Government Pledged to Resolve Workforce Shortage Since Early 2000s

As of Last Year, 1,810 Process Personnel

Estimated Shortage of 1,013 in Research and Design

Comprehensive Workforce Supply and Demand Survey for Battery Ecosystem

First Full Survey Effectively by Next Month

Shin Hak-cheol, Vice Chairman of LG Chem, is conducting a global talent recruitment event at the Marriott Hotel in Teaneck, New Jersey, USA, last September.

Shin Hak-cheol, Vice Chairman of LG Chem, is conducting a global talent recruitment event at the Marriott Hotel in Teaneck, New Jersey, USA, last September. [Asia Economy Reporter Choi Dae-yeol] Top executives, including CEOs, are flying to distant foreign countries to hold recruiting events. They promote the company's strengths and offer various incentives. This is a recruiting scene reminiscent of domestic university campuses before the foreign exchange crisis over 20 years ago. Recently, some companies have partnered with universities to create separate degree programs or even established independent educational institutions. This is a desperate measure being squeezed out by the battery industry struggling with a labor shortage.

The complaint that it is difficult to find talent when an industry grows rapidly in a short period is common across all fields. The battery industry, which began to develop and commercialize secondary batteries mainly by Japanese companies in the late 1990s and soon grew centered on the home appliance industry, is now expanding rapidly day by day thanks to the growth of the electric vehicle and energy storage system (ESS) industries.

This is because efforts have been made to promote electric vehicle adoption to address climate change and carbon neutrality, and as the share of renewable energy increases, the demand for ESS, which stores and supplies electricity, has surged. According to market research firm IHS Markit, the secondary battery market is expected to surpass the memory semiconductor market by 2025. A single memory semiconductor product accounted for about 12.5% of South Korea's total exports in 2020, indicating that batteries are highly likely to become the next-generation key industry for South Korea.

The key issue is how quickly the talent gap can be filled. CEOs of major companies, including Jeon Young-hyun, president of Samsung SDI and chairman of the Korea Battery Industry Association, have repeatedly requested the government to actively intervene in securing manpower at official and unofficial occasions. It is fundamentally a challenging field that handles chemical substances and requires research and development across various fields, making it difficult to produce many skilled workers in a short period.

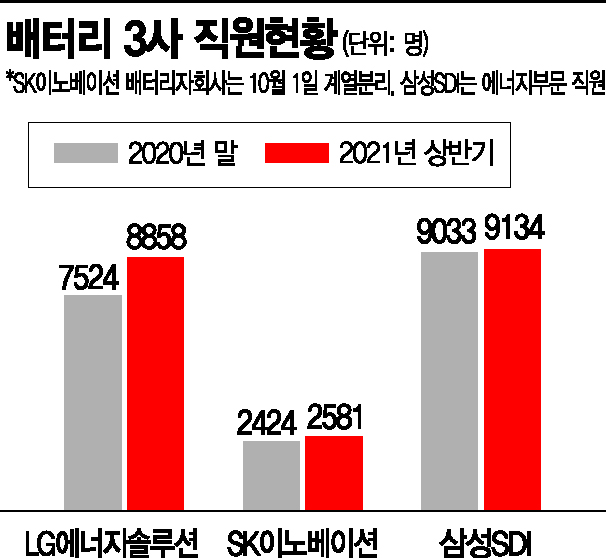

As fields with relatively weak domestic foundations, such as used battery recycling and battery raw materials, are also growing rapidly, manpower supply and demand issues are likely to arise across the board. According to the Korea Battery Industry Association, as of last year, the shortage of personnel was estimated at about 1,013 research and design personnel (master’s and doctoral level) and 1,810 process personnel (bachelor’s level). In July, the government announced a comprehensive battery industry support plan and pledged to cultivate about 1,100+ specialized personnel annually.

The battery industry views this with mixed feelings of concern and expectation. The concern stems from the fact that the government has declared since the early 2000s its intention to increase manpower in the battery industry, but the shortage has not only failed to improve over nearly 20 years but has worsened. Previously, the government announced large-scale manpower training support for the secondary battery industry in 2003 and 2010. At that time, it also announced plans to increase the total workforce to thousands or tens of thousands and to add 1,000 specialized personnel over ten years.

Kim Jun, President of SK Innovation, is presenting the company's strategy and future vision at a global forum held last month in San Francisco, USA.

Kim Jun, President of SK Innovation, is presenting the company's strategy and future vision at a global forum held last month in San Francisco, USA. On the other hand, some believe that the conditions to attract talent have improved this time because the market size is much larger than in the past. Hundreds of people attended recruitment briefings recently held by LG and SK CEOs in the United States, showing interest. Gu Hoi-jin, secretary-general of the Battery Industry Association, said, "Since this is still an early-stage field, there is an inevitable mismatch between manpower demand and supply. Considering specialized training courses, it takes one to two years before personnel can be deployed on the front lines, so it is necessary to create an environment where they can adapt quickly."

At the industry level, the battery sector has decided to conduct a thorough survey to better understand the manpower situation. After selecting secondary batteries as a sector council (SC) to support manpower development in various industries, the Korea Industrial Technology Association has decided to specifically examine the manpower supply and demand situation across the domestic battery ecosystem as its first task. This is effectively the first comprehensive survey related to battery ecosystem personnel. Lee Myung-gyu, a team leader at the Battery Industry Association, said, "We will examine the basic status and future prospects from multiple angles across the entire upstream and downstream industries, including association member companies. The survey results will be internally reviewed and are expected to be announced around April next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.