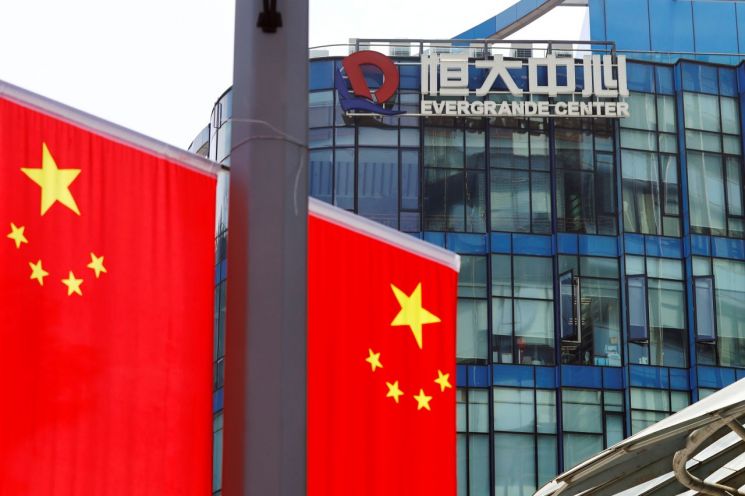

The chairman of Evergrande (恒大), a Chinese real estate developer facing a default (insolvency) crisis, is reported to have secured a loan from a bank using a luxury residence in Hong Kong as collateral.

According to Hong Kong media outlet HK01 on the 27th, it was confirmed through land registration that the detached house in The Peak, Hong Kong's most affluent neighborhood where Evergrande founder Xu Jiayin and his wife have lived, was pledged as collateral to China Construction Bank on the 19th.

The property, measuring 464.51㎡ (approximately 140.51 pyeong), is valued at about 700 million Hong Kong dollars (approximately 105.5 billion KRW), and a loan of up to 300 million Hong Kong dollars (approximately 45.2 billion KRW), which is 40% of the house price, can be obtained.

The previous day, Bloomberg reported, citing anonymous sources, that Chinese authorities demanded Xu Jiayin personally use his assets to resolve the issue immediately after Evergrande failed to pay interest on its dollar bonds on the 23rd of last month.

However, most of Xu Jiayin's personal assets are Evergrande shares, which have plummeted more than 80% this year, so it is uncertain whether this can resolve Evergrande's debt crisis.

According to Bloomberg's tally, Xu Jiayin's net worth, which peaked at 42 billion USD (approximately 48.97 trillion KRW) in 2017, has shrunk to 7.8 billion USD (approximately 9.09 trillion KRW).

As of the end of June this year, Evergrande's debt scale reached 300 billion USD (approximately 351 trillion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.