Finance Forum October Issue

[Sejong=Asia Economy Reporter Son Seon-hee] The Korea Institute of Public Finance (KIPF), a government-funded research institute, has emphasized the necessity of 'tax increase.'

Yoon Sung-joo, a research fellow at KIPF, stated in the report titled "Tax and Fiscal Policy and Discussion Status of the Biden Administration," published in the October issue of the Fiscal Forum on the 28th, "Considering changes in population and social structure, it is judged that a tax increase will be necessary in the not-too-distant future in Korea," adding, "Efficient fiscal management by the government is important to minimize tax resistance that may arise during the tax increase process."

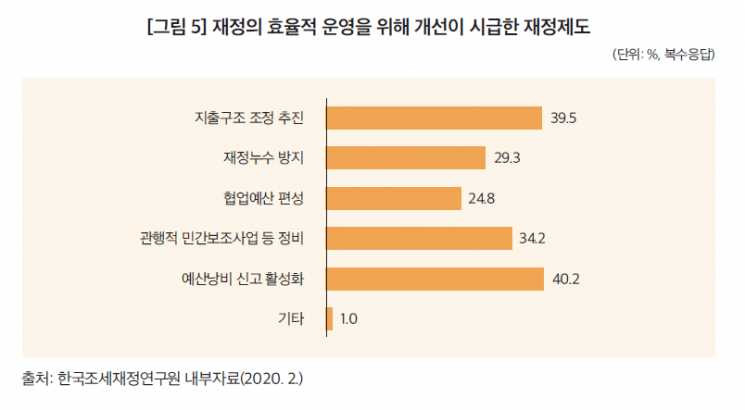

According to a recent survey conducted by KIPF targeting general citizens, the fiscal system improvement most needed for efficient fiscal operation was "activation of budget waste reporting," accounting for 40.2%, the highest response. This was followed by "promotion of expenditure structure adjustment" at 39.5%, and "reorganization of habitual private subsidies, etc." at 34.2%.

Referring to this survey, Research Fellow Yoon emphasized, "It is particularly suggestive that the 2030 generation prioritizes the activation of budget waste reporting."

This suggestion came from analyzing the tax and fiscal policies of the U.S. Biden administration and evaluating the Korean government's 'Korean New Deal' policy in light of that. Yoon analyzed that while the Biden administration pursues a 'big government' approach with large-scale tax and fiscal expenditure policies, "there are positive evaluations that it will contribute to U.S. economic growth; however, there are concerns that excessive government intervention may hinder private investment and weaken competitiveness in the international market, ultimately potentially causing negative effects on the U.S. economy."

In particular, he said, "There are concerns that rapid fiscal expansion in the welfare sector may lead to unintended consequences," adding, "Currently, the U.S. unemployment rate has not recovered to pre-COVID-19 crisis levels, which is also regarded as due to excessive unemployment benefits." He also mentioned concerns about inflation resulting from large-scale expansionary fiscal policies.

In light of the U.S. situation, Research Fellow Yoon evaluated the Korean government's 'Korean New Deal' policy as "having an appropriate direction."

However, he pointed out, "To enhance the effectiveness of the Korean New Deal projects, continuous supplementation of feasibility and concreteness of projects, cooperation with local governments, and private sector participation is necessary," warning, "If private participation is not induced, it may remain a typical government fiscal project."

He particularly criticized the lack of a specific funding plan despite the expected massive fiscal input, stating, "Although citizen-participatory New Deal funds are proposed and operated, the funding plan during the project period needs to be more concrete," adding, "Compared to the investment plans presented by the government, the aspect of securing funds cannot be considered relatively concrete."

Finally, Research Fellow Yoon emphasized 'policy consistency,' saying, "If there are significant changes in policy depending on the government, the policy is unlikely to gain market trust, and consequently, it is difficult to achieve the expected outcomes." He continued, "Especially for large-scale fiscal expenditure policies over the medium term, such as the Korean New Deal, it is important to establish sustainable and predictable plans through bipartisan support beyond political factions and to pursue consistent policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)