Launch of Integrated Wooty App

Same Service Domestically and Internationally

Taxi Franchise and Brokerage Call Service Provided

Introduction of Pre-Confirmed Fare System

Expansion to 10,000 Franchise Taxis Within the Year

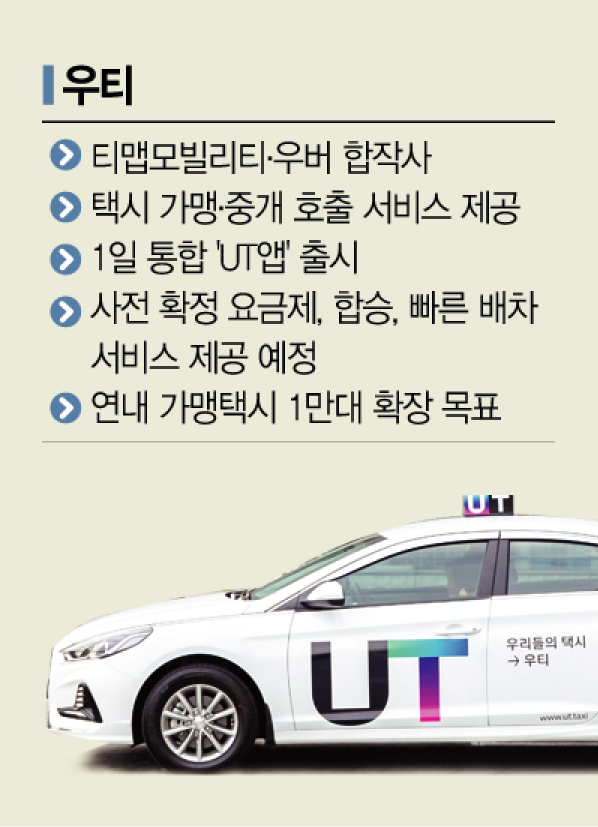

‘UT’ is challenging the dominance of Kakao Taxi. UT is a joint venture between the global company Uber and T map Mobility, a subsidiary of SK Telecom. The name means ‘Our Taxi,’ embodying the spirit of coexistence and development among drivers, passengers, and local communities. UT is officially entering the taxi platform competition against the industry leader Kakao Mobility and ‘Tada,’ recently acquired by Toss.

Launch of the Integrated ‘T map Taxi + Uber’ App

On the 1st, UT held an online press conference and announced the launch of the UT application, which combines Uber and T map Taxi. Previously, the T map Taxi app was provided as UT, and Uber had a separate app. From this day forward, the two apps will be integrated. Domestic UT app users can access the same service in over 10,000 cities worldwide, and users who used the Uber app abroad can use UT services domestically. Tom White, CEO of UT, explained, "We combined T map’s excellent navigation technology with Uber’s proven technology through years of actual operation worldwide." He expressed confidence that UT will become an open platform encompassing all taxi drivers nationwide who want to join.

UT operates taxi brokerage and dispatch services as well as franchise taxis. For the franchise taxis called ‘UT Taxi,’ a pre-determined fare system will be added once approved by relevant authorities. This system notifies the fare in advance on the app based on the passenger’s entered destination and confirms the fare before use. Passengers pay the fare informed before boarding regardless of the actual amount upon arrival. However, fares may be recalculated in unforeseen situations such as traffic accidents. Additionally, UT is preparing new services such as UT Pool (tentative name), a taxi ride-sharing service, and UT Flash, which provides passengers with faster dispatch services. A dynamic pricing system that adjusts fares according to supply and demand is also being pursued.

UT also revealed plans for franchise taxi operations. UT aims to expand franchise taxis to 10,000 vehicles within this year and add more than 10,000 franchise taxis next year. The premium service ‘UT Black,’ based on large sedans, will be rebranded and offered to passengers. CEO White stated, "Going forward, UT will introduce various advanced services that consider both drivers and customers, contributing to the growth of the mobility market based on coexistence." He added, "We will implement innovative technology to satisfy not only domestic users but also overseas visitors to Korea."

He continued, "Korea is a very important market as it is one of the top five markets globally, valued at 8 billion dollars (about 9.4 trillion won). We believe we can solve taxi-related issues in the Korean market," he emphasized.

The Three-Way Competition in Domestic Taxi Dispatch

Kakao Mobility, which has maintained the top position in the industry, has recently been embroiled in monopoly controversies, creating opportunities for UT and Tada to target niche markets. Kakao Mobility’s taxi dispatch app ‘Kakao T’ has 28 million subscribers and is used by over 90% of taxi drivers. The franchise taxi Kakao T Blue also has about 26,000 vehicles as of the second quarter. However, Kakao Mobility is currently cautious as regulations against Kakao are tightening, mainly led by the government and ruling party, leading to the abolition of the paid dispatch service ‘Smart Dispatch’ and other measures.

Tada, once popular with its white Carnival vehicles, is also aiming for a comeback. Although ‘Tada Basic’ withdrew due to amendments to the Passenger Transport Service Act, known as the ‘Tada Ban Law,’ it is seeking a turnaround by expanding its taxi business. Recently, the financial platform Toss acquired Tada’s operator VCNC, marking a new phase. Tada is aggressively recruiting drivers with offers of up to 41 million won. Next month, Tada will launch ‘Tada Next,’ a dispatch brokerage service based on seven-seater large vehicles.

An industry insider said, "Although UT and Tada may find it difficult to immediately overcome Kakao Mobility’s dominance, the formation of a competitive landscape itself will have a positive impact on the mobility ecosystem that Kakao had monopolized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.