Publication of '2022 Industrial Outlook' Report

Pandemic-driven IT and Automotive Sectors Slow Down

[Asia Economy Reporter Kiho Sung] It is forecasted that the recovery of major industries will slow down next year due to a reduced growth rate in global trade and a base effect. However, although the overall growth of manufacturing will be sluggish due to the slowdown in advanced countries' recovery and delays in supply chain disruptions, eco-friendly and digital sectors are expected to lead industrial trends and continue improving. Additionally, with the transition to the With-Corona era, domestic service sectors such as lodging, travel, food service, and duty-free shops, which had been sluggish, are expected to recover.

Hana Financial Management Research Institute, affiliated with Hana Bank, announced the '2022 Industry Outlook' on the 27th and assessed the future prospects of major industries.

The institute forecasted that the business cycle of final goods manufacturing industries such as IT and automobiles, which showed strong performance due to pandemic-related special demand, will slow down. This is because recent supply chain disruptions, risks of economic slowdown in China, and raw material costs are expected to weigh down the recovery of major domestic industries.

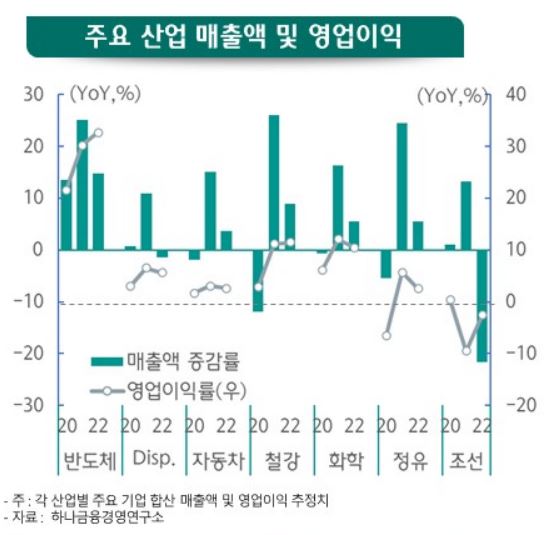

Among the 14 industries analyzed, except for some materials sectors such as secondary batteries, chemicals, and refining, the business cycles of industries that performed well this year, including semiconductors, displays, and automobiles, are expected to decline. Semiconductors and steel are judged to enter a stable phase due to the slowdown in downstream industries, while displays and automobiles are expected to be somewhat sluggish due to the decrease in pandemic-related special demand and the impact of semiconductor supply disruptions. However, secondary batteries, which are experiencing increased demand due to the transition to electric vehicles, and the shipping industry, which continues to see growth in cargo volume, are expected to maintain a boom phase through next year.

Material industries such as chemicals, refining, and steel, which are expected to continue relatively favorable conditions, will lose the benefits of rising product prices but are forecasted to maintain solid growth due to improved downstream demand. However, researcher Hyeyoung Ahn mentioned, “Although downstream demand such as textiles and apparel will increase, new capacity expansions in Asia, including China, are scheduled to be supplied from the second half of next year, raising the possibility of oversupply concerns.”

Along with this, as the environment shifts to With-Corona, social distancing measures are relaxed and consumer sentiment improves, domestic and service industries are expected to see improved business conditions.

The institute also noted that even if the pandemic crisis eases next year, companies should pay attention to ▲continued supply chain disruptions ▲burdens of responding to the climate crisis ▲changes due to the normalization of With-Corona.

Researcher Namhoon Kim stated, “Although suppressed consumption during the COVID-19 era may recover rapidly, risks of production disruptions in manufacturing due to supply shortages remain, and inflationary pressures from rising supply costs are high, making management capabilities increasingly important for companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.