Rising Inflation in US and China Intensifies Policy Criticism

South Korea and US Stock Markets Decline... Concerns Over Return to Tightening Policies

Powell Reiterates "Caution on Interest Rate Hikes"

[Asia Economy Reporters Byunghee Park and Hyunwoo Lee] The U.S. stock market reversed to a decline amid overlapping concerns centered on the U.S. and China, including consumer sentiment contraction due to soaring inflation, economic downturn, and fears of a return to tightening policies. Going forward, governments and central banks worldwide are expected to face the dual challenge of curbing inflation while keeping the spark of economic recovery alive.

As public sentiment turned cold due to the immediate surge in inflation, the Biden administration in the U.S. announced an unprecedented move to deploy the military to repair port facilities to resolve the supply chain crisis.

On the 9th (local time), the New York Stock Exchange reversed to a decline after nine trading days. Influenced by the U.S. stock market, the Korean stock market also failed to avoid weakness. The Dow Jones Industrial Average closed at 36,319.98, down 112.24 points (0.31%) from the previous trading day, the S&P 500 index fell 16.45 points (0.35%) to 4,685.25, and the tech-heavy Nasdaq index dropped 95.81 points (0.60%) to 15,886.54.

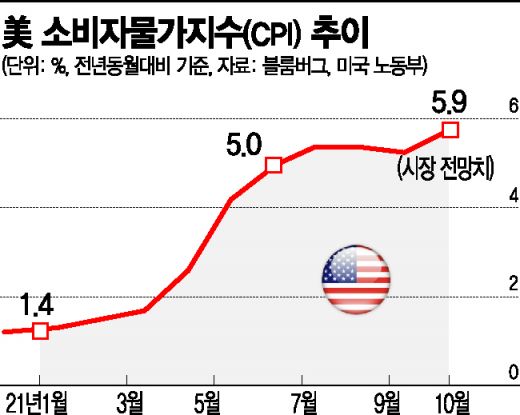

The New York Stock Exchange had been on a continuous rise since the Federal Reserve’s (Fed) announcement on the 3rd to keep the benchmark interest rate unchanged, fueled by expectations of ongoing liquidity. However, concerns grew that the Fed would shift to tightening policies due to the faster-than-expected rise in inflation indices in the U.S. and China, leading to a decline.

In China, where the Producer Price Index hit a record high again last month, voices opposing the government’s coercive market policies are emerging. According to the Hong Kong South China Morning Post (SCMP), the National Economic Research Institute (NERI) of China announced that the market-friendliness reform index of the Chinese government’s policies recorded 5.81, the lowest in five years since 2016. This criticism points out that the government’s recent large-scale crackdowns and regulations on major IT companies, private education, and the real estate market, along with supply chain issues, are causing inflation to skyrocket.

Similarly, facing criticism over soaring inflation, the Biden administration recently declared its active commitment to resolving the supply chain crisis, which has been identified as a major factor behind inflation. According to Bloomberg News on the same day, President Biden met with CEOs of major U.S. logistics companies such as Walmart, United Parcel Service, FedEx, and Target to discuss solutions to supply chain bottlenecks, which are known to be the main cause of the recent logistics chaos in the U.S. President Biden reportedly urged the logistics CEOs to ensure there are no disruptions in delivery issues ahead of the large-scale shopping season at the end of the year.

The Biden administration is reportedly set to launch a project to supplement and modernize port facilities across the U.S. by deploying the military as part of the infrastructure investment bill’s budget. CNBC cited a Biden administration official saying, "Within the next 60 days, the U.S. Army Corps of Engineers will be mobilized to carry out port construction work worth about $4 billion (approximately 4.7 trillion KRW)," adding, "An additional $3.4 billion will be invested in port modernization projects."

President Biden is scheduled to visit the Baltimore port in Maryland on the 10th to reiterate the necessity of the infrastructure investment bill and announce measures to supplement port facilities and alleviate port bottlenecks.

Fed Chair Jerome Powell also reiterated his cautious stance on raising the benchmark interest rate despite inflation risks, emphasizing the importance of employment stability. In a virtual meeting on the theme of economic diversity and inclusion, Chair Powell mentioned disparities across employment sectors and stressed, "The Fed will strive to reduce unemployment across as broad a spectrum as possible, including among the impoverished."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.