[Asia Economy Reporter Park Jihwan] Due to the global stock market boom, early redemption of derivative-linked securities (DLS·ELS) increased in the first half of this year, resulting in a significant decrease in the outstanding issuance balance.

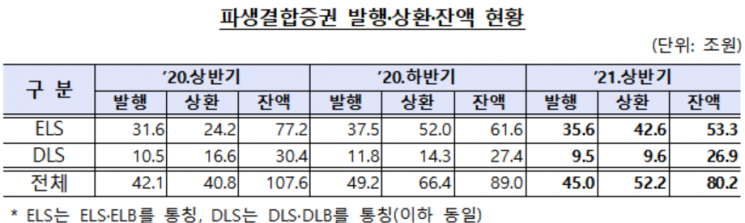

According to the Financial Supervisory Service on the 26th, as of the end of June, the outstanding issuance balance of derivative-linked securities was 80.2 trillion won, down 27.4 trillion won from a year earlier. This is the lowest level since the end of 2013, when it recorded 63.2 trillion won.

In the first half of the year, the issuance amount of derivative-linked securities was 45 trillion won, a decrease of 2.9 trillion won compared to a year earlier. The redemption amount increased by 11.4 trillion won to 52.2 trillion won, resulting in a decrease in the outstanding balance.

By type, the issuance amount of equity-linked securities (including ELS·ELB) increased by 4 trillion won from a year earlier to 35.6 trillion won. The issuance amount in the second quarter was 16.8 trillion won, down 10.8% from 18.8 trillion won in the previous quarter. This was due to a decrease in ELS demand caused by rising reference prices, declining coupon yields, and the implementation of regulations on complex financial investment products. The issuance amount of index-type ELS was 27.8 trillion won, up 1.4 trillion won from a year earlier, accounting for 78.0% of the total issuance amount, a decrease of 5.7 percentage points.

The issuance amount of stock/mixed types increased in proportion to 22.0% of the total issuance amount, up 5.7 percentage points from a year earlier, due to increased demand for individual stock inclusion. Among these, Samsung Electronics was the most included underlying asset. The issuance proportion of ELS with three underlying assets was the highest at 67.4%, maintaining a similar level compared to the same period last year.

The issuance scale by underlying asset was in the order of S&P 500 (24.6 trillion won), Euro Stoxx 50 (19.9 trillion won), KOSPI 200 (15.1 trillion won), and Hong Kong H (11.9 trillion won).

The redemption amount of ELS was 42.6 trillion won, an increase of 18.4 trillion won from a year earlier. The outstanding issuance balance was 53.3 trillion won, a decrease of 23.9 trillion won. Compared to a year earlier, the issuance amount of DLS was 9.5 trillion won, down 1 trillion won.

The annual average investment returns for ELS and DLS in the first half of this year were 3.1% and 0.2%, respectively, down 0.2 percentage points and 0.7 percentage points from a year earlier.

The profit generated by securities companies from issuing and managing derivative-linked securities turned positive at 586.5 billion won, compared to a loss of 1 trillion won a year earlier.

A Financial Supervisory Service official stated, "As volatility in domestic and international financial markets has recently increased, we plan to guide investors to pay attention to early redemption barriers, expected investment periods, and the presence of stigma when investing in ELS."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.