Long-Term Slump in Hotel Industry as Overseas Travelers Stop

Short-Term Profit Recovery Difficult

Prime Large Hotels in Seoul Also Up for Sale

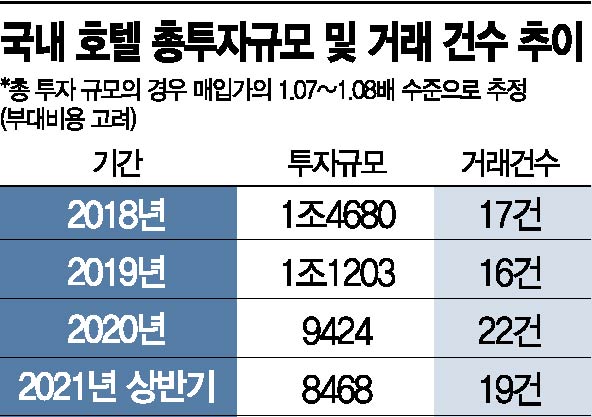

Domestic Hotel Investment Reaches 846.8 Billion Won in First Half

Signs saying "For Lease," "Temporary Closure," and "Business Closed" are posted at stores in Myeongdong. Photo by Moon Ho-nam munonam@

Signs saying "For Lease," "Temporary Closure," and "Business Closed" are posted at stores in Myeongdong. Photo by Moon Ho-nam munonam@

[Asia Economy Reporter Ryu Tae-min] Due to the prolonged recession caused by the COVID-19 pandemic, hotel listings in Seoul that could not withstand the downturn are continuously increasing. In particular, the sold hotels are changing their business types entirely by converting to office or residential facilities, whose asset prices have surged. Despite recent expectations for the implementation of the ‘With COVID-19 (gradual recovery of daily life)’ policy, the industry outlook remains dominated by the view that profitability recovery in the short term is difficult due to the nature of the sector.

According to the research center of Aegis Asset Management, an alternative investment specialist, the scale of domestic hotel transactions in the first half of this year was recorded at 846.8 billion KRW. This amount is almost equal to the entire scale of last year (942.4 billion KRW) in just six months.

Additionally, according to the ‘Q3 2021 Domestic Commercial Real Estate Market Report’ released by global comprehensive real estate service company CBRE, the domestic hotel investment scale in the third quarter was about 259 billion KRW, indicating that the cumulative investment scale this year has already exceeded 1 trillion KRW.

The scale of domestic hotel transactions reached a record high of 1.4681 trillion KRW in 2018. At that time, due to favorable factors such as the restoration of Korea-China relations, demand from overseas travelers increased, leading to a surge in new hotel investments. However, while hotel supply exploded, the COVID-19 pandemic starting last year caused overseas travelers to stop visiting, delivering a direct blow. Unable to endure, small-scale hotels began to flood the market with listings.

Especially since the end of last year, even large hotels have been unable to withstand the recession and have come onto the market. Hotels in major Seoul areas such as Hilton Hotel in Jung-gu, Le Meridien in Gangnam, and Sheraton Seoul Palace Gangnam have also been listed for sale.

Recently, cases of sold hotels changing their use entirely to offices or officetels have been increasing. The Sheraton D Cube City Hotel, sold to Keppel Asset Management last month, and the Myeongdong Tmark Hotel, purchased by Aegis Asset Management, are reportedly planning to transform into office spaces. The Seoul Le Meridien Hotel, famous for the club ‘Burning Sun,’ is said to be planning conversion into mixed-use residential or residential facilities.

This trend appears to be because hotel profitability has deteriorated, while asset prices for offices and officetels have soared, increasing their marketability. A source from the asset management industry explained, “Although discussions about ‘With COVID-19’ continue, the dominant view is that the hotel industry’s profitability will be difficult to recover in the short term. Especially, offices have recently seen high demand for leasing and sales and offer high profitability, making them highly preferred by investors.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)