements in U.S. Treasury yields led to simultaneous rises or falls in both value and growth stocks, but since 2010, as U.S. Treasury yields have significantly decreased, market interest rates have ceased to be a variable indicating economic phases. As a result, when market interest rates fall, the returns of growth and value stocks differ greatly, whereas during periods of rising rates, their performance is similar. Lee Jae-man, a researcher at Hana Financial Investment, said, "During periods when market interest rate forecasts change, style strategies within the stock market become confused," adding, "The binary strategy of growth stocks versus value stocks during rate hikes may no longer hold much meaning."

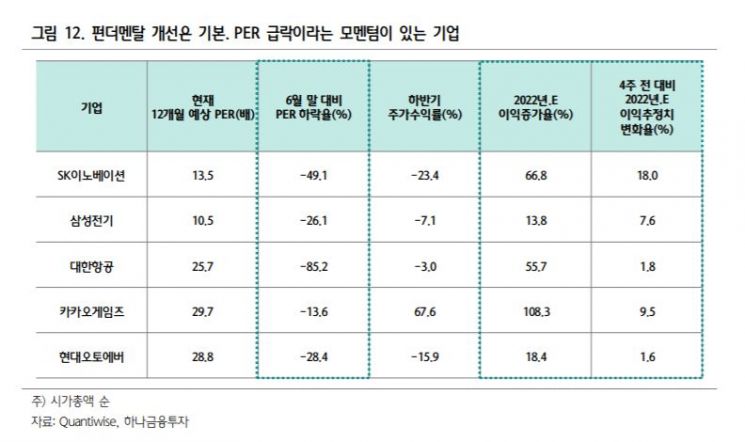

Lee suggested that in such a market, fundamental improvements like ‘earnings growth’ are essential, and investors should focus on sectors with momentum options such as expectations for U.S. infrastructure investment and the Metaverse. Companies with high net profit growth rates next year and whose earnings estimates have been revised upward over the past four weeks, resulting in a significant drop in price-to-earnings ratios (PER), include SK Innovation, Samsung Electro-Mechanics, Korean Air, Kakao Games, and Hyundai AutoEver. Additionally, companies recommended include Kia, KB Financial Group, Hyundai Heavy Industries, CJ ENM, and LS, which have increasing net profits, upward earnings revisions over the past four weeks, price-to-book ratios (PBR) below 1, and have seen net foreign buying since the fourth quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.