[Asia Economy Reporter Minji Lee] Z Holdings recorded stable performance in the second quarter (fiscal quarter ending in September), and it is expected that the merger effects of Line and Yahoo Japan will continue to positively impact future results. In the long term, the company is predicted to grow into a major player in Japan's digitalization era.

On the 7th, Z Holdings' stock price reached 795 yen, growing 18% over the past month. This rise is attributed to investor optimism about the company's performance expectations and long-term growth potential.

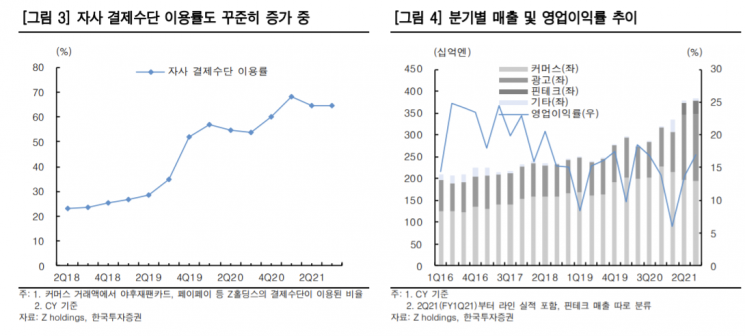

In the second quarter, the company's revenue was 33.7 billion yen, and operating profit was 64.1 billion yen, representing growth of 33.3% and 34.6% respectively compared to the previous year. By segment, media revenue reached 155 billion yen, an 86% increase over the same period. This high growth in media revenue is analyzed to be due to the newly reflected Line performance, development of new advertising products, and recovery in Japanese advertising demand. Line advertising and Yahoo Japan advertising increased by 29.8% and 11.9% respectively, with Line's DA growth rate nearing 39.8% thanks to an expansion of new advertisers and platform quality improvements.

Commerce revenue was 192.6 billion yen, up 8.2% year-over-year. The growth rate of commerce transaction volume increased compared to the previous quarter, and Line's new commerce category, Gift Giving, showed a strong growth rate with a 184% increase compared to the same period last year. In the strategic business division (fintech), the expansion of payment usage for Line Pay and PayPay, along with the integration effects of the cross-system between Line Pay users and PayPay merchants, contributed to a significant improvement from a deficit in the previous quarter.

Like other big tech companies, Z Holdings continues to see growth in its core business units such as advertising and e-commerce. The advertising division's growth rate, which was in single digits last year, has risen to over 10% this year, and Line advertising still maintains a high growth rate close to 30%. Commerce transaction volume also increased to around 14%.

Researcher Hoyoon Jung from Korea Investment & Securities explained, “Z Holdings is enhancing its commerce competitiveness by adopting Naver’s Smart Store business model and strengthening logistics infrastructure,” adding, “Advertising is also expected to continue growing next year as efforts to efficiently utilize ad inventory through cross-selling between Line and Z Holdings increase.”

The fact that cost reductions have appeared since the merger is expected to positively impact performance. The company mentioned that about 10 billion yen in cost savings is anticipated this fiscal year, attributed to cost reductions related to Line Pay and office consolidations. Business synergies are also expected. Researcher Sohae Kim from Hanwha Investment & Securities stated, “Line Digital Frontier acquiring Z Holdings’ E-BOOK stake and the acceleration of cross-selling strategies between Yahoo advertising and Line advertising will further enhance synergy,” and added, “There is high anticipation for the launch of ‘My Smart Store,’ a service based on Naver’s successful Smart Store business model for small and medium-sized enterprises in Korea, into the Japanese commerce market.”

However, despite cost reductions, the company maintained its existing guidance for sales and profit growth this year. The company forecasts sales and profit growth of 26% and 2.8% respectively compared to the same period last year. Researcher Donghwan Oh from Samsung Securities commented, “This reflects ongoing investments to strengthen growth drivers,” and noted, “Although it is somewhat disappointing that profit growth is limited this year due to continued losses in strategic businesses, the accelerated business integration of Line in advertising and commerce, along with new service launches and cost reductions, is making synergies visible, which will strengthen mid- to long-term profit growth potential.”

In the long term, Z Holdings is expected to grow into the most influential company in Japan’s digitalizing market. The synergy from integrating a search engine portal and messenger can be likened to an alliance between Naver and KakaoTalk in Korea. With a single app, it is expected to connect all conveniences for sellers and users, including search, comparison, payment, marketing, and eventually logistics and delivery. Researcher Hoyoon Jung analyzed, “Compared to Korea, Japan’s online market size is still relatively small, and internet companies’ market capitalization is also relatively low, so Japan will have greater long-term opportunities in the internet business.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.