[Asia Economy Reporter Kim Hyemin] As the tug-of-war over house prices between sellers and buyers continues, Seoul apartment sale prices have shown a slight increase for three consecutive weeks.

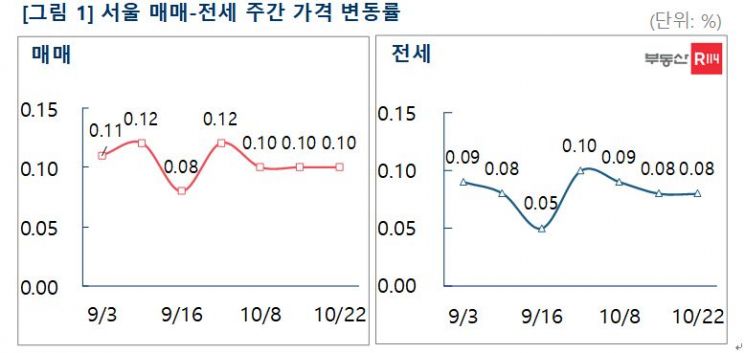

According to Real Estate R114 on the 24th, the rate of change in Seoul apartment sale prices recorded 0.1% for three consecutive weeks. General apartments rose by 0.1%, and reconstruction apartments increased by 0.12%.

With buying sentiment shrinking due to loan regulations and concerns over interest rate hikes, homeowners holding out and maintaining their asking prices have caused the recent Seoul sales market to show a sluggish trend.

However, the price increase trend for large apartment complexes in relatively less expensive outskirts such as Gwanak, Geumcheon, and Dobong remained steady. By region, the increases were ▲Gwanak (0.2%) ▲Gangbuk (0.16%) ▲Gangdong (0.15%) ▲Guro (0.15%) ▲Nowon (0.15%) ▲Gangseo (0.14%) in order.

New towns and Gyeonggi·Incheon areas saw prices rise by 0.06% and 0.07%, respectively, compared to the previous week, as price adjustments continued.

In new towns, the increases by region were ▲Paju Unjeong (0.2%) ▲Pyeongchon (0.1%) ▲Sanbon (0.09%) ▲Dongtan (0.09%) ▲Pangyo (0.09%), and in Gyeonggi·Incheon, the rises were ▲Suwon (0.13%) ▲Anyang (0.11%) ▲Namyangju (0.1%) ▲Paju (0.1%) in order.

The Seoul jeonse (long-term lease) market rose by 0.08% compared to the previous week. By region, as autumn moving demand flowed into areas convenient for commuting, the increases were ▲Gangseo (0.22%) ▲Mapo (0.18%) ▲Gwanak (0.15%) ▲Gangdong (0.14%) ▲Gwangjin (0.14%) in order.

New towns and Gyeonggi·Incheon rose by 0.04% and 0.06%, respectively, compared to the previous week.

Yeo Kyung-hee, chief researcher at Real Estate R114, analyzed, "Although the decrease in transactions due to shrinking buying sentiment has become prominent this month, Seoul apartment prices are not showing significant fluctuations. However, factors for decline such as interest rate hikes and additional household debt measures, and factors for increase such as jeonse market instability, supply reduction, and abundant liquidity are in a tense balance."

She added, "Autumn moving demand is intermittently entering the sales market, so it seems difficult for the current upward trend to reverse easily. The jeonse market has scarce supply, but with the resumption of jeonse loan financing, demand planning to move may increase, so market instability is expected to continue for some time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)