[Asia Economy Reporter Lee Seon-ae] The complex calculations weighing the pros and cons surrounding the acquisition of shares in Zinus, a leading domestic mattress company famous for its "Amazon Mattress" and holding the No.1 market share in the US online market, have entered the main phase. Following SK Group (SK Networks), global private equity funds (PEFs) have also expressed interest in acquiring shares, expanding the scope of the deal. Key variables in the transaction include the valuation of the company and whether management rights are included.

According to the investment banking (IB) industry on the 4th, Zinus is pursuing various funding options from multiple investors, including SK Group, PEFs, and large retail companies, to ensure sustainable growth and expansion. These options include the partial sale of shares held by the largest shareholder. Global PEF operators such as Blackstone, Bain Capital, CVC Capital, and Carlyle, along with SK Networks, have entered the bidding, and major domestic retail companies are also showing interest.

The shares being considered for sale include a portion of the 40% stake, which includes some of the 35.31% held by Chairman and CEO Lee Yoon-jae of Zinus. However, Chairman Lee plans to retain management rights and continue participating in management. Even if investment is attracted, Zinus intends to keep part of the shares and remain involved in management, so it is not a "sale of management rights," according to the company. Zinus stated, "We have reviewed various funding options from multiple investors, including SK Group, and the partial sale of the largest shareholder’s stake, but nothing has been specifically decided or finalized yet."

It is reported that SK Networks, which negotiated the share acquisition, had differences regarding whether management rights would be included in the deal. Ultimately, the core of this deal is investment attraction excluding management rights. Additionally, the valuation of the company is also a variable. Zinus’s market capitalization as of the previous day was KRW 1.2798 trillion. While the market talks about a valuation in the mid-KRW 1 trillion range, global PEF operators are said to have proposed higher valuations.

An IB industry insider said, "Compared to competitors in the US such as Casper and Purple, which currently have price-to-earnings ratios (PER) ranging from 25 to 30 times and even up to 40 to 50 times, Zinus is currently undervalued," adding, "PEFs based in the US believe that investing in Zinus’s US logistics facilities will accelerate growth, hence they have assigned a higher value."

Kim Myung-joo, a researcher at Korea Investment & Securities, analyzed, "Zinus’s 2022 price-to-earnings ratio (PER) was 10.3 times, the lowest since its listing," and added, "It is cheap not only compared to competitors in the US but also compared to Korean furniture companies, so a valuation increase can be expected in the mid to long term."

Another IB industry insider said, "Chairman Lee’s side of Zinus hopes for a KRW 3 trillion valuation, and if PEFs propose a valuation close to that level, the deal is likely to be completed," but added, "However, since the deal excludes management rights, whether it will be finalized remains to be seen."

If Zinus succeeds in attracting investment, it plans to use the funds for building a third factory in Indonesia and expanding its furniture line. It is also considering investing in additional automation equipment for three leased warehouses in the US or converting them into directly operated facilities.

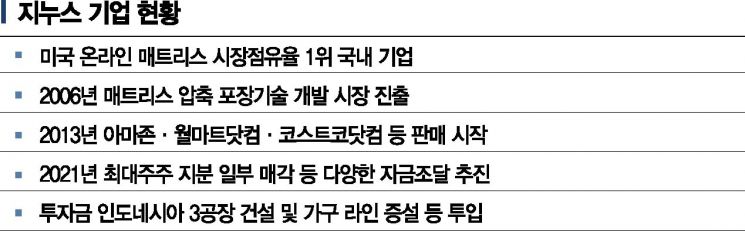

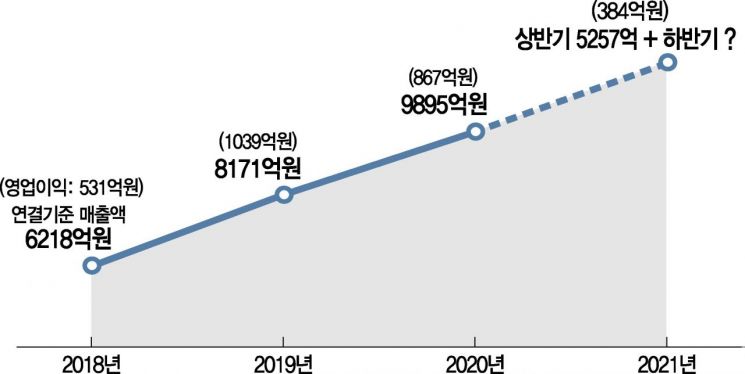

Zinus is a domestic company holding the No.1 market share in the US online mattress market. It first entered the mattress market in 2006 and began selling mattresses through Amazon in 2013. Although it holds a 30% share of the US online mattress market, the expected online penetration rate in the US market in 2022 is 15.8%, which is still low compared to the Korean market (40%), indicating significant growth potential. It established a sales subsidiary in Australia in 2018, entered Japan in 2019, and expanded to Singapore and Indonesia in the first half of 2020. In the second half of that year, it additionally established sales subsidiaries in Vietnam and the UK, which oversees sales in Europe (EU). Zinus’s consolidated sales steadily increased from KRW 621.8 billion in 2018 to KRW 817.1 billion in 2019 and KRW 989.5 billion last year. Operating profit during the same period was KRW 53.1 billion, KRW 103.9 billion, and KRW 86.7 billion, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.