From 2 PM on the 3rd, 'NaeBoheom Chajum' Enables

Batch Claims for Hidden Insurance Money

Automatic Payment of Claim Amounts When No Verification Needed

[Asia Economy Reporter Ki Ha-young] Starting from the 3rd, it will be possible to check and claim hidden insurance money all at once on the 'Find My Insurance' website.

The Financial Services Commission announced on the 2nd that it will introduce a simple claim system to allow consumers to conveniently and quickly retrieve hidden insurance money. From 2 PM on the 3rd, hidden insurance money can be claimed in bulk on Find My Insurance.

The amount of hidden insurance money that consumers have not claimed continues to increase. It rose by more than 3 trillion KRW over four years, from 9.167 trillion KRW at the end of November 2017 to 12.397 trillion KRW at the end of August this year.

Until now, consumers could only check hidden insurance money on Find My Insurance, which is operated by the Financial Services Commission and the insurance industry. To actually claim insurance money, they had to visit branches separately, access individual insurance companies' websites, or make phone requests.

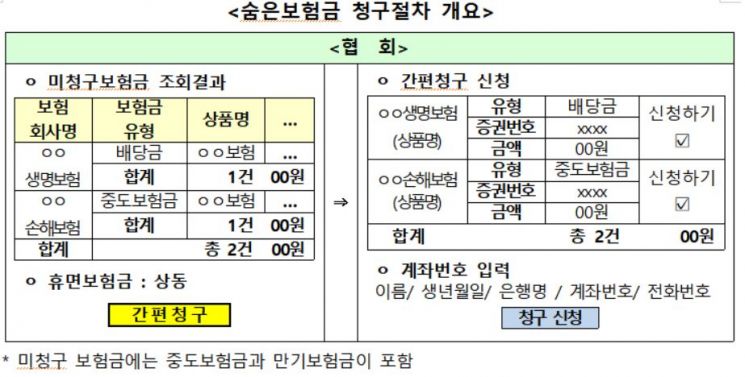

However, with the introduction of this simple claim system, consumers can check and claim hidden insurance money all at once on Find My Insurance. They can select all contracts for which they want to claim hidden insurance money by company and contract and submit a single claim.

Payments will also be automatically made if no separate verification is required after claiming hidden insurance money. For small insurance amounts under 10 million KRW that do not require additional information verification, the claimed amount will be automatically paid to the entered account within three business days. For cases requiring additional information verification or for large insurance amounts exceeding 10 million KRW, the insurance company will verify additional information through confirmation calls (callbacks) before payment. Cases requiring additional verification include selecting the pension type (lifetime, fixed, inheritance) when receiving a pension or when the policyholder is not the beneficiary.

A Financial Services Commission official said, "Since hidden insurance money accrues interest, it is important to carefully check and claim the interest," and added, "Insurance claim information does not reflect real-time deductions such as insurance contract loan principal and interest or tax withholding, so there may be some differences between the checked amount and the final received amount."

Also, if dormant insurance money has been contributed to the Korea Inclusive Finance Agency, claim and payment procedures through the Korea Inclusive Finance Agency are required, so caution is necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)