[Asia Economy Reporter Lee Seon-ae] Asset management companies and real estate developers are focusing on value-add investments to improve the profitability of hotel assets. Value add refers to assets with high vacancy rates or aging conditions that currently have relatively low value but can generate profits by enhancing their value. Investment strategies vary, including facility improvements, changes in use, and expansions. Especially due to the prolonged COVID-19 pandemic and the resulting decline in profitability, there is active movement to purchase hotels focusing more on real estate value than hotel operational performance, and to generate profits through redevelopment involving changes in use.

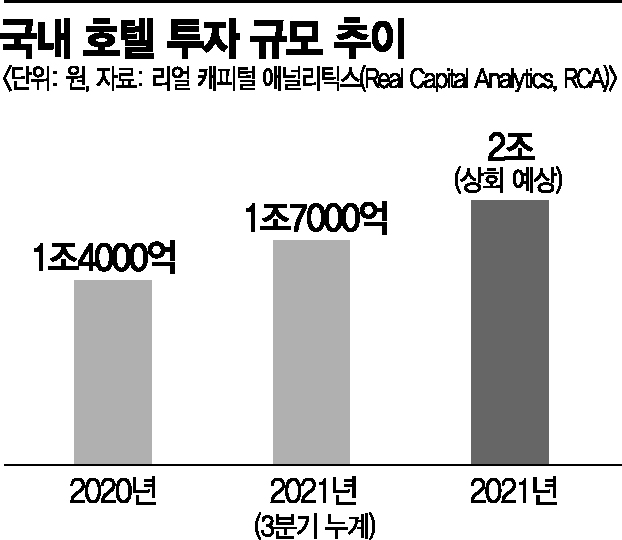

According to Real Capital Analytics (RCA) on the 2nd, the scale of domestic hotel investments this year has reached 1.7 trillion KRW as of the third quarter cumulative total. This already exceeds last year's hotel investment scale of 1.4 trillion KRW. RCA expects hotel investment transactions to continue until the end of the year, projecting that this year's investment scale will exceed 2 trillion KRW.

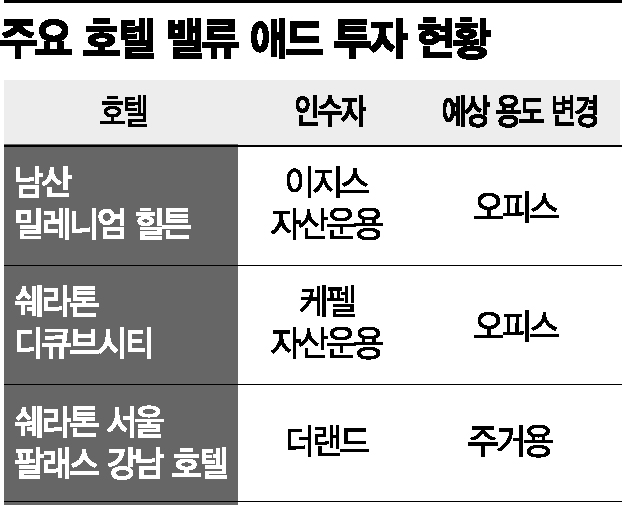

First, Keppel Asset Management, which acquired the Sheraton D-Cube City Hotel on September 14, plans to close hotel operations as of October 31 and remodel it into a large office building. Built in 2011, this hotel has 15 floors with 257 rooms, 12 suites, and 12 conference rooms. The Sheraton Seoul Palace Gangnam Hotel and Le Meridien Hotel, sold in early 2021, are also scheduled to be redeveloped into luxury residential facilities and residential-commercial complexes, respectively.

Major hotels such as the Millennium Hilton Seoul Hotel and Jeju Kal Hotel are expected to be traded by the end of this year. Aegis Asset Management recently exchanged a memorandum of understanding with Hilton Hotel for a sale negotiation worth around 1 trillion KRW and plans to finalize the main contract by December. Aegis Asset Management is reportedly pursuing a plan to build an office building on the hotel site. Aegis Asset Management stated, "As hotel listings are expected to increase this year due to the COVID-19 impact, we invest in hotels converted to residential or other uses."

Crown Tourist Hotel is also expected to make a fresh start under new ownership. A consortium of Hyundai Construction, Hana Alternative Investment Management, and RBDK has been selected as the preferred negotiator and is about to sign the main contract for Crown Tourist Hotel. Although the change of use is not yet decided, there is a high possibility of conversion to residential use.

Kim Mi-sook, a researcher at KB Securities, said, "As the COVID-19 pandemic prolongs, value-add investments involving redevelopment by changing the use of hotels with deteriorated profitability are increasing. Investors want to remodel and redevelop hotels into offices and residences, whose asset values have recently risen significantly, by utilizing the location conditions and large site area rather than short-term operational profits of hotels." A senior official in the asset management industry also interpreted, "In the past 2-3 years, residential real estate prices have surged, and investment sentiment for office real estate has revived this year, leading to an increase in hotel use changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)