The Index of Economic Hardship for Ordinary People Also Rises for the Third Consecutive Year

[Asia Economy Reporter Jang Sehee] As inflation continues its high ascent, the ‘Economic Pain Index,’ which sums the inflation rate and unemployment rate, recorded its highest level in three years for the month of September. The index rose as inflation recently exceeded 2%.

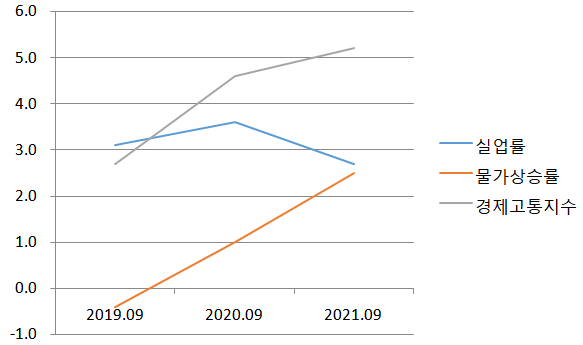

According to calculations based on Statistics Korea data by Chu Kyung-ho, a member of the People Power Party, the Economic Pain Index last month was 5.2. For September, it fell from 5.7 in 2018 to 2.7 in 2019 but rose again to 4.6 last year due to the impact of COVID-19, and increased once more this year.

While the unemployment rate dropped to 2.7% compared to 3.6% in the same month last year, inflation for September rose continuously from -0.4% in 2019 to 1.0% in 2020, and then to 2.5% in 2021.

The Economic Pain Index (unemployment rate + inflation rate) is an indicator that reflects the economic difficulties felt by the public. When unemployment rises due to job shortages or inflation increases, thinning wallets, the Economic Pain Index rises accordingly.

The Low-Income Economic Pain Index, which adds the expanded unemployment rate (Employment Supplementary Indicator 3) and the living cost index inflation rate, was also 15.1 in September, 0.7 higher than 14.4 in the same month last year. The expanded unemployment rate was 12.0%, and the living cost index change rate was 3.1%. The Low-Income Economic Pain Index also rose from 9.9 in 2019 to 14.4 in 2020, and surged further this year.

With inflation having risen significantly, increasing the burden on low-income households, inflationary pressures may grow further due to ongoing supply bottlenecks and the impact of With-Corona (gradual recovery to normal life). On the 27th, the Bank of Korea stated in its report titled ‘Review of Major Inflation Drivers in Korea and the U.S.’ that "Attention should be paid to the possibility that the high inflation trend may last longer than expected due to the domestic ripple effects of global supply bottlenecks and increased demand following the restructuring of the quarantine system."

In particular, as inflationary pressures are likely to increase further due to ongoing supply bottlenecks and the With-Corona (gradual recovery to normal life) effect, the Economic Pain Index is also expected to continue rising. Professor Andonghyun of Seoul National University’s Department of Economics said, "When production costs rise, the final consumer prices inevitably increase as well," adding, "From a corporate perspective, they have no choice but to pass on some of the inflation to consumers."

Meanwhile, there is a forecast that consumer prices will rise by more than 3% this month. On the 26th, Kim Woong, director of the Bank of Korea’s Research Department, said at a seminar titled ‘Review of Major Issues in Our Economy’ that "It cannot be ruled out that the consumer price inflation rate in October will exceed 3%," and added, "The effect of last year’s mobile communication fee support is expected to raise consumer prices by 0.7 percentage points."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.