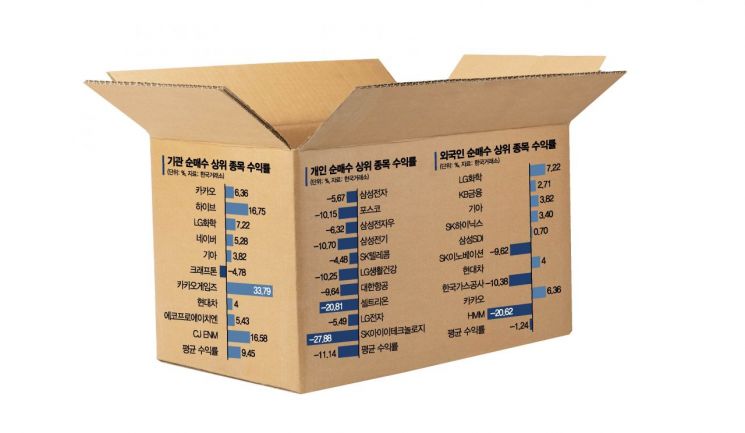

Top 10 Net Buyers in October Comparison

Institutions with High Returns on KOSDAQ, Only Positive Average at 9.45%

Foreigners Holding Battery Stocks -1.24%

Individuals Picking Up Samsung, -11.14%

[Asia Economy Reporter Song Hwajeong] As the stock market remains stuck in a box range showing sluggish movement, institutions have demonstrated the best returns. Institutions achieved high returns through KOSDAQ stocks, foreigners focused on battery stocks, and individuals continued to concentrate on Samsung Electronics.

On the 2nd, an analysis of the top 10 net purchase stocks in October by major market participants including institutions, foreigners, and individuals showed that institutions recorded the best performance with an average return of 9.45%. Institutions were the only group among the three to have positive returns.

Last month, the top 10 net purchase stocks by institutions were Kakao, HYBE, LG Chem, Naver (NAVER), Kia, Krafton, Kakao Games, Hyundai Motor, EcoPro HN, and CJ ENM, in that order. Among these, Kakao Games recorded the highest return. After a sluggish performance in August and September, Kakao Games rebounded last month with a 33.79% increase. Next were HYBE (16.75%) and CJ ENM (16.58%), which also rose sharply. Krafton (-4.78%) was the only stock among those purchased by institutions to record negative returns. Notably, unlike other market participants, institutions showed a remarkable buying trend in KOSDAQ stocks, which resulted in favorable returns.

Hainhwan KB Securities researcher said, "The strong trend of KOSDAQ compared to KOSPI, which has been ongoing since May this year, is expected to continue next year," adding, "The exclusion phenomenon of KOSDAQ compared to KOSPI was most severe in the first half of this year, and since May, this exclusion has been resolving, with sufficient room for further resolution." In addition, institutions also purchased many internet stocks and content-related stocks that showed strength last month.

Foreigners recorded a -1.24% return last month. The top 10 net purchase stocks by foreigners last month were LG Chem, KB Financial Group, Kia, SK Hynix, Samsung SDI, SK Innovation, Hyundai Motor, Korea Gas Corporation, Kakao, and HMM. Among these, SK Innovation (-9.62%), Korea Gas Corporation (-10.38%), and HMM (-20.62%) saw significant price declines, pulling down the average return. Foreigners, who continue to sell in the domestic stock market, maintain a buying stance on battery stocks. Last month, they purchased LG Chem the most, and Samsung SDI and SK Innovation also ranked among the top net purchases. LG Chem, the most purchased stock by foreigners, rose 7.22% last month, showing the highest increase among the top 10 net purchase stocks by foreigners.

Individuals showed the poorest performance. The average return of the top 10 net purchase stocks by individuals last month was -11.14%. Individuals' net purchases were in the order of Samsung Electronics, POSCO, Samsung Electronics Preferred, Samsung Electro-Mechanics, SK Telecom, LG Household & Health Care, Korean Air, Celltrion, LG Electronics, and SK IE Technology. All ten stocks recorded negative returns. The stock with the largest decline was SK IE Technology, which fell 27.88% last month. Celltrion followed with a 20.81% drop, and Samsung Electro-Mechanics, LG Household & Health Care, and POSCO also fell more than 10%. Individuals showed particularly strong affection for Samsung Electronics. Samsung Electronics fell 5.67% last month, breaking the 70,000 KRW level. Additionally, considering the phased daily recovery (With Corona) starting this month, individuals led net purchases of ‘reopening’ stocks such as LG Household & Health Care and Korean Air.

Last month, individuals and institutions net purchased 2.8302 trillion KRW and 737.6 billion KRW respectively in KOSPI, while foreigners net sold 3.8842 trillion KRW. In KOSDAQ, individuals (76.9 billion KRW), institutions (285.9 billion KRW), and foreigners (35.6 billion KRW) all showed buying trends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.